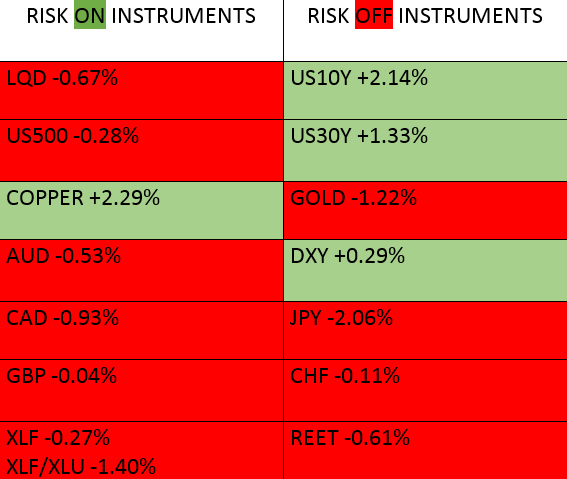

On the board today we have a mix of weekly closes from Friday’s close from February 17, 2023, with more of a tilt toward a Risk OFF scenario. It is important to note that the assets listed in the table are in different phases in their actual market structure, therefore some are going through pullbacks, breakouts, accumulations, distributions, mark ups and mark downs. Viewing the market holistically can get complicated, even when you have narrowed your focus to one key data point. However closes are important due to the fact institutions deal at the closes, so they are still worth noting despite variability in structure.

The late week recovery in Copper and some industrial metals was the only green close among the risk on asset classes. The high beta currencies and stocks were down while the US dollar and the treasury markets closed higher, signaling a tilt to risk aversion. However the Yen and Swiss Franc closed lower, even though their market structure still leaves room for a turn around. We will be watching how Real Estate Investment Trusts, copper, gold and the low beta currencies perform this week as they are proving to be the laggards in the risk baskets.

The dollar effect on commodities is something to watch in regards to how it affects copper and oil. The strong US dollar and bonds, should they continue, will likely weigh down on commodities. The expected rate hikes will also likely continue to strengthen the greenback.

Economic numbers coming out of the US this week will be important to watch. The good news conundrum may continue, if the numbers come out strong and force the FED to further slowdown the US economy to curb inflation.

Click HERE to read up in the article with the definition of Risk ON and Risk OFF.

Leave a Reply