A confidential source has revealed that virtually all the Nigerian banks including top tier bank, GTBank, and mid-size banks, Fidelity and Union Bank Plc were involved in the N33 billion illicit money laundering operation run by Ismaila Mustapha aka Mompha and his associate Hamza Koudeih.

According to the source, “there is no way you have a money laundering operation of that scale where billions of Naira are involved and the bank doesn’t know the source of money is illegitimate money.

“These things are encouraged rather than frowned upon. At the end of the day as a marketing staff in a bank, you have to meet your target or face several stiff career challenges.”

READ ALSO: Another Union Bank Staff Steals Customer’s Life Savings

The Economic and Financial Crimes Commission (EFCC) has said that Mompha operated over 51 different bank accounts, despite the BVN policy of the Central Bank of Nigeria (CBN), which was implemented to forestall such illegal activity.

The EFCC said in a statement, “Worrisome is that Mompha was able to successfully operate 51 fraudulent bank accounts, through which the monies were laundered even with the enhanced account tracking and surveillance which the Bank Verification Number (BVN), introduced by the Central Bank of Nigerian in February, 2014 provides.”

ALSO READ: Mompha had 51 bank accounts, His arrest remains a Landmark Achievement- EFCC

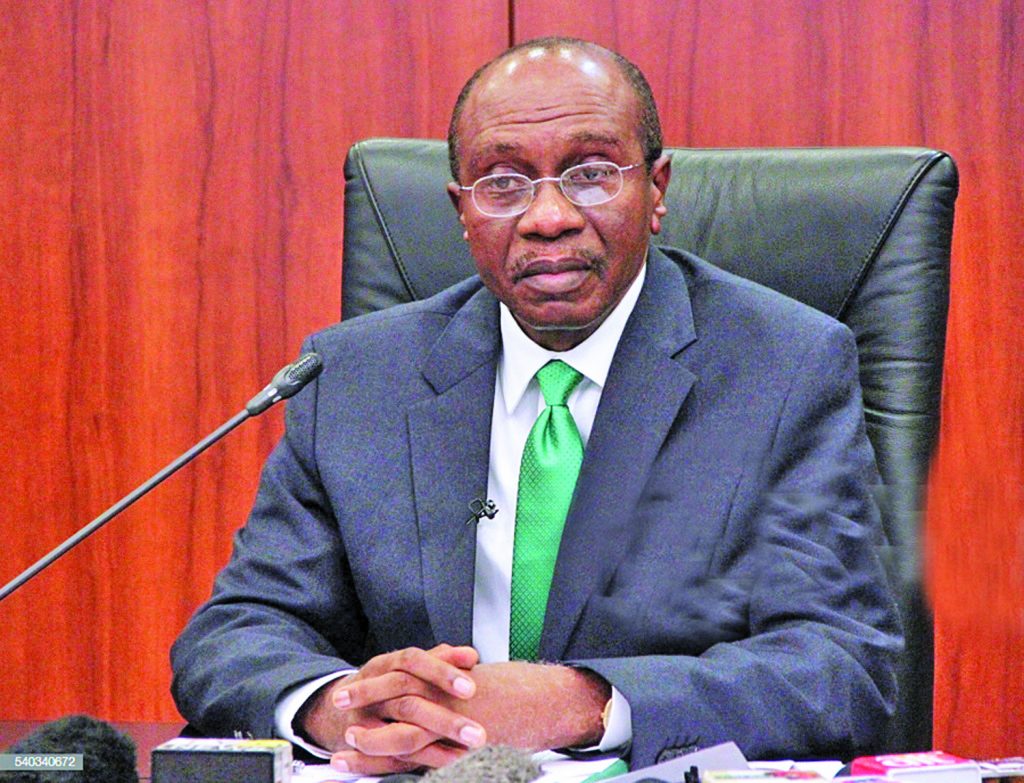

The EFCC boss Ibrahim Magu said, “I make bold to tell you that these arrests have further confirmed our commitment to the anti-graft war, while also sending a red alert to potential internet fraudsters.”

The EFCC chairman was however silent on what penalties the banks would face, if any, for allowing money laundering on a grand scale to be perpetrated through their institutions.

Leave a Reply