Risk Gauge

02/06/2023

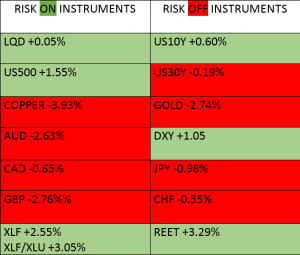

On the board today we have a mix of weekly closes from Friday’s close on February 3, 2023, with no complete tilt to either side. It is important to note that the assets listed in the table are in different phases in their actual market structure so traders should use their individually derived methods to filter the information for a more refined gauge of market risk appetite.

The uptick in the US dollar on strong data on Friday had the expected effect across board with the majors dropping, as well as commodities, commodity-linked currencies and safe haven currencies. The dollar is still under structural resistance with the Composite PMI still in a contraction phase albeit a slowing one. It is important to note that Europe and Japan are in an expansion phase, according the readings on their composite PMIs, so it they may be good pairings against a potentially weakening dollar.

If the structural technical support on the Copper, AUD and CAD resume in the direction of the underlying demand in the commodities market, then we can expect a strong risk on sentiment, a continuation in the drop on the dollar and a rally continuation on equities.

We also took note of the fact that the S&P500 and the Financial Sector (XLF), with the likes of Barclays (BAC), managed to close in the green despite the resurgence of the greenback, the finance-sector dependent UK economy and GBP could benefit from this. We’ll be watching the intraday timeframes for a full tilt towards risk on or off. We will also be watching FED chairman Jerome Powell’s speech on Tuesday evening for further hints about the rate trajectory of the apex bank of the United States.

The real estate investment trusts are still gaining although, as is made evident by the BAC/REET ratio, weaker than the finance sector.

Click HERE to read up in the article with the definition of Risk ON and Risk OFF.

Leave a Reply