Union Bank Plc today released its H1 2017 earnings, posting N73 billion in Gross Earnings, a growth of 22.6% over the last year.

However, according to insiders, the bank is exposed to litigation issues that could see it in serious financial trouble in the future as events unfold in the courtroom.

Union Bank has had its fair share of legal issues like all players in the banking sector, however, its low profitability (the bank posted N9 billion PAT for H1 2017), could take a further hit as legal issues continue to fold.

There are several legal issues plaguing the bank. According to one source with knowledge of the bank’s legal issues, there is a case that has been instituted against the bank for over two decades and is recently making headways, after one of Nigeria’s top legal firms was hired to prosecute the matter at the Lagos High Court.

The matter alleges the bank acted improperly by exercising their right to sell the property of a client, a late accountant from the South-West, in a fraudulent manner thereby causing the family untold hardship, pain and suffering, over a period exceeding two decades.

The family is reportedly in court claiming over nine figures in damages against one of the oldest lenders in the country.

Over the years, the fraud perpetrated by various employees and agents of Union Bank exceeds tens of billions of Naira.

For instance, in 2009, the Central Bank of Nigeria sacked Bart Ebong, then MD of Union Bank Plc, for his part in a $90 million fraud perpetrated against the Nigerian people. The bank was also at the same time involved in an N500 billion margin loan default. 20 charged were filed by the Economic and Financial Crimes Commission bordering on money laundering and other offences.

Also in 2016, the Federal High Court issued a writ of summon to C. S. Sankey, chairman, Nigeria International Bank Limited, Citi Bank; Emeka Emuwa, managing director, Union Bank Plc and Olusola Fagbure, legal adviser/company secretary, Citibank, to appear before it on Monday, January 25 in a N10.7 billion criminal charge preferred against them and 14 others by the federal government of Nigeria.

Order charges filed against the bank in relation to that suit included 419, conspiracy, and forging of documents against others.

Also in 2014, two senior managers of the bank diverted depositors funds totalling N661 million for personal use.

In the process of their crime, they falsified documents to cover their tracks.

These are just a few of the instances of criminal fraud allegedly perpetrated by the management and staff of Union Bank Plc, which place the company’s financial future in a place of uncertainty.

Other banks in Nigeria have recently been made to settle their legal disputes to the tune of billions of Naira. The advantage the banks have over the customers and other little guys who have been ripped off is they have the money to keep the litigation tied up in the courts for years.

However recent decisions, some even by the Supreme Court of Nigeria have been in the favour of defrauded bank customers, and some litigants are ready to continue spending money to ensure that the banks pay what they owe.

Banks have a fiduciary duty to their clients, and in situations where the breadwinner goes to a bank like Union bank and takes a loan, but is unable to settle it due to his untimely death. And instead of showing professionalism, the bank goes ahead to collude with unscrupulous persons in order to circumvent the wishes of the late customer and dispose of his assets in a fraudulent manner so as to receive illicit gains, such situations are unfortunate.

Union Bank Plc is planning an N50 billion rights issue, shareholders who intend to increase their shareholding in the bank would do well to ensure the bank has disclosed its exposure to potential multi-billion Naira judgments so as to avoid even more litigation in the years, and even decades to come.

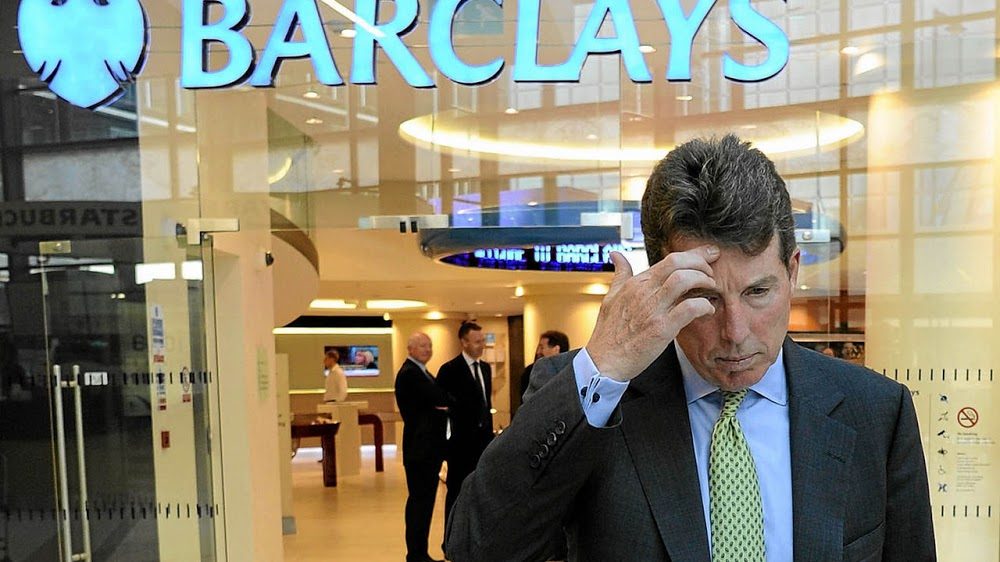

One of the bank’s largest investors, Bob Diamond is a former top executive of Barclays Bank UK who was forced to step down amid an interest rate scandal that saw Barclays employees who were directly under his supervision, commit multi-billion pounds fraud in order to make a profit or spruce up their books during the 2008 financial crisis. A crisis that began in Europe and eventually affected banks in Nigeria, including Union bank.

Barclays was fined £290 million (N145 billion) and Bob Diamond was forced to resign. He has since set up shop in Africa were banking regulations are not as stringent as the United Kingdom or the United States of America.

Nigerian banks and scams are not new thing. But the scams from union bank in particular are heartless. Many families are crying because of them. It may not be as a result of the sitting bankers there now but they should endeavour to do something to right past wrongs.

All of them are rogues, both past and present sitting directors. They will try and drag out the matter in the courts instead of settling the aggrieved parties like in saner climes because they know there is no justice in Nigeria. Two of their former directors are in President Buharis cabinet. Thieves!!!!!!

Union homes too, anything union bank touches is fraud