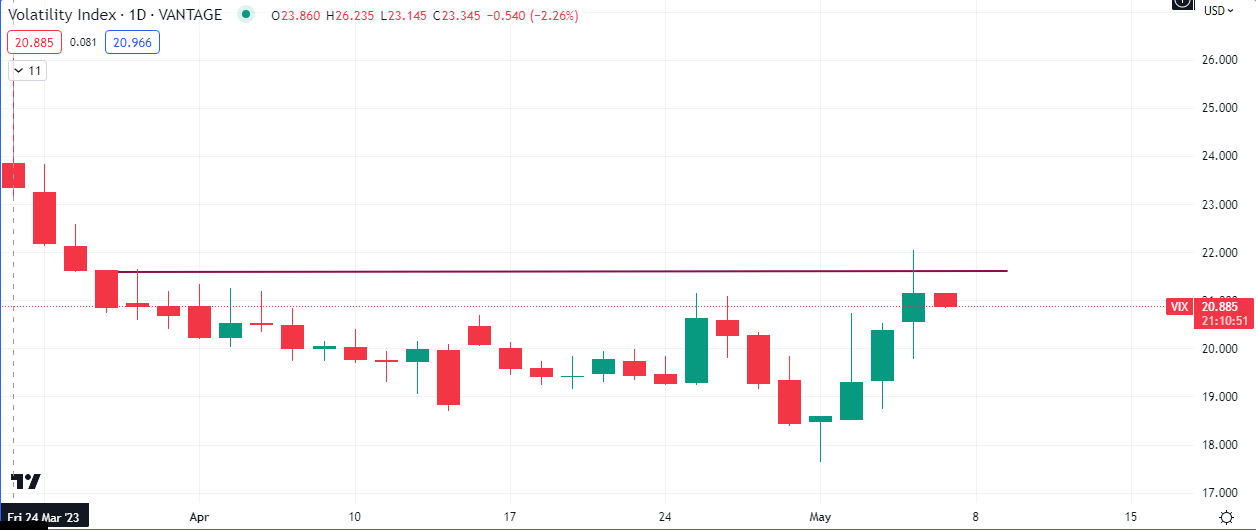

Today’s trading session was largely dominated by the situation on Volatility ($VIX), which has been largely resurrected after a long bearish period. The ‘fear’ index closed the day up +3.8% and is currently trading higher at +13.23% on the week so far.

With the Non farm payroll number coming out of the US tomorrow, investors will be keen to see if the forecast for a small increase of 0.1% in unemployment numbers will be accurate.

Some of the key closes of the day are as follows;

$DXY +0.22%

$VIX +3.8%

$WTI -0.06%

$BRENT +0.79%

$SPX -0.48%

$NDAQ -0.31%

$DOW -0.64%

The effect of the surge in volatility for the third straight day was felt, as usual, in the equity markets, which shed some points across all the indexes.

The inability to break the imbalance late march opens up the possibility of a possible pull back on the $VIX. This could give equities a bit of a boost going into the last day of the week.

Stock of the day

$AAPL reported fiscal second-quarter revenue of $94.8 billion, down from $97.3 billion a year before, while analysts had been expecting $92.9 billion. Revenue for the iPhone category rose to $51.3 billion from $50.6 billion, with analysts surveyed by FactSet expecting a decline to $48.7 billion.

Chief Financial Officer Luca Maestri said on the earnings call that the iPhone growth was driven by “strong performance in emerging markets from South Asia and India to Latin America and the Middle East.”

The share price, which is up by 27% this year, jumped 0.46% post earning release in the trading session today, although it had opened gap down on the day by as much as -0.99%.

Leave a Reply