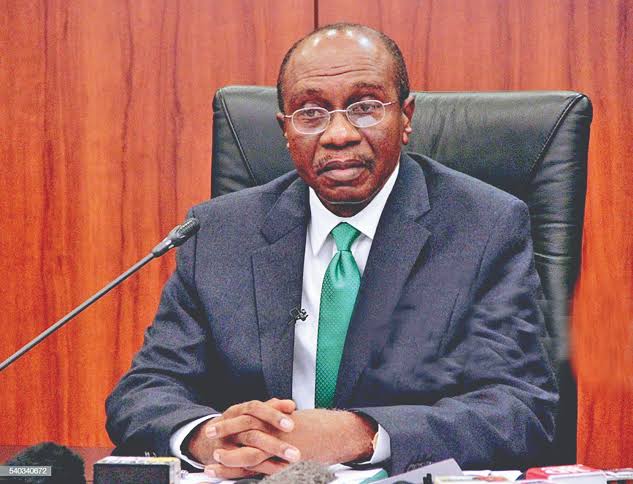

The Central Bank of Nigeria (CBN) Governor, Mr Godwin Emefiele, has said that electronic transaction volumes increased by about 67 per cent during the COVID-19 lockdown with increased transactions at agent networks.

This is contained in a statement issued by Mr Nelson Olagundoye, Head, Corporate Communication and External Relation, Chartered Institute of Bankers of Nigeria (CIBN) in Lagos on Thursday.

Olagundoye quoted Emefiele as saying this during the 20th edition of the National Seminar on Banking and Allied Matters for Judges.

The seminar was organised by the CIBN, in collaboration with the National Judicial Institute (NJI), under the auspices of the Bankers Committee of CBN.

Emefiele was represented by the Deputy Governor of CBN, Aisha Ahmad, at the seminar.

The CBN governor said that the payment system infrastructure accommodated the surge as more citizens moved to electronic channels.

READ ALSO: Yahaya Administration Uncovers N1.48b, 265 Hidden TSA Accounts in Gombe

He said that the banking and payments system was able to retain its operational resilience, maintaining the availability of electronic payment and mobile banking channels.

Emefiele, who highlighted the role of technology, noted that this was in the face of the COVID-19 pandemic, which has ‘’unravelled itself as a global health and economic crisis of seismic proportions’’.

He said that domestic and international travel and global trade value chains had suffered severe disruptions, with significant negative impact on financial markets, financial services industry, oil and gas, health, transport & aviation, education, hospitality and tourism, to mention just a few.

“Individuals, families, businesses, industries, economies, countries – all have had to adapt to a new normal, even as global coronavirus cases continue to rise above 50 million.

“The effects of the pandemic, particularly the crash in international oil prices, disruption in trade value chains and muted business activities during the lockdowns have severely impacted economic output and heightened domestic macroeconomic vulnerabilities with GDP growth for Q2 2020 contracting by 6.10%per cent compared to 1.87per cent growth in Q1, 2020, a decline of -7.9per cent,” he said.

Emefiele, however, noted that the Nigerian financial services sector continues to be resilient, with positive financial soundness indicators evidenced by strong capital adequacy, liquidity and asset quality metrics.

He said that banks and other financial institutions sustained the credit growth momentum, channelling a significant amount of lending (over N3.7 trillion) to the real sector– manufacturing, consumer, agriculture, etc.

Emefiele advised that the administration of Justice process should also leverage technology to facilitate mass communication and business processes in the country.

He said that to stimulate fast trial and opportunities in the new normal, the judiciary needed to undertake critical steps such as keying into digital transformation to improve the efficiency of the justice delivery system.

“Electronic trials should be used to complement traditional court hearings to clear the backlog and improve the speed of dispensation of justice.

“The judicial system must keep abreast of the transformations to be in a pole position to adjudicate cases presented by the financial sector.

“The sector should ramp up investments in critical infrastructure (hardware and software) needed to function in the new normal.

“Above all, continuous learning and capacity development in ICT skills is critical for the judiciary to maintain its support for the financial services industry in its intermediation role,” he said.

The statement also quoted Mr Bayo Olugbemi, President/Chairman of CIBN, as saying that the banking industry had embraced the innovations accompanying what is now known as the “New Normal”.

” With the option of working from home now more of a reality than ever, banks and other financial institutions have further leveraged on technological advancements to improve the efficiency of services, operations, compliance and regulations,” he said.

Leave a Reply