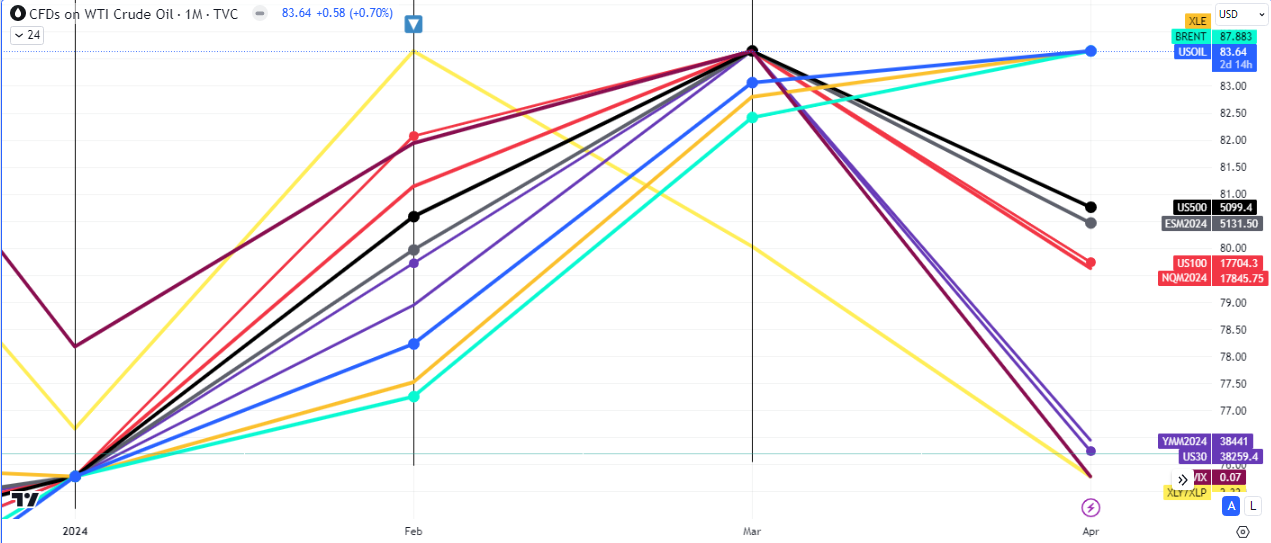

Institutional investors began aggressively rotating out of growth stocks into defensive stocks in March, much to the chagrin of the general bullish tone of the market. The XLY/XLP line which tracks the flow between consumer discretionary stocks and consumer staples, was down -2.78% in the month of March, while the stock indices and oil kept trudging along upwards (see comparison chart below).

This month, we have seen the $DOW down -3.81%, $SPX -2.80%, $NDAQ -2.95% and the XLP/XLY line is down a further -3.37%. What has made this bearish cocktail of rotations more intoxicating, for bullish market participants, is the fact that the volatility index ($VIX) has joined the party to the downside.

All in all, the XLY/XLP line is down a whopping -6.2% in 2024 so far. In the chart above, you may observe that the oil markets, $WTI – $BRENT – $XLE, have not declined. Some of the factors associated with this are the geopolitical issues brewing over Ukraine, Gaza and other hotspots around the world.

The hot CPI numbers that came out this month also did not help in easing the Feds inflation fueled headache, so we may add that to some of the fundamental drivers for this current decline.

The market is still obviously bullish overall but some warning signals may be creeping in, indicating a possible strong reversal may be in the offing.

If the VIX and the Growth-Defense rotation keeps diving, then we can expect a continuation to the downside in stocks. If oil begins to also drop then we should also see a decline in energy stocks like Exxon $XOM, despite the current resilience of the energy index ($XLE).

Turn on notifications for more interesting updates.

Leave a Reply