The day’s trading session was largely about the continued drop in the commodities market, as this is closely tied to inflation and growth. With many investors already factoring in a coming recession, the day’s drop in the price of oil and copper prices added fuel to that narrative.

The key closes were as follows;

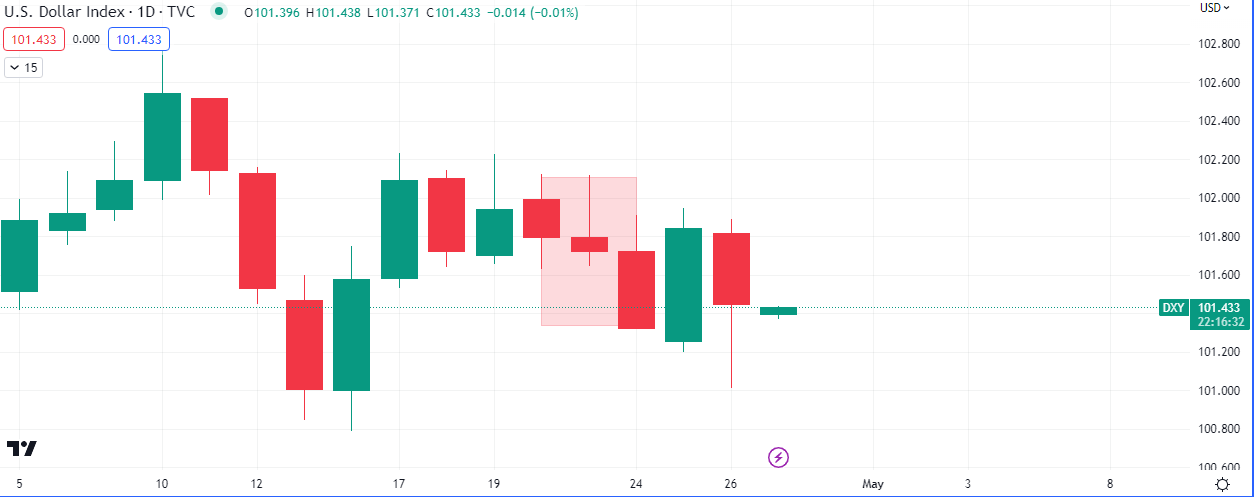

DXY -0.39%

VIX +0.48%

SPX -0.56%

NDAQ +0.34%

DOW -0.82%

WTI -3.59%

BRENT -3.55%

JPY +0.01%

AUD -0.38%

CAD -0.03%

US30Y +1.26%

US10Y +1.38%

US02Y -0.15%

Thursday’s close suggests a likely rally, especially if buyers can keep the dollar bid going into Friday’s close.

The risk off flows in the market continued although the spike in volatility was tempered with a smaller increase, compared to yesterday’s +13%

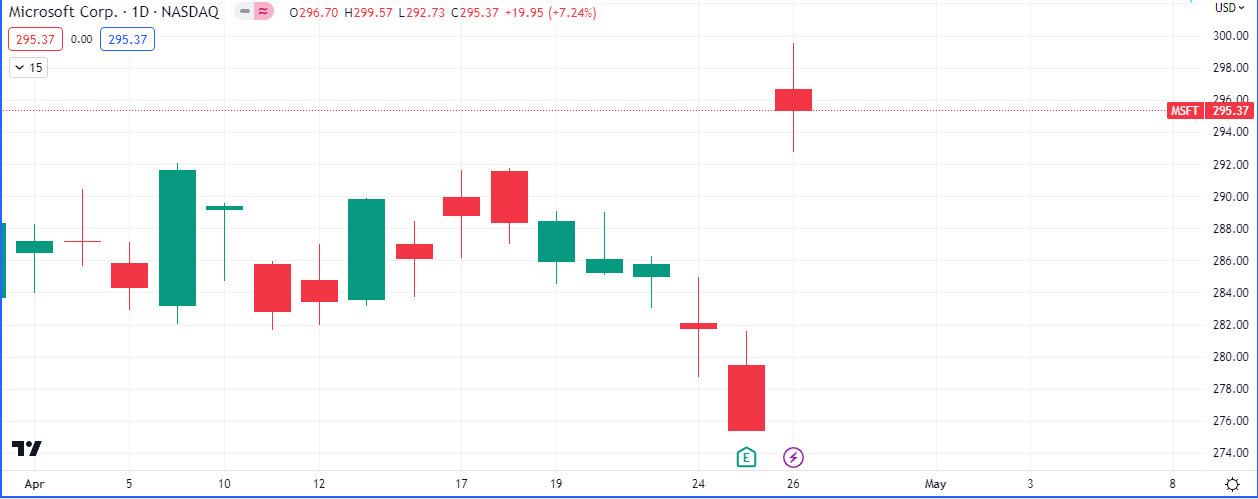

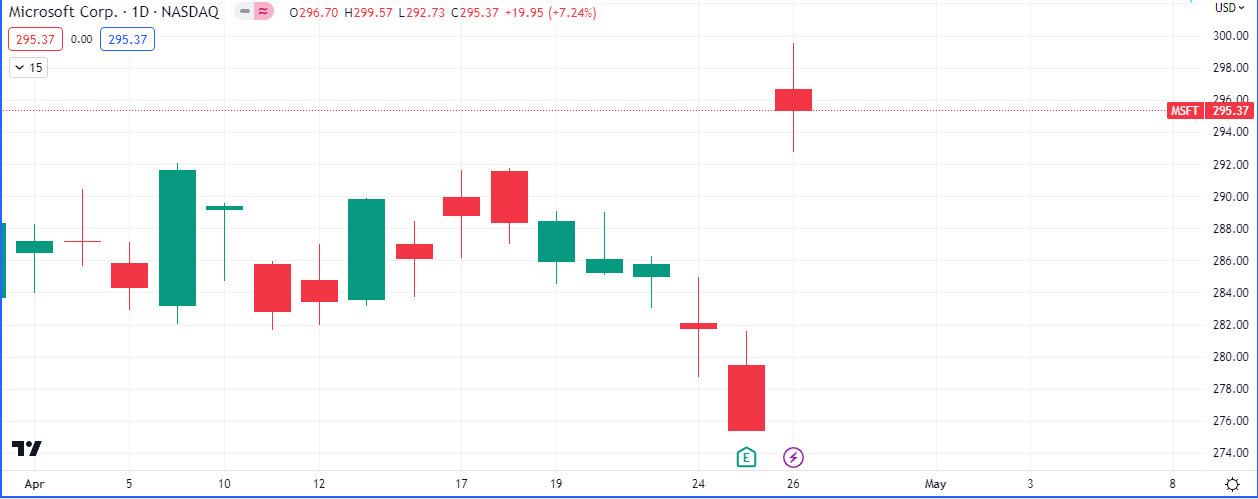

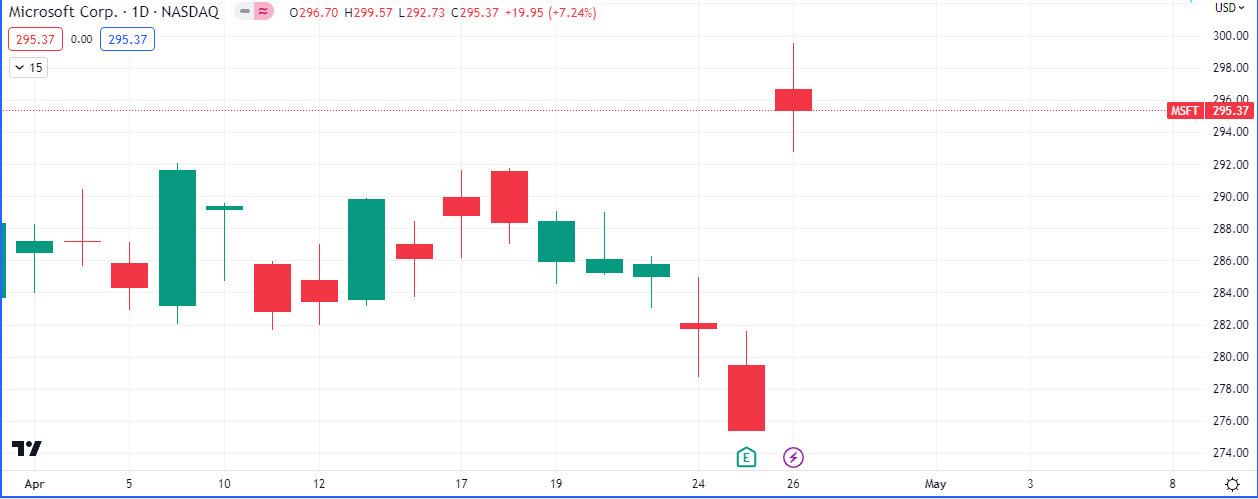

$MSFT opened the day with a massive +7% gap up on the open, although it did manage a red close. The software giant reported string earnings yesterday but could not escape the general bearishness of the broader market, as a more hawkish fed may be emerging.

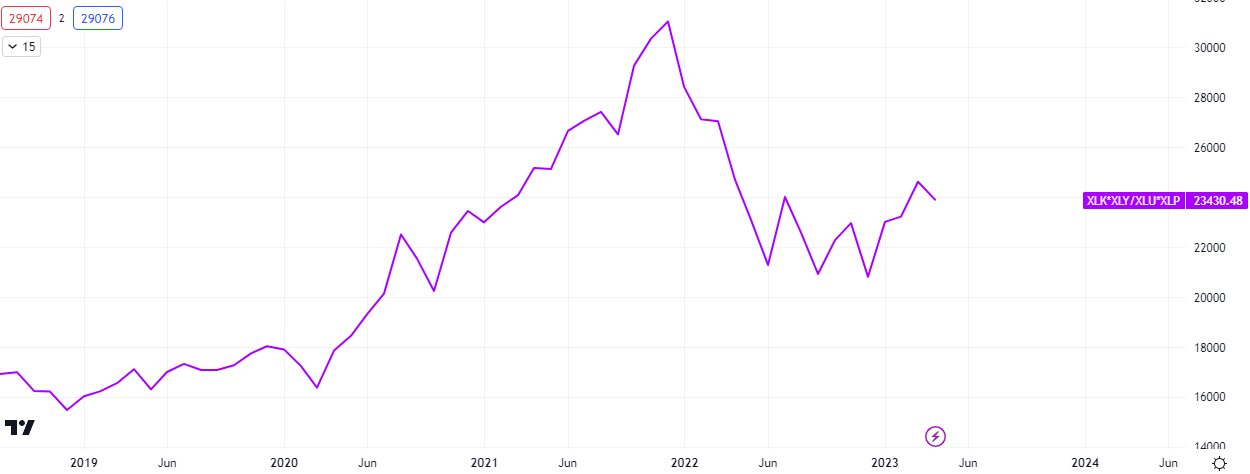

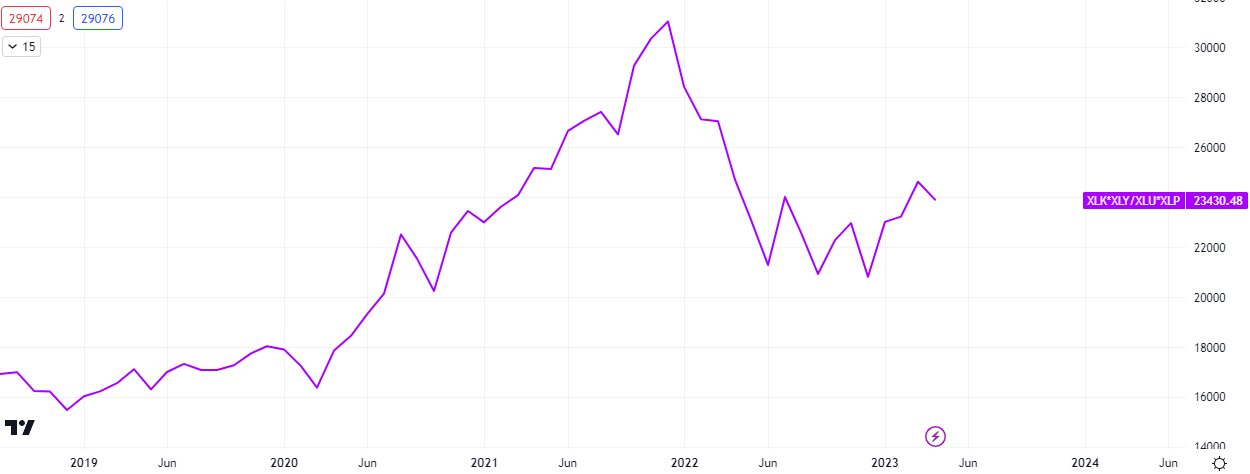

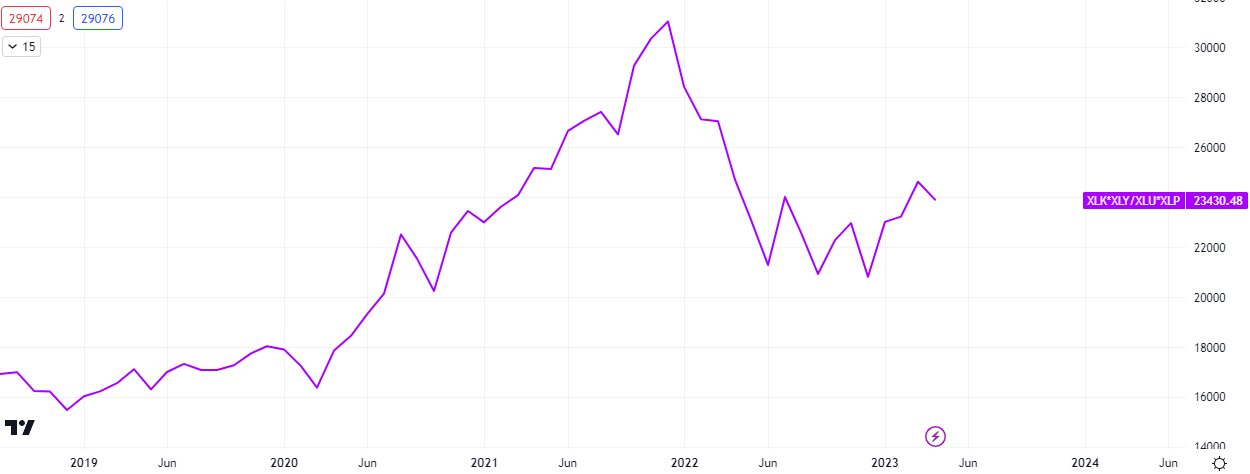

The capital outflows from offensive (growth) sectors into defensive sectors are still ongoing this month although the opposite has been the case for most of the year so far.

Leave a Reply