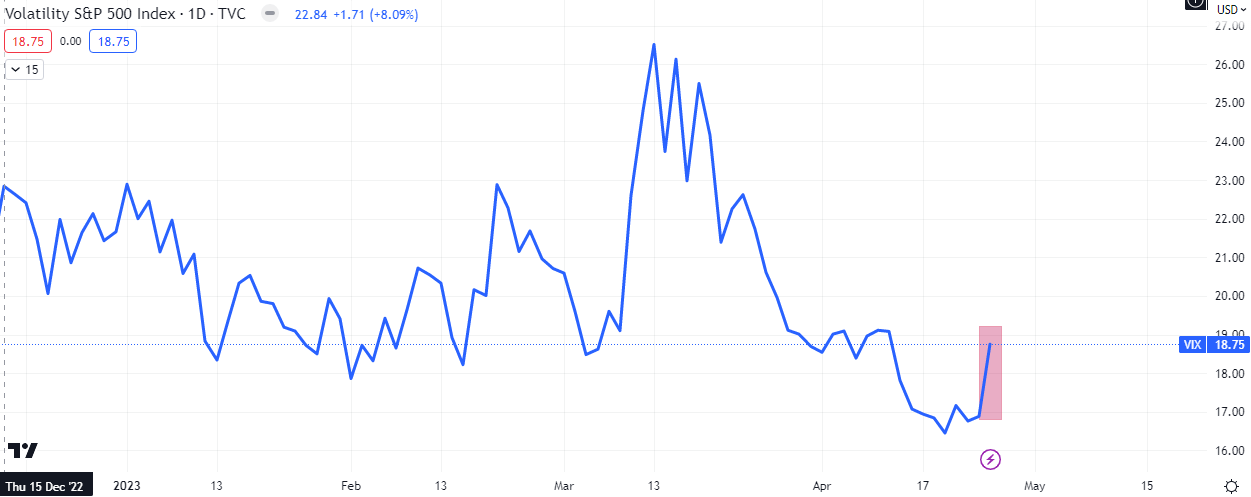

At the closing bell today, investor sentiment looks to have shifted further into a risk off sentiment as the ‘fear’ index ($VIX) spiked by over 11% on the day, leading to a drop in equities despite some strong earnings reports by some big names.

The key closes were;

USD +0.51

VIX +11.08%

SPX -1.14%

NDAQ -0.98%

DOW -0.76%

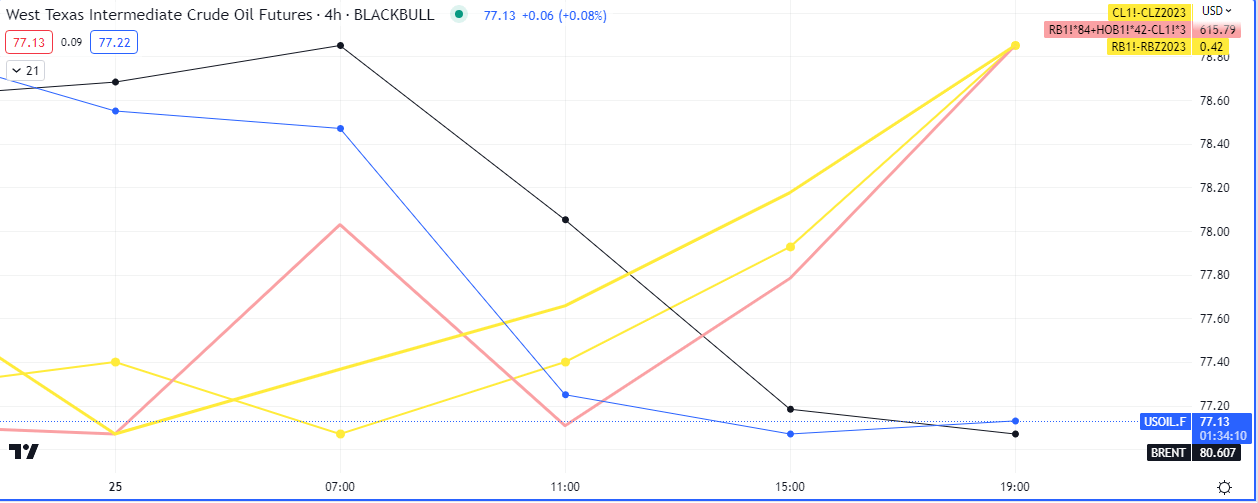

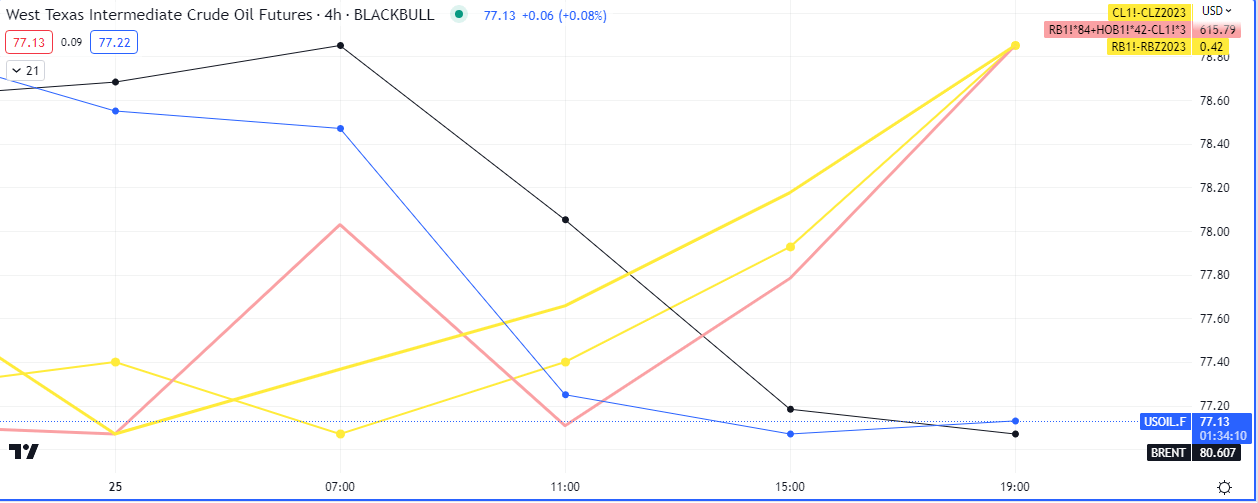

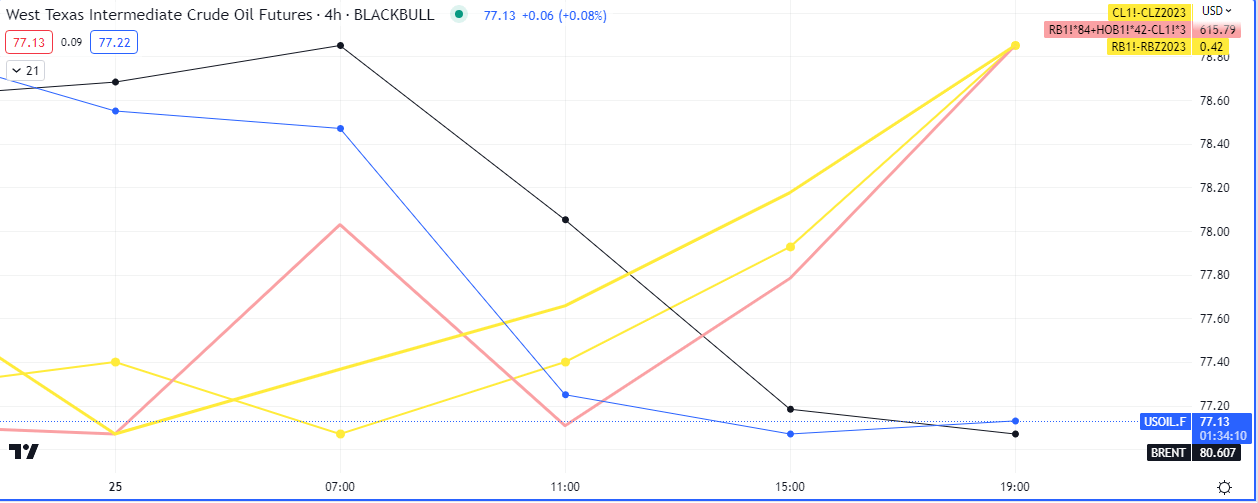

WTI -2.15%

BRENT -2.25%

US30Y -1.45%

US10Y -2.60%

US02Y -3.30%

$MSFT -2.25%

$GOOG -2.03%

The Dollar Index recovered Monday’s losses but could not close above the high of the opening day of the week, leaving the possibility of a lower retest open.

The $VIX surge confluence with a spike on the US dollar added to the risk off brew in the market going into the close.

We saw the crack spread and calendar spread for oil showing signs of backwardation in the day’s trading although WTI and BRENT succumbed to the weekly resistance. We may see a rise in the price of oil in the Asian session tonight but our short term sentiment is for a bearish week on oil, as stated here.

$MSFT closed lower today despite posting very strong earnings in its top and bottom line, although cloud storage did shrink.

- Revenue was $52.9 billion (vs 51.03 bn exp) and increased 7% (up 10% in constant currency)

- Diluted earnings per share was $2.45 (vs $2.24 exp) and increased 10% (up 14% in constant currency)

“The world’s most advanced AI models are coming together with the world’s most universal user interface – natural language – to create a new era of computing,” said Satya Nadella, chairman and chief executive officer of Microsoft.

“Across the Microsoft Cloud, we are the platform of choice to help customers get the most value out of their digital spend and innovate for this next generation of AI.”

By segment, they also beat across the board with but revenue growth from Azure slowed to 27% (in line with expectations) from 31% in the prior quarter.

- Productivity and Business Processes revenue $17.52 billion, estimate $17.1 billion

- Intelligent Cloud revenue $22.08 billion, estimate $21.89 billion

- More Personal Computing revenue $13.26 billion, estimate $12.15 billion

- Microsoft Cloud revenue $28.5 billion, estimate $28.19 billion

$GOOG also lost -2.03% despite beating expectations, a good result in cloud storage and a $70 billion stock buy back on the horizon.

- Revenue $69.79BN, up 3% YoY, and beating est. $68.99BN

- Revenue Ex-TAC $58.07BN, beating est. $56.99BN

- Operating income $17.42BN, beating est. $16.19BN

- EPS $1.17, down from $1.23 YoY and beating est. $1.09

Taking a closer look at Revenues, Traffic Acquisition Costs (TAC), and number of employees reveals the following:

- Total ad revenue $54.5BN, just fractionally lower than the $54.7BN a year ago, and beating the est. of $53.79BN

- Search and other related businesses — the company’s financial lifeblood — posted first-quarter sales of about $40.4 billion, beating estimates of $39.4 billion.

- YouTube Ads Rev. $6.69B, beating the est. $6.65B

- Google Other Rev. $7.41B, beating the est. $7.22B

- Other Bets Rev. $288M, missing the est. $299.9M

- Google Cloud $7.45BN, up a whopping 28% from $5.8BN, if just below estimates of $7.46BN.

Both $GOOG and $MSFT have both shed share price after posting strong results in the past, much like today, it was the post announcement conference call that unraveled the initial ‘good result’ spike, albeit temporarily.

Leave a Reply