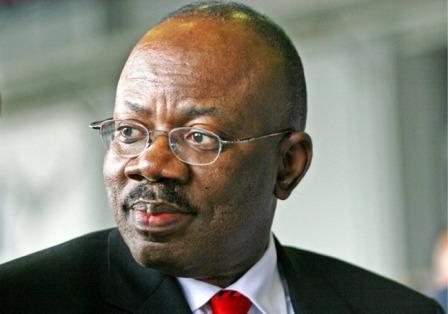

The Chairman of Zenith Bank Plc, Jim Ovia, has lauded the present administration for implementing various economic policies that have helped shore up the nation’s foreign reserves which presently stands at over $40 billion.

Ovia made this known in an interview on the sidelines of the World Economic Forum 2018 which held in Davos, Switzerland between January 23-26.

Established in 1971, the World Economic Forum is an “independent international organisation committed to improving the state of the world by engaging business, political, academic and other leaders of society to shape global, regional and industry agendas.”

He said, “Only very recently, the government got thumped up by the World Bank in the area of ease of doing business. It has never been done before for several years. Various government regulatory agencies are playing tremendous roles, particularly the Central Bank Governor. They are doing so excellently well in this regard.”

Ovia allayed the fears within the international community over the 2019 presidential elections in the country, noting that Nigeria will continue to make appreciable progress economically while bolstering its democratic institutions.

“The Nigerian economy in an election year will remain practically the same. We have had several elections in the past 20 years. It is (usually) calm and well-handled, well-organised and well-articulated. Information is also well disseminated. Nigeria is not the kind of country that people used to think about 40, 50 years ago during the military era. We are now in a full-fledged democratically-structured government with processes. Election will come and go,” he said.

He expressed Zenith Bank’s readiness to continue to lead the change in digitising banking operations and by extension digitising the nation’s economy.

Read full interview below:

The Nigerian delegations are upbeat because the economy has bounced real back and for the very first time in four years, the international foreign reserve has hit $40 billion. It has never been so for the past four years. So, we are right up there again. We want to take full advantage of that in terms of accelerating the economy, inviting foreign investors… in terms of what the government is doing to provide an enabling environment.

Only very recently, the government got thumped up by the World Bank in the area of ease of doing business. It has never been done before for several years. Various government regulatory agencies are playing tremendous roles, particularly the Central Bank Governor. They are doing so excellently well in this regard.

Nigeria has just come out of recession and there is a big election coming in 2019. What are the prospects for the economy?

The Nigerian economy in an election year will remain practically the same. We have had several elections in the past 20 years. It is (usually) calm and well-handled, well-organised and well-articulated. Information is also well disseminated. Nigeria is not the kind of country that people used to think about 40, 50 years ago during the military era. We are now in a full-fledged democratically-structured government with processes. Election will come and go. There won’t be any street fighting. It used to happen before I was born, but there are no more street-fighting in elections. It comes and is done successfully. We have had successive, through democratic process, handing over from one civilian government to another civilian government. Nigeria is probably one of the very few African countries that have done that successfully. The one for 2019 is going to be exactly that.

What are investors at the World Economic Forum asking you? Obviously, the foreign exchange crisis that Nigeria suffered recently did a lot of damage to Nigeria’s international reputation. Do you believe that has passed you now?

The issue of foreign exchange crisis in Nigeria two or three years ago is a phenomenon (that happens) all over the world – different emerging markets, world economies. It will always happen. It is not when you fall that things go terribly wrong but when you are unable to get up. Nigeria dropped down a little bit but also go up and we are now back running. The price of oil has hit $70 – Brent crude. It will remain there for the next foreseeable future – I do hope it will happen that way. For the fact that the financial system is very stable: there are no bank failures; banks are making profit and are doing well. It is also good for banks to make profit because it is an indication of how solid or strong the economy is. Those are the indicators that attract foreign investors to come to Nigeria to do business. Stable foreign reserve – $40 billion – I think we should give kudos to the Central Bank Governor again.

We are in the third day of World Economic Forum annual meeting here at Davos. What has been the most exciting for you and are you achieving Zenith Bank’s agenda?

Definitely! What has been the most exciting for me has to do with financial inclusion. For the past third to five years all over the world, in various economic fora or discussions, inclusion has been a major topic because you don’t want to leave out the poor, the un-included, the unbanked and the voiceless. We have to bring them into the fold, into the proper, well-structured digital economy. And the most important thing that Zenith Bank together with, of course, all the Nigerian banks are doing is digitising the banking system. In that process, we are also indirectly digitising the economy. It is we who are in the private sector that will continue to digitise our economy and we are in the forefront of deploying appropriate technology in bringing Nigeria’s economy to the digital world, information age. Information technology, ICT deployment, that is what we have been doing and what we will continue to do to grow Nigeria’s economy.

Watch video below:

Founder/Chairman, ZenithBank Plc, Mr. Jim Ovia spoke on Nigeria's economic rebound at the 2018 World Economic Forum. He talks on the stability of financial institutions, the success of the oncoming 2019 presidential elections & digitising Nigeria's economy https://t.co/bNpnmFnXVO

— Zenith Bank (@ZenithBank) March 29, 2018

Leave a Reply