US equities had a mixed day today, the tech heavy Nasdaq ($NDAQ) proved to be the laggard, closing -0.82% lower. Dow Jones ($DOW) and S$P500 ($SPX) closed higher, 0.61% and 0.13% respectively.

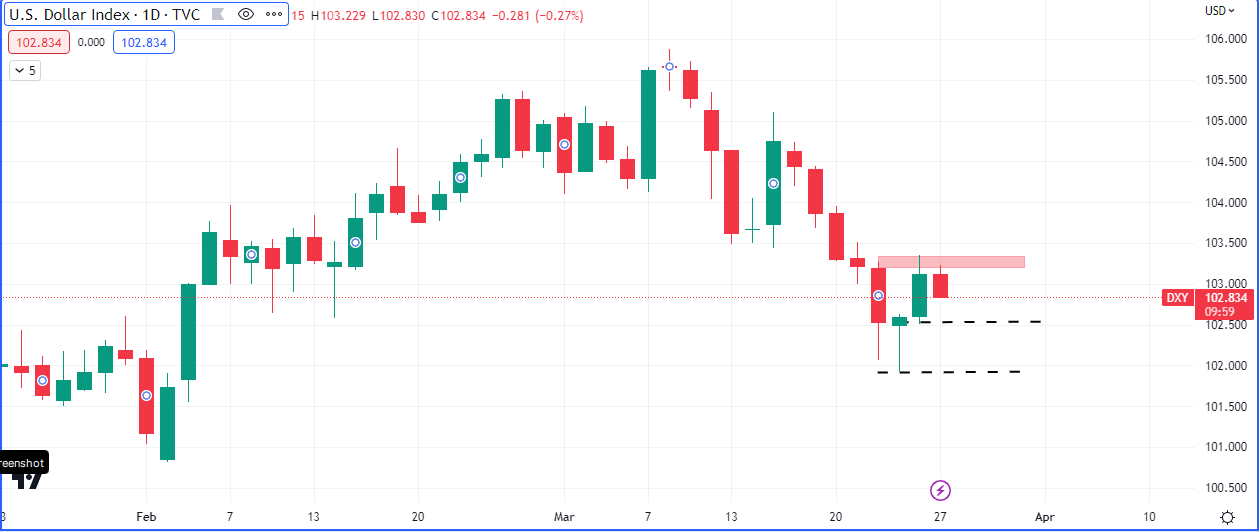

Volatility ($VIX) dipped a further -5.15% and the dollar index ($DXY) also fell -0.27%, with the next possible support level at Friday’s low.

With the orderflow in the Monthly and Weekly timeframes bullish, the daily bearish momentum is likely temporary with possible bullish continuations in the 102.000 area.

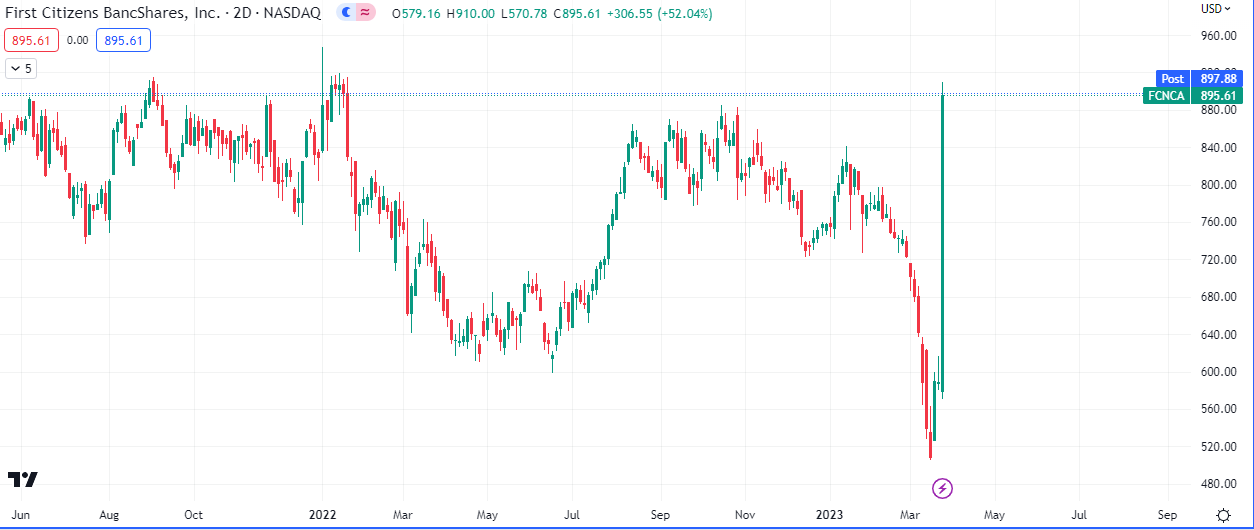

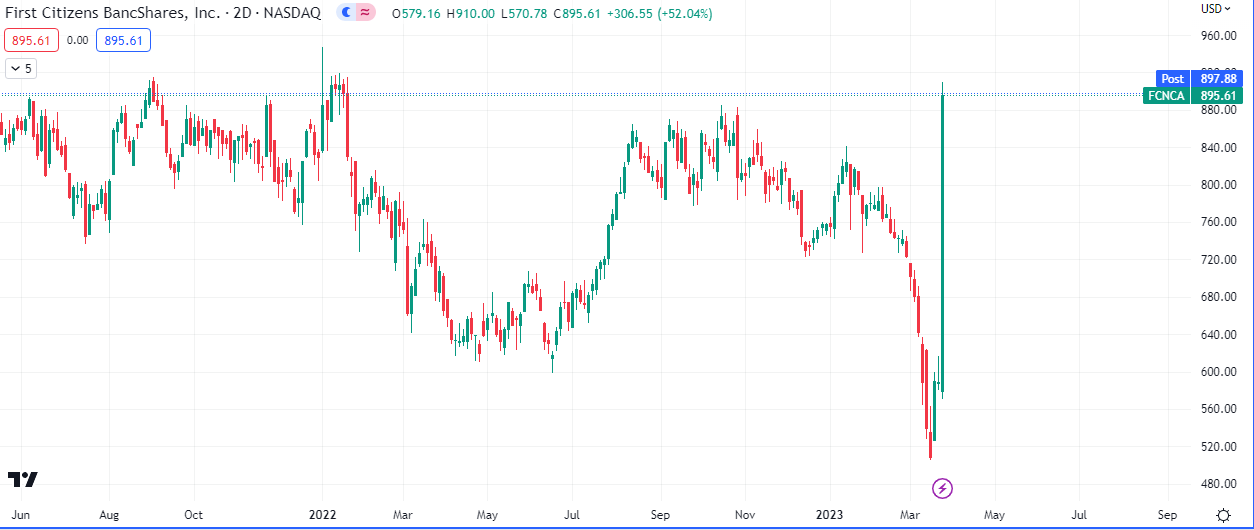

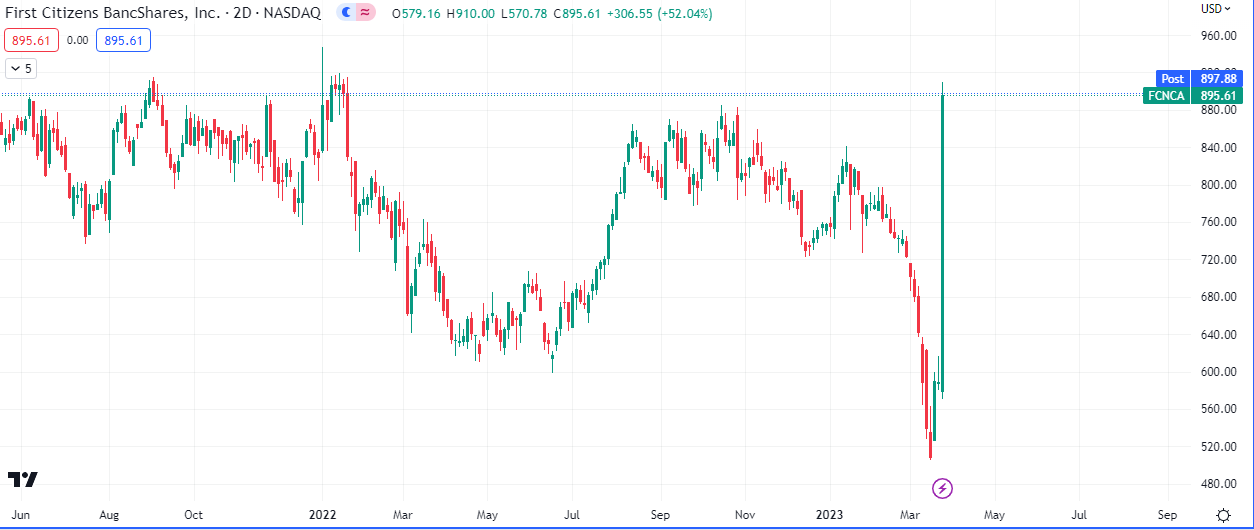

The financial sector ($XLF) got a small lift, +0.06%, as a deal was struck between First Citizens BancShares ($FCNCA) and Silicon Valley Bank, for the former to buy a large chunk of of the latter’s loans and deposits. XLF’s upward drift today was it’s first in almost a week full of multiple bank crisis in the US and Europe. $FCNCA closed the day 50% higher.

Crypto shares were also down Monday after the Commodity Futures Trading Commission (CFTC) said crypto exchange Binance and its CEO and founder Changpeng Zhao have been sued by the CFTC for operating an “illegal” exchange and a “sham” compliance program.

Overall, Advancing issues outnumbered declining ones on the NYSE by a 2.57-to-1 ratio; on Nasdaq, a 1.44-to-1 ratio favored advancers.

Oil continued to add to its bullish reversal from last week, WTI is trading at $72.8, up over 5% on the week so far while Brent oil is trading at $77.6, 4.26% higher from last week’s close. The next visible resistance test on WTI is at $77. We will be watching to see what the inventory numbers are midweek to get a further sense of the situation with supply and demand.

Last week the oil benchmarks along with the crack spread and German spreads closed higher, but some of the currencies of some of the major oil producers closed lower. So far we have seen the cross between the Canadian Dollar and the Japanese Yen rise in favor the CAD, being a net exporter of oil. The Yield differential of the two countries 10Y bonds also showed an orderflow in favor of the CAD.

Leave a Reply