The trading week started off with a massive gap up on both oil benchmarks, on the open due to supply cuts by OPEC. WTI opened $75.018 up from $71.858, Brent opened $78.396 up from a close of $76.314.

Some of the key closes for the day were;

$DXY -0.03%

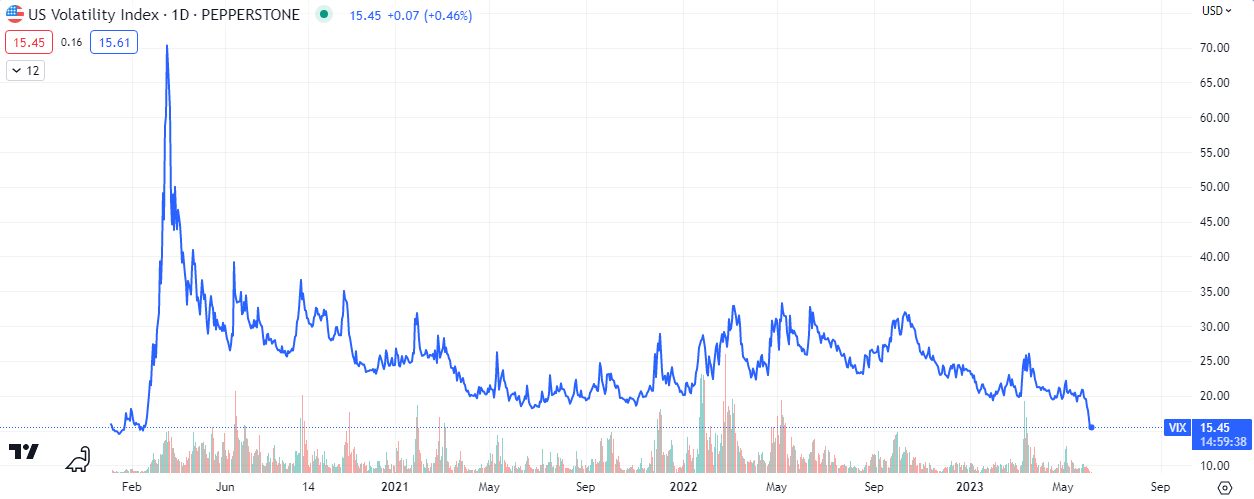

$VIX -13.93%

$SPX -0.20%

$NDAQ -0.02%

$DOW -0.58%

$WTI +0.57%

$BRENT +0.32%

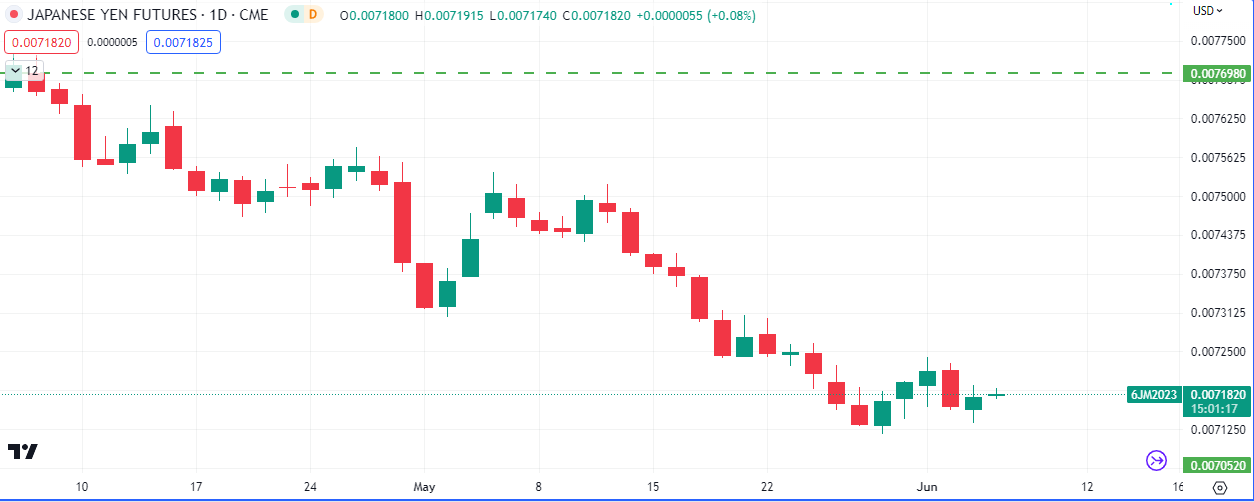

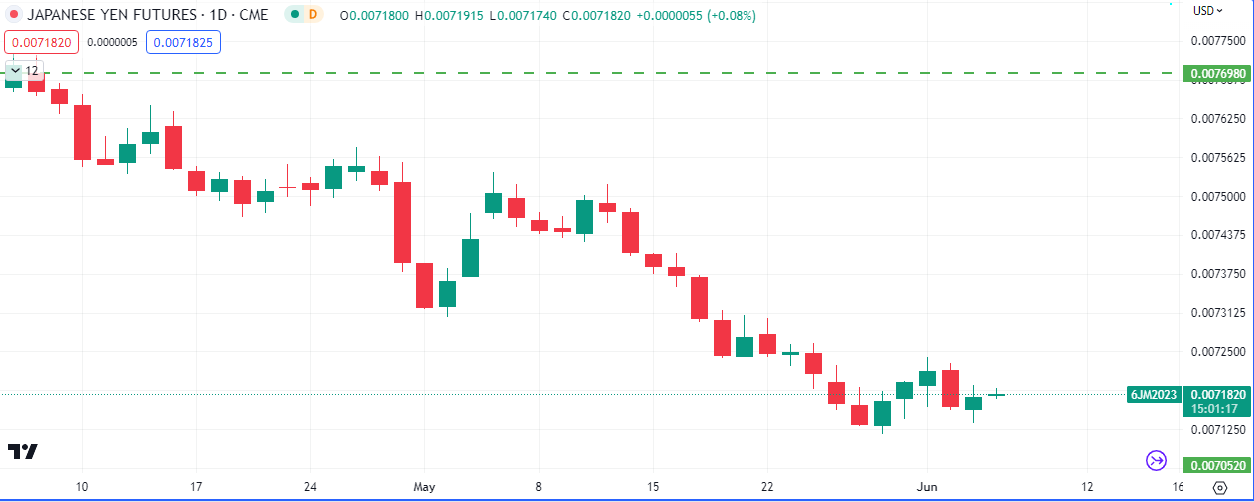

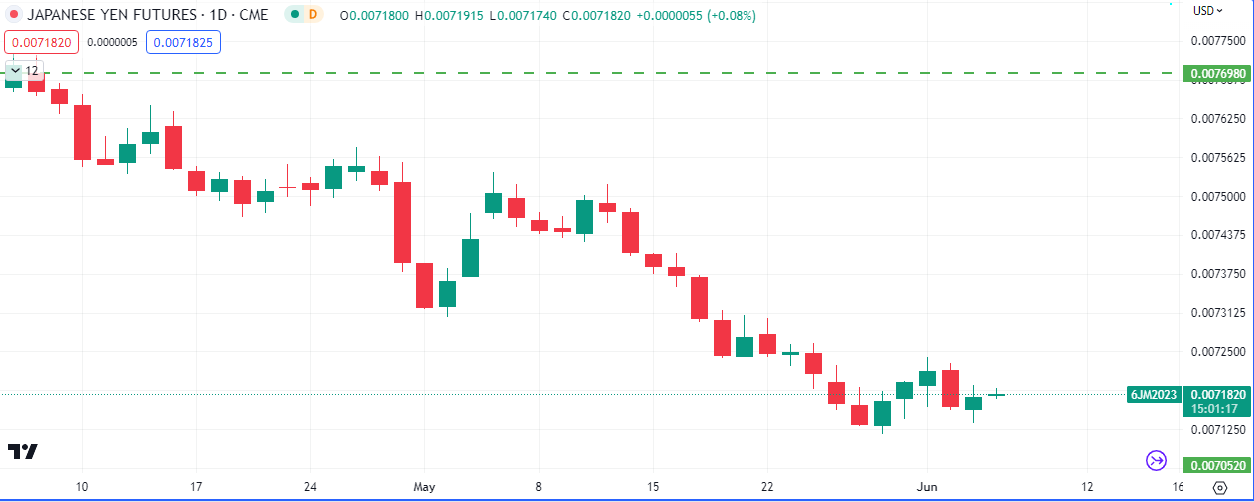

Yen Futures (6J1!)

$VIX

The ‘fear index ($VIX) is currently traversing oversold levels. Historically speaking, volatility is likely due for a strong uptick.

Japanese Yen

The Japanese Yen futures market is still in a downtrend, however yesterday’s close leaves the likelihood of a break of last week high on the table.

We will be watching what the new governor of ultra dovish Bank of Japan does about monetary policy this week.

Oil

The oil market gapped up on the open of the week by as $4, off OPEC cuts led by Saudi Arabia and Russia. The gap was however erased by the end of the trading session.

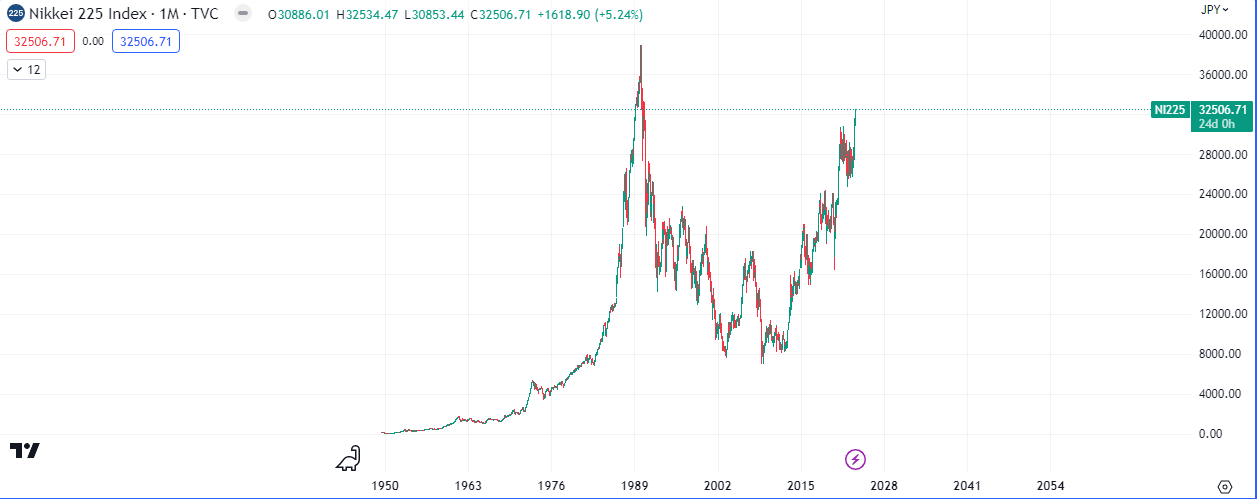

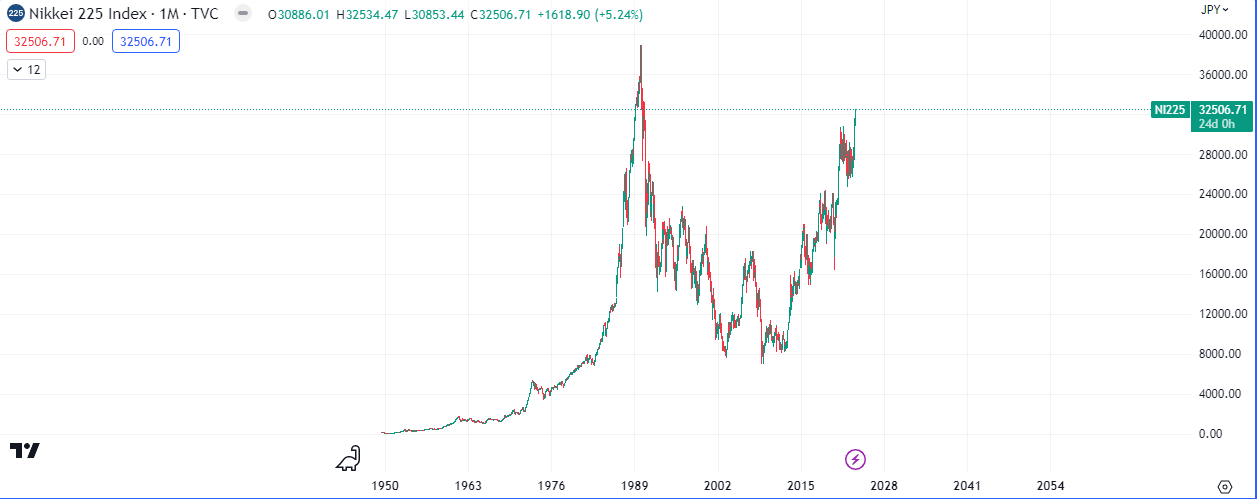

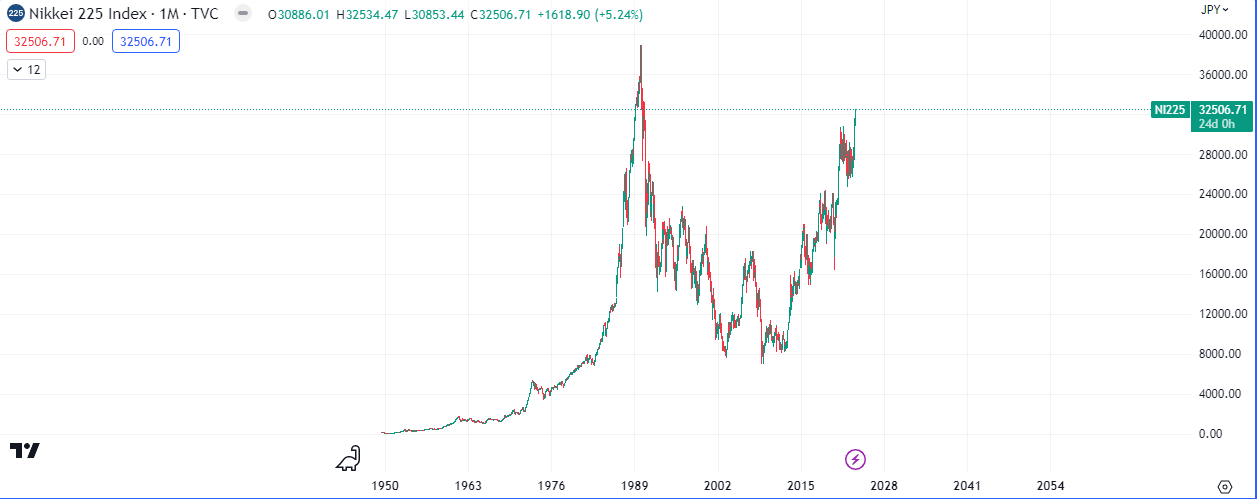

NIKKEI 225

The Japanese stock index has been in a range for decades, post the massive boom experienced in the 70s to 80s. The index is now approaching all time high territory.

Something to watch closely would be the Japanese government’s monetary policy, since the Yen is traditionally meant to be negatively correlated to the stock market, at least at extremes.

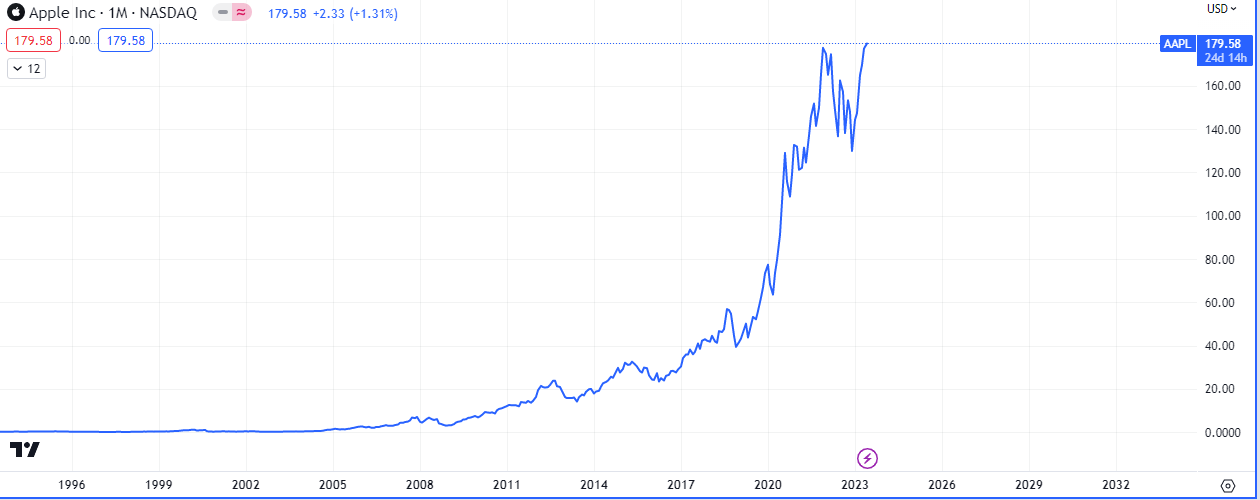

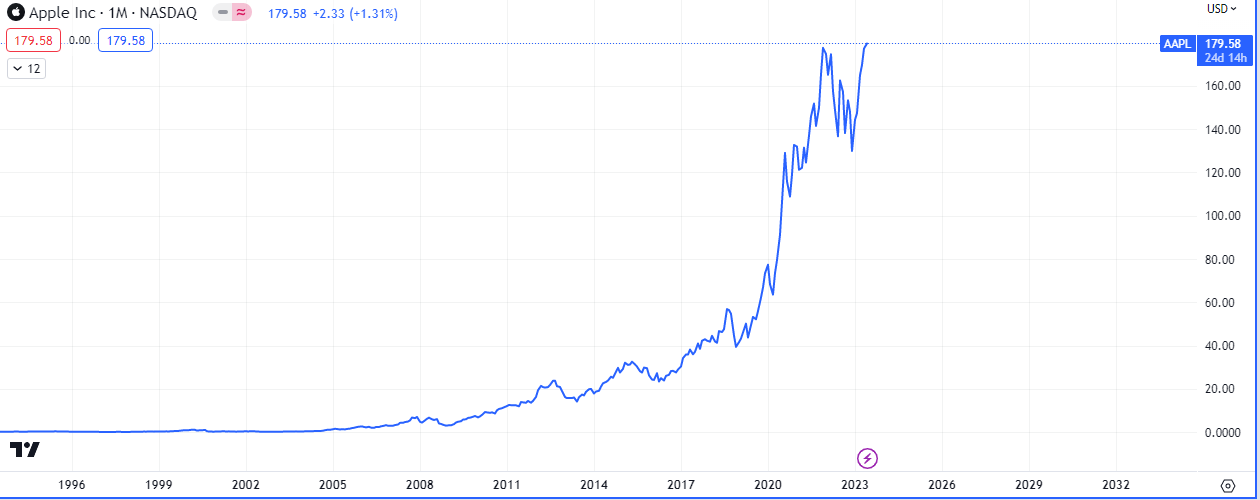

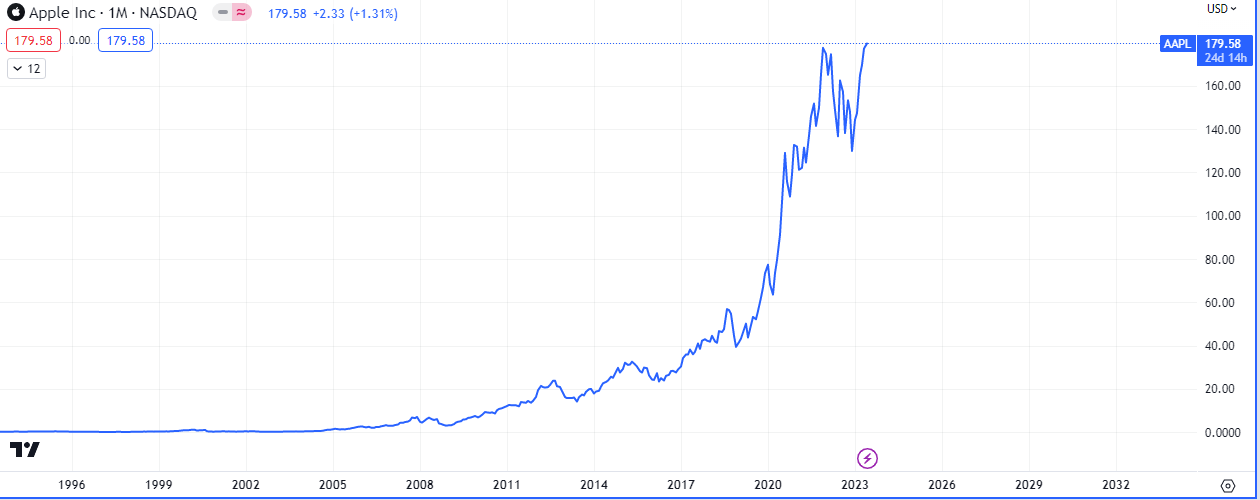

$AAPL breaks all time high

Last week $NVDA broke it’s all time high, this week $AAPL followed suit as it took out the highs of 2022 ($157). The tech giant, which is also in the race for developing AI technology, introduced a new of AR/VR headset into the market.

Conclusion

With the risk on sentiment that has pervaded for months being challenged by persistently negative macro economic headwinds, we will be watching to see when or if risk off begins to seep into the markets. Key to this watch will be the Japanese Yen as it is traditionally a risk off asset.

Leave a Reply