Inflation in developed economies has remained hotter than expected and that is forcing a repricing of policy expectations, keeping the FOMC, ECB, and BoE on their tightening trajectory, even if growth dynamics are mixed.

The US employment report will help determine whether the FOMC will hike or pause in June. The risk for payrolls each month is downward, both because job growth has outpaced the GDP path since 2021, and momentum for GDP growth is moderating.

The SmartEstimate by Reuters is for the Non-Farm Payroll to grow by 192,000. The range in the Reuters poll estimates varies from 100,000 to 293,000.

Average Hourly Earning (Previous: 0.3%, Forecast: 0.5%)

Non-Farm Employment Change (Previous: 193k, Forecast: 253k)

Unemployment Rate (Previous: 3.5%, Forecast: 3.4%)

These expected estimates point to a rather damp sentiment for the dollar going into the end of the week.

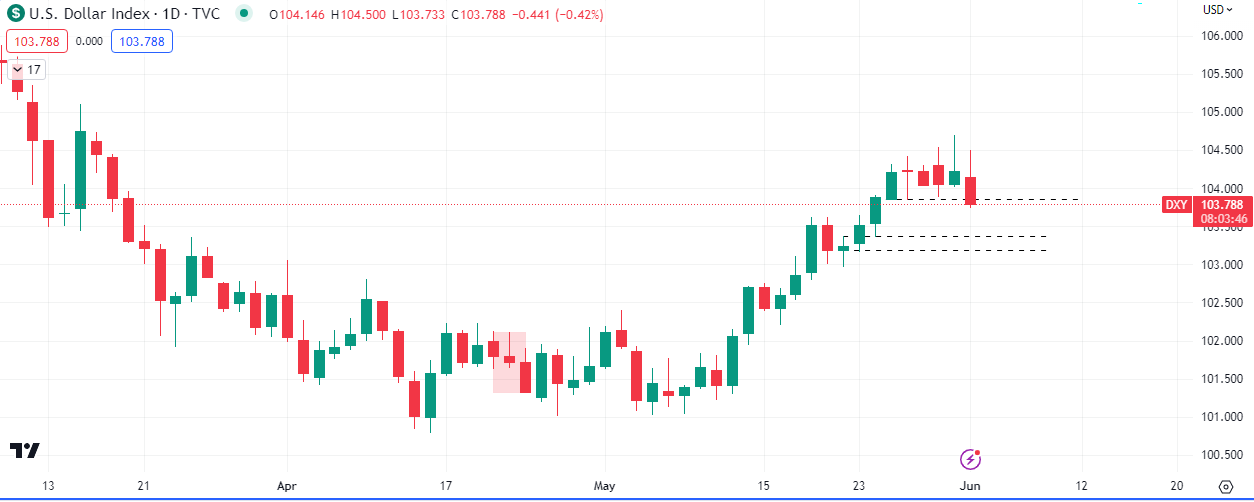

The price action suggest the following;

A close below the weekly low should cause a drop to retest the lows of last week, while an inability to close below this week’s low should cause a markup to the previous high.

Surprises in tomorrow’s employment numbers would probably have a volatile effect and large ramifications for June’s FOMC meeting of the Fed.

Leave a Reply