The Federal Inland Revenue Services has issued a 30-day grace to tax payers to acquire their tax clearance certificate.

This was approved by the newly appointed Executive Chairman of the Federal Inland Revenue Service (FIRS), Mr Muhammad Nami and announced in a public statement signed by the tax chief which was issued on Sunday on the official Twitter page of the agency.

Mr Nami disclosed in the statement that the 30 days grace was given in other to mitigate and ease taxpayers in meeting up their obligations.

READ ALSO: SERAP, others take drastic decision on N37bn NASS renovation budget

The statement reads;

“Following the numerous complaints received from our esteemed taxpayers with respect to difficulties encountered before obtaining Tax Clearance Certificate (TCC) and the fact that taxpayers need TCC to enable them to, inter alia, seek and obtain contracts and loans, renew permits, registrations, franchises, agreements and/or licenses that will invariably generate revenue from which taxes will be paid, management has looked into the above complaints and has taken steps to ease the process of obtaining TCC.

“Consequently, notice is hereby given that the service has put in place machinery to issue 2020 TCC for all eligible taxpayers from January 2, to January 31, 2020.

“The service may not hesitate to use enforcement activities including imposition of lien on bank accounts of such defaulting companies to recover any outstanding debts when it discovers that the taxpayer has misled the service in her duty to observe tax compliance.

“The issuance of TCC to ease the burden of taxpayers is in line with the provisions of Section 101 (1) of CITA LFN 2004 and in conformity with Self-Assessment Regulation, 2011.

“Taxpayers are, therefore, encouraged to take advantage of this initiative and apply for their 2020 TCC, as soon as possible.”

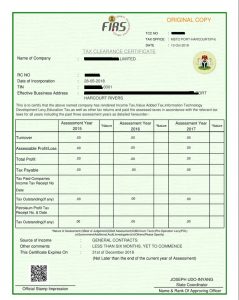

See Tax Clearance Certificate Below:

Leave a Reply