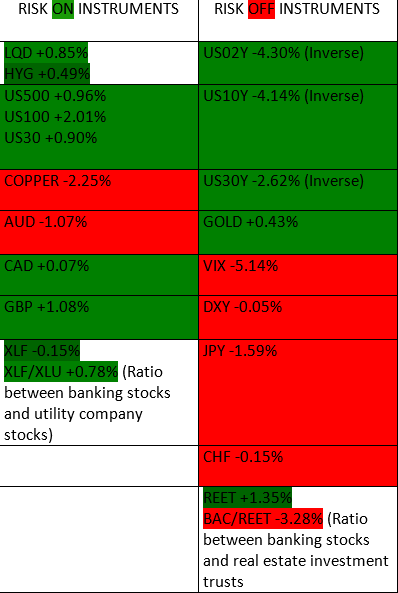

On the risk gauge table we have a mix of closes with a tilt to the risk ON side of the spectrum. The assets typically associated with a good risk appetite closed in the green with the exception of industrial metals and the Aussie.

Friday’s close was important as it also happened to be the close of the month for most of the capital markets, barring the crypto currency markets, which closed on Sunday.

Going into this week it will be important to watch the demand levels on the US dollar and the Volatility Index ($VIX), as they may rebound to the upside, especially with the hawkish twist to the plot with the Federal Reserve.

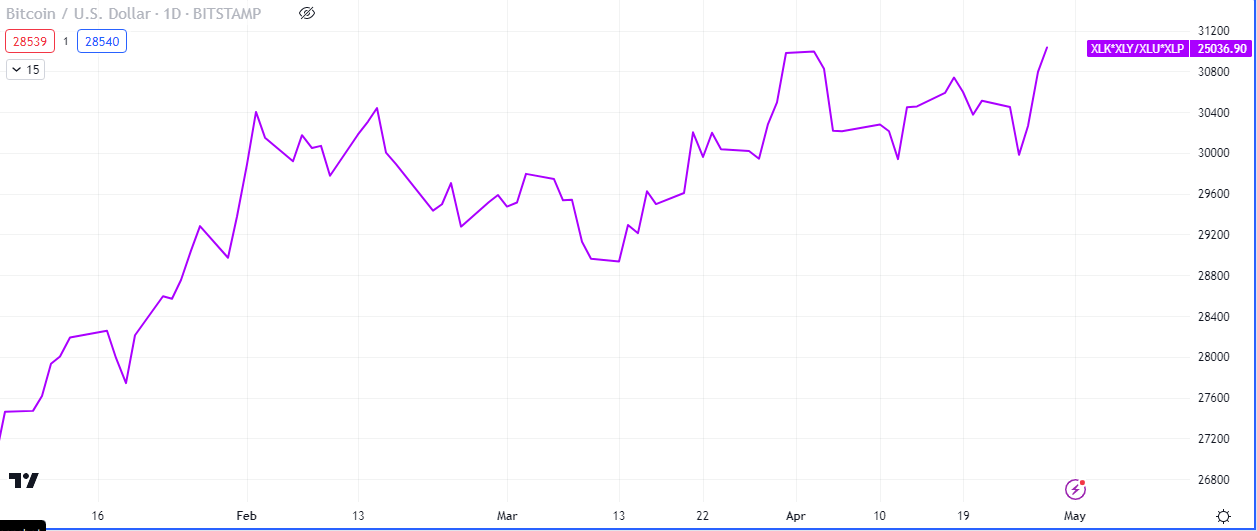

The ratio comparison of the tech sector and the consumer discretionary sector versus the utilities sector and the consumer staple sector, shows a tilt towards the tech and discretionary sectors. This aptly reflects the situation as we can see that the highest gaining equity index on the risk table was $NDAQ.

Oil continued it’s downward trajectory as WTI shed -1.40% and BRENT lost -1.76% on the week. More of the same is expected this week, from the look of market structure. We will be watching the inventory numbers going into the middle of the week.

Some economic data releases from the US to watch out for this week include;

ISM Manufacturing Index

JOLT Job Openings

Non Farm Payrolls

Services PMI

FOMC

Fed Funds Rates

It is going to be a volatile week due to the major news releases expected, with the general consensus forecasts being for a surge in dollar strength.

Leave a Reply