The tech heavy $NDX has rallied 5.35% in spite of ‘hawkish’ headwinds from the banking sector and the Federal Reserve. The failure of Silicon Valley Banks spread contagion fears across the banking sector but the Federal Reserve stepped in with bail outs. Credit Suisse also had to be bailed out by the Swiss National Bank after the Saudi National Bank refused to inject any more capital into the struggling institution.

The US economy has also had a series of strong economic numbers coming out throughout Q1 this year and this spurred analysts to expect an increase in rate hikes by the Fed, in their tapering battle with inflation.

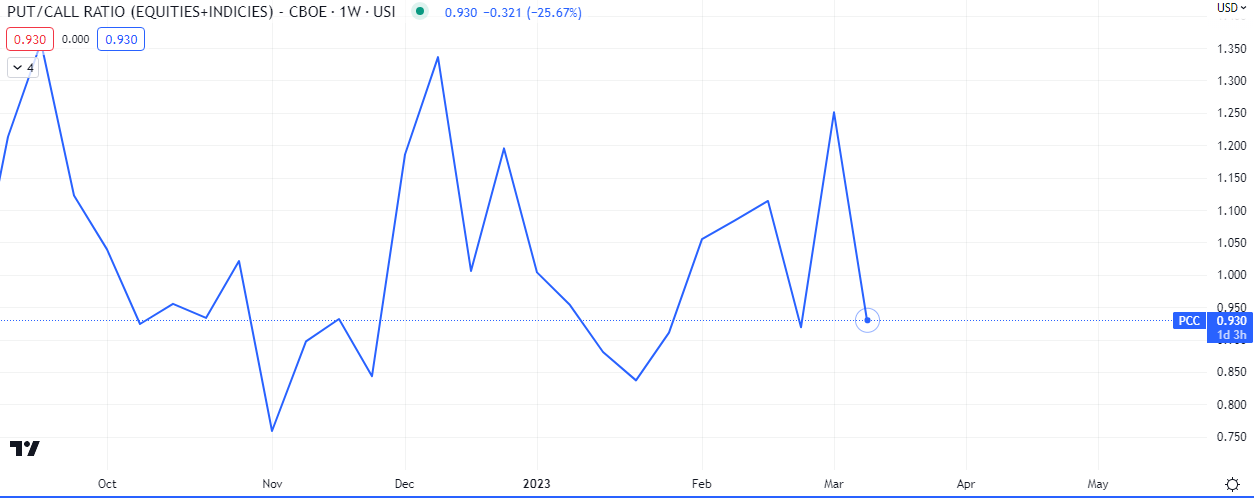

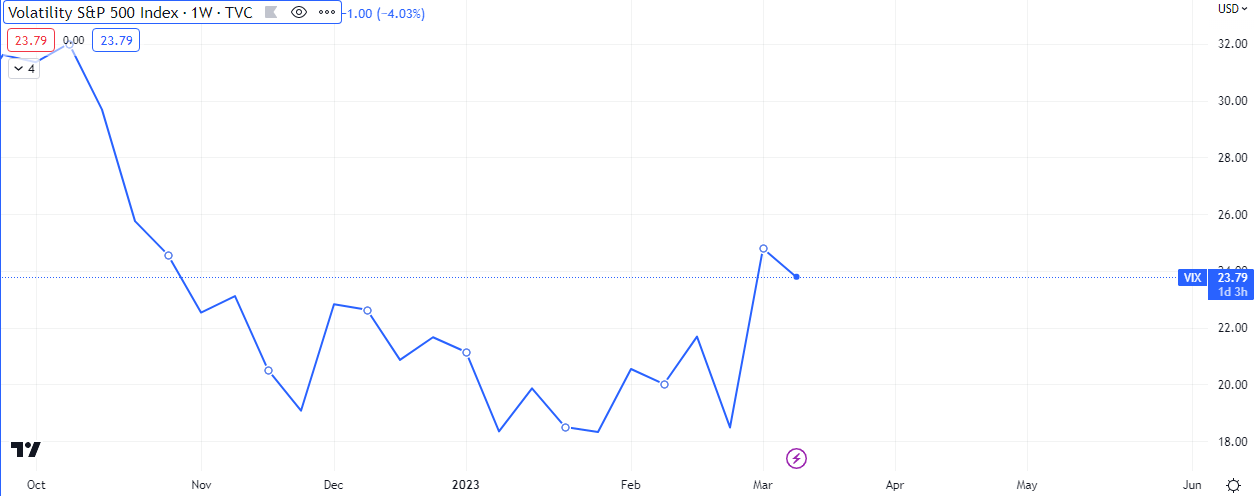

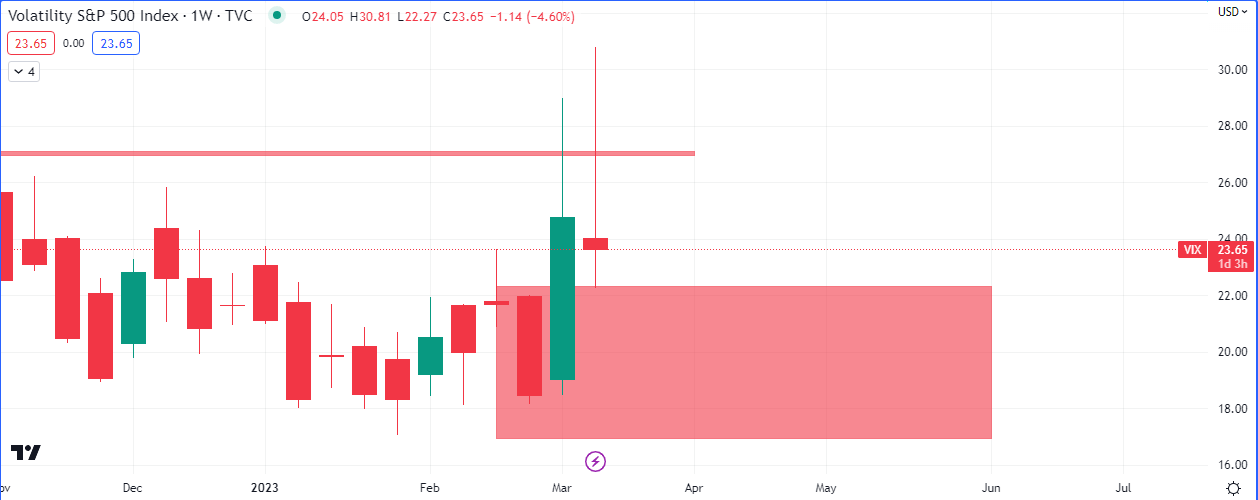

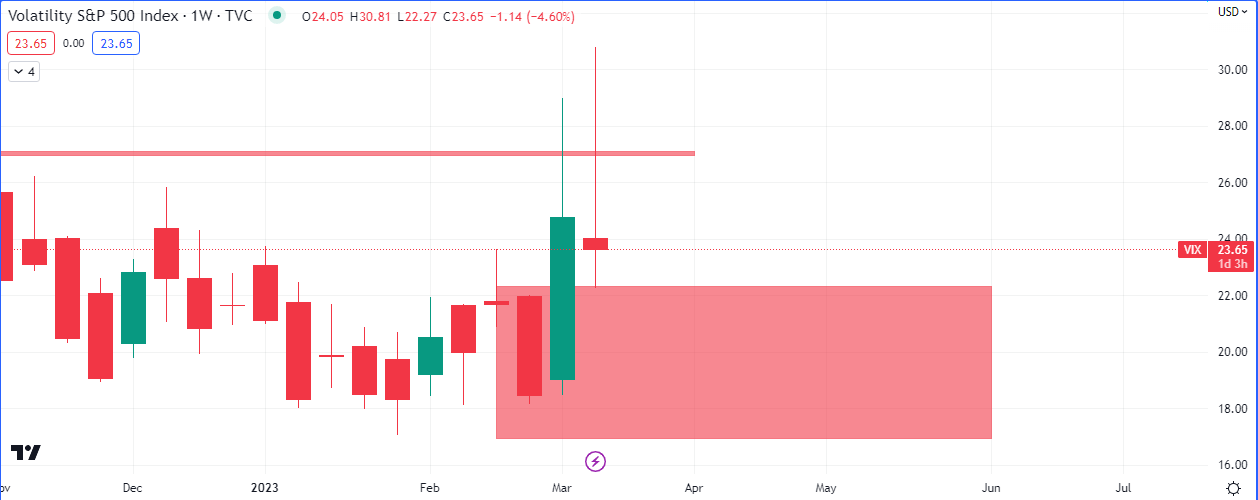

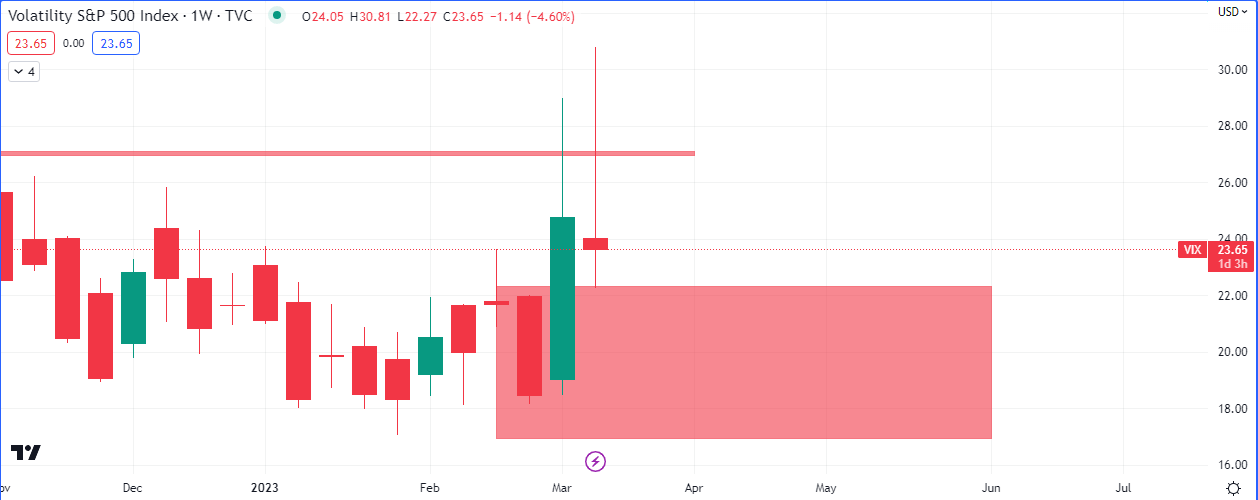

In spite of this, there were some signs of ‘strength’ coming out of the US equity markets this week. As at the time of writing this the Put-Calls Ratio is down 25% on the week while the $VIX (Volatility Index) is down 3.67%. Both of these instruments are negatively correlated to US stocks, depending on what part of the market cycle we are in.

The number of put options being bought have dwindles this week and the call options have risen sharply.

Volatility has also pulled back from it’s March rally.

Taking a closer look at VIX shows that momentum is likely pushing downward and last week’s 35% rally could be partially or completely erased, giving wings to the equity markets.

How the today, Friday and the week in general closes, will determine momentum for the rest of the month.

Leave a Reply