The long-awaited spinoff of Meta Materials (NASDAQ:MMAT) preference shares (OTC:MMTLP) has taken an unexpected turn. Some shareholders are outraged because trading in MMTLP stock has been suspended ahead of Meta Materials’ (MMAT) planned spinoff to Next Bridge Hydrocarbons.

Metamaterials (MMAT) is a Canadian firm that was listed on the Nasdaq in June 2021. Meta Materials merged with Torchlight Energy in order to be listed on the NASDAQ (TRCH).

The Financial Industry Regulatory Authority (FINRA) revised its notice regarding the corporate action of exchanging META’s Series A Preferred shares (OTC:MMTLP) for shares of common stock of Next Bridge Hydrocarbons, Inc.

The firm via a statement said that “Please note that this disclosure and dates from FINRA regarding the trading of MMTLP in connection with the distribution of the shares of Next Bridge Hydrocarbons, Inc. supersedes and replaces all of META’s prior disclosure regarding the logistics and timing of the trading of MMTLP in connection with the distribution.

“Please contact your broker, bank or other nominee for assistance with any questions concerning ownership or trading of META’s Series A Preferred shares.”

Reactions, petition

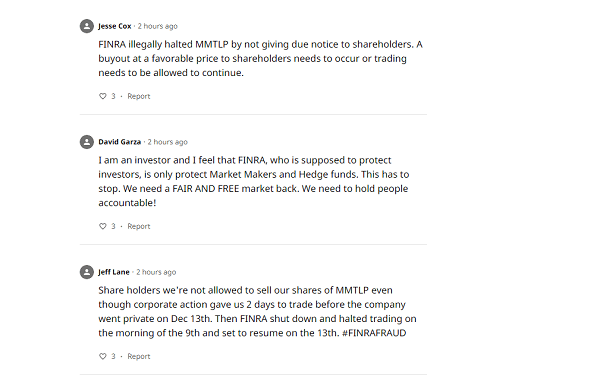

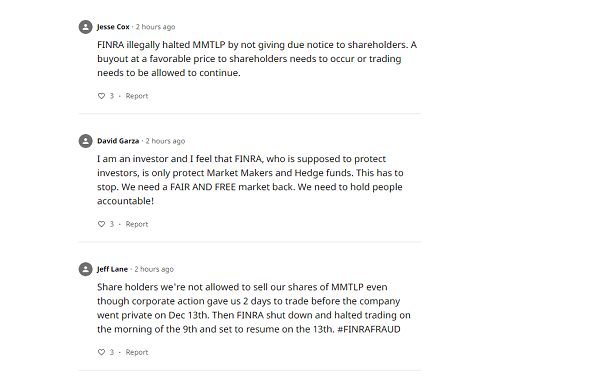

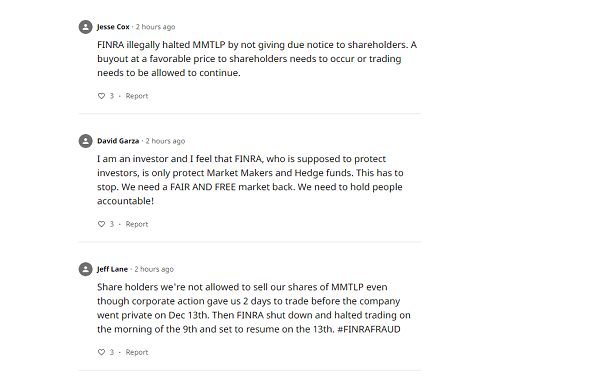

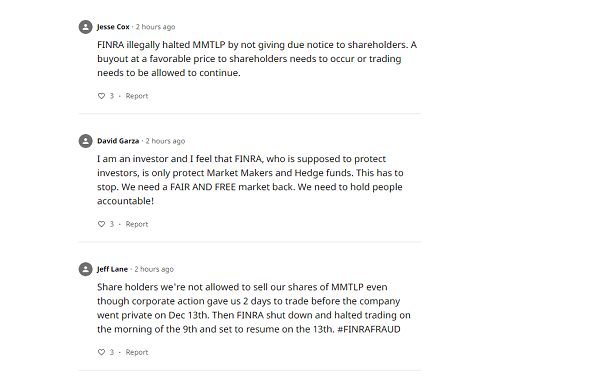

Retail investors, on the other hand, have been outraged since FINRA imposed the trading halt. Some have accused the organization of market manipulation, while others have praised the organization’s short interest levels.

Many traders have called for a lawsuit against FINRA, naming market influencers such as Elon Musk and AMC Entertainment (NYSE:AMC) CEO Adam Aron as targets. However, so far, all of the actions appear to be legal, with no illegal activities.

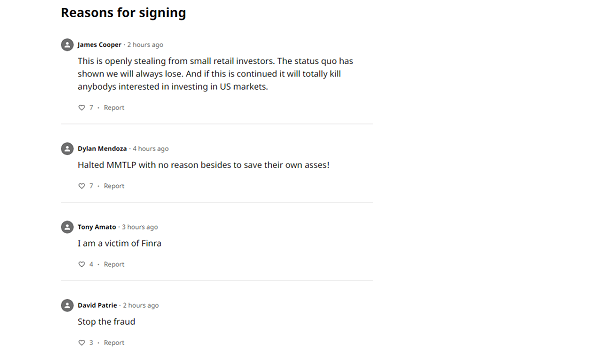

Over 2,000 grieved investors have signed a petition against FINRA, citing the suspension of the stocks ‘as unlawful, greedy, corrupt and thieves.

FINRA’s rule book states that “FINRA may impose a trading and quotation halt in an OTC Equity Security pursuant to Rule 6440(a)(3) where FINRA determines, in its discretion, based on the facts and circumstances of the particular event, that halting trading in the security is the appropriate mechanism to protect investors and ensure a fair and orderly marketplace.”

THIS JUST GOT CRAZY ‼️‼️

One of the Market Makers who created and had $MMTLP trading is on the Board of @FINRA

Ari Rubenstein is the Co Founder of GTS and board of FINRA

THIS IS ILLEGAL #FinraFraud pic.twitter.com/V9imet8ODw

— ShortSqueeze (@AShortSqueeze) December 10, 2022

FINRA ur breaking the law. what you have to understand you APPROVED dates.

Investors saw those date and knew they had up to the 12th to sell if they didn’t want a private company..

You BROKE THE LAW by halting and taking millions of dollars away from them #finrafraud $MMTLP RT pic.twitter.com/RCzWMHdSHM

— ShortSqueeze (@AShortSqueeze) December 10, 2022

Just filed a complaint against @FINRA with my Attorney General for what they did with $MMTLP. I hope others do the same. #finrafraud

— Machew (@MachewWV) December 10, 2022

Very true, everyone knows if you short, you take the risk to infinity 🚀🚀. Certainly @FINRA knows this and @AriGTSX should know this too. Not $MMTLP holders fault they got boxed in by their illegal activity. BE TRANSPARENT Finra, tell us what you really know! https://t.co/TF0kFOKj4q

— John Brda (@johnbrda) December 10, 2022

$mmtlp After a number of requests I am adding a sample template for you to complain at @FINRA Please edit or amend as you wish and lets keep the pressure on FINRA. We pay their wages. #finrafraudhttps://t.co/qdb9yYOCnS pic.twitter.com/j8Mjnp9qsJ

— TradingSecrets (@TradingSecrets7) December 10, 2022

$MMTLP I ask all shareholders of MMTLP to sign the petition for the trading halt from @FINRA #FINRAFRAUD

Sign here: https://t.co/WLWgb6HBIB pic.twitter.com/s0F0lnwiod

— Metamaterial News🚨 (@MMATNEWS) December 10, 2022

Should we start a protest?

[email protected]⁰1735 K Street, NW⁰Washington, DC 20006⁰301-590-6500 $MMTLP $MMAT #FINRAFRAUD pic.twitter.com/DqDl1riGBa

— ShortSqueeze (@AShortSqueeze) December 10, 2022

We know @FINRA CEO salary is 3.12 million a year…

And he wants to make retail suffer #Manipulation #FinraFraud $MMTLP pic.twitter.com/57h8fZOKkR

— ShortSqueeze (@AShortSqueeze) December 10, 2022

$MMTLP @JohnBrda here is an even more recent injunction that has no info on it yet by @AriGTSX… I bet there is a pattern here! WE SEE YOU #FinraFraud https://t.co/X0EtxPoU5J @cvpayne @MeetKevin pic.twitter.com/FwKOXZJNak

— UncleSmokeyStockTrades (@SmokeyStock) December 10, 2022

$MMTLP @JohnBrda here is an even more recent injunction that has no info on it yet by @AriGTSX… I bet there is a pattern here! WE SEE YOU #FinraFraud https://t.co/X0EtxPoU5J @cvpayne @MeetKevin pic.twitter.com/FwKOXZJNak

— UncleSmokeyStockTrades (@SmokeyStock) December 10, 2022

There! @FINRA , I fixed your background picture. According to what they did to $MMTLP investors today, they should probably update this.. pic.twitter.com/RvAm8sgLWr

— therrmann77 (@therrmann77) December 9, 2022

Even if you weren’t in this play it should scare the hell out of you. @FINRA colluded with hedgefunds and literally turned off the ticker. It’s a fucking joke and a travesty. This will happen with any ticker they want to “protect” retail (really shorts) from #MMTLP $MMTLP https://t.co/ILFnPiB3CB

— Epically Fetch (@Epically_Fetch) December 9, 2022

READ ALSO: 2023: Get your PVC, vote for me – Tinubu tells Nigerians

Yea FINRA really stabbed the investors in the back here, problem is there’s no easy way out now. The halt can’t be carried out to deletion because there’s more than 165 million shares the transfer company is already full and thousands haven’t registered there shares. It turns out that hedge funds massively over shorted this stock, creating millions of synthetic shares in the process, this was most certainly the root of the trading halt liquidity questions if trading went forward. But since they sold more seats than were available there’s no way out, it’s a mess hopefully trading will be opened and this can work it’s way through the normal legal process. The even bigger issue is how many small companies are so heavily naked shorted that there closing would represent a major threat to multiple hedge funds and the overall faith in the economy?

Mmtlp holders see this as unlawful restraint on alienation. FINRA approving the dates, allowing shorts to drive the price down, then halting it after so that RETAIL is trapped IS CRIMINAL ACTIVITY. We know there are hundreds of millions of counterfeit shares.. it’s proven. Hedgefunds and market makers need to be held accountable or this will set the precedent that this is ok. FREE OUR MARKETS !

These criminals better not get away with this! I want justice and I want my money!

The crazy thing is, Thursday, they shorted the stock into oblivion to $2.96. There was even 426 trades made in pre market on Friday around $6 and once they saw the high limit sell orders they were probably scared and halted the market to save their “buddies” from losing. Causing retailers to lose once again. Not a free and fair market. Give us our money. Just because they were about to lose they changed the rules and started kicking their feet like babies.

We just want a free & fair market but us retailers may never see this !!! #FINRAFRAUD

The faith in our market system is being undermined by a group that has been and will continue to be a dark force in capitalism. There should be an open market reconciliation of price and the oversold shares should be able to be bought back at the price the seller and buyer negotiate for, the open market price. Stating sale ability of shares through December 12th that was put forth last week by FINRA and then changing the rules on Friday with an “Unusual Circumstances” statement that was not supported with details justifying such action resulted in a trade halt causing no selling and caused a forced trap. FINRA is responsible. Write to the Secretary of the Board Governors as posted on their sight under Board.

A significant Shareholder with intense interest.

If unchecked, this type of market manipulation will destroy confidence in, and perhaps cause complete collapse of, our financial system as we know it. There is no misunderstanding of the way MMTLP was supposed to play out. Thousands of retail investors have researched, done their due diligence and have shared information with each other for well over a year in anticipation of this event. What we saw instead was pure greed and manipulation for the benefit of the hedge funds and market makers who illegally allowed this non-tradeable placeholder share to be traded in the first place.

It’s truly appalling to witness such abhorrent and blatant criminality. I am a single father. I bust my a** working to try to provide as good as I can for my son. I invested my small nest egg into this because I did my research, and had everything played out by the rules, it would have set my son up for future success and alleviated a lot of the stress I am facing in this sh*tshiw of an economy. But of course they couldn’t allow the little guy to even have one win. This is disgusting. I don’t even know what I am going to do. Someone is going to pay, one way or another.

Thank you for covering this important story!

Seems pretty simple to me – If the hedgefunds overlevereged themselves and created synthetic/naked shares to short a stock they take on INFINITE RISK, especially when they are doing to a company about to go private because everyone knows that you can’t take FAKE shares into a company that is going private. SEC approved the S-1 with dates, FINRA approved it to take place with dates; then FINRA Halts the stock from trading after HF shorted the stock into oblivion (-70% within the week), once they realized they screwed up?? Sorry not Sorry – you lay in the bed you make and are no longer able to reap the rewards off the backs of the common retail investor. #FinraFraud

Lost a lot of money by believing it. Where do I sign?

Thank you for covering this. There were so many counterfeit shares in MMTLP! All signs point to them trying to cover it up while they leave all investors in a blind limbo on where our investment is, & confusing conflicting information being told to us by brokers & ATS. This FRAUD & THEFT of Wallstreet & it’s supposed “over-site” of big $$$ HAS TO STOP! If the little guys lose, they just lose. If THEY (hedgefunds big $) lose, they cheat & change the rules. > fairmarketsnow.org