One of the key aspects of a fixed income investor’s job is determining the risk profile of bonds. In this article we look at the risk classifications of corporate bonds: investment grade and high yield.

Not all bonds are the same

Bonds classified as investment grade tend to be less risky than those designated as high yield and usually deliver a lower return. High yield bonds are volatile and typically offer higher returns, but with more risk, because the issuers are considered to have a greater chance of default. As a result, these companies pay higher coupons to reflect the additional uncertainty associated with the debt they issue. For instance, bonds issued by a new technology firm or an expanding property developer would likely be viewed as high yield.

Different types of bonds appeal to different types of people. One would assume that high yield bonds appeal more to younger investors with a long investment horizon as well as a high risk appetite. Conversely older investors may be more comfortable buying investment grade debt, both corporate and government, due to their perceived security.

Classification of bonds

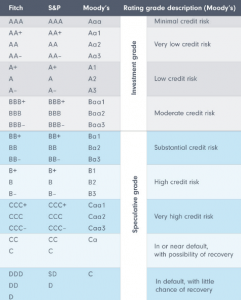

The assessment of a bond’s risk profile is fairly straightforward, with much of the detailed research carried out by external credit rating agencies. The three biggest firms in the market are Standard & Poor’s (S&P), Moody’s and Fitch, who screen the bond multiverse to decide which are investment grade instruments or high yield instruments.

For example the S&P’s classification system assigns different credit ratings, based on how much risk is attached to the repayment of capital. These comprise one to three letters; ‘AAA’, ’BB’ or ‘C’ (with ‘+’ or ‘–’ signs providing further differentiation).

Bonds with good credit ratings of at least ’BBB –’ are classed as investment grade bonds, while those below ‘BBB–’ are treated as high yield bonds (also known as speculative or junk bonds).

Moody’s rating scale slightly different from but similar to that of Fitch and S&P.

Bonds’ credit ratings may also be upgraded or downgraded over time. Therefore, investment grade bonds could become high yield bonds – the so called ‘fallen angels’.

It is worth noting that government bonds are classified in a similar way. Therefore, the US’s debt might be ranked investment grade with Philippine’s classed as high yield.

What economic factors affect bonds?

A deteriorating economy favors investment grade bonds due to the risk of sentiment that is prevalent in such climes. However, under prosperous conditions, demand for high yield bonds increases. Amid stronger global growth, higher yielding bonds have generally outperformed lower yielding ones.

Interest rates and their effect on a bond’s rating

Bonds with higher or further out durations are more sensitive to actual, or expected, changes in interest rates than bonds with lower or durations.

Investment grade bonds usually have higher durations, because proportionately more of their total income stream is received via the repayment of principal at maturity. The most attractive investment grade bonds are similar to high quality government bonds (which also tend to have above average durations).

With high yield bonds, proportionately more of the payments are received via of coupons, and their maturities are shorter. Therefore, when interest rates rise or are expected to, they tend to be less affected than investment grade bonds. However, when interest rates fall or are expected to, the prices of high yield bonds are rise by less than prices of investment grade bonds.

Leave a Reply