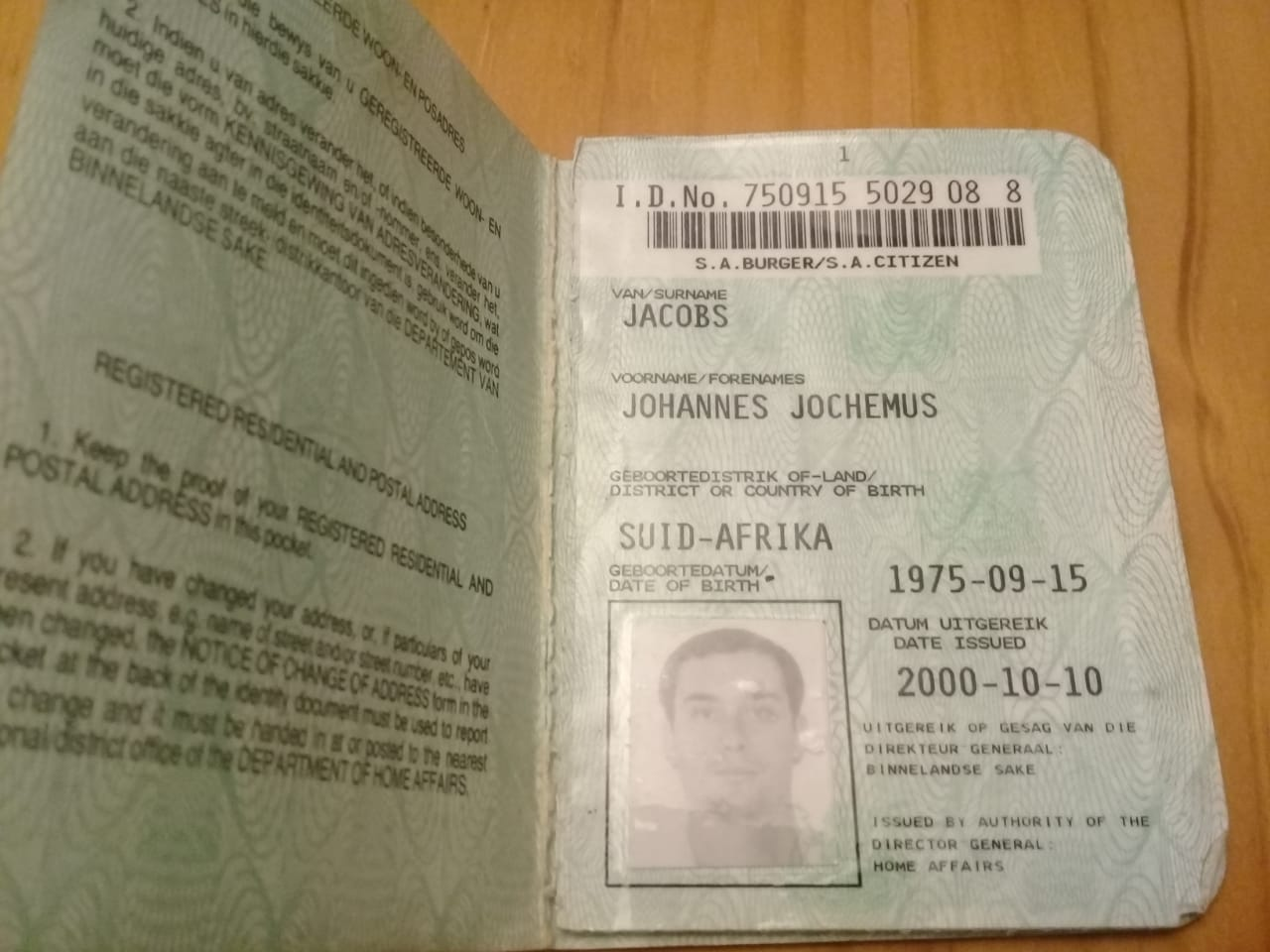

Two American businessmen say they are being stonewalled by South African authorities going as far up as the presidency, excluding Rahima Shaik, an official in the Deputy President’s office, who has been the only one instrumental in giving them a voice, in their spirited efforts to recover $100,000 embezzled by South African nationals, Johannes J Jacobs and Wim Fourie and Madelin Fourie, who are offering unlicensed and fraudulent financial products in contravention of South African law.

In an earlier report, The Herald learnt how Ivorian American businessman, Prosper Kouassi, and an associate who preferred anonymity, in 2021 invested $50,000 each in separate financial instruments offered by the Fouries and Jacobs, who is their known associate, believing the products to be legitimate.

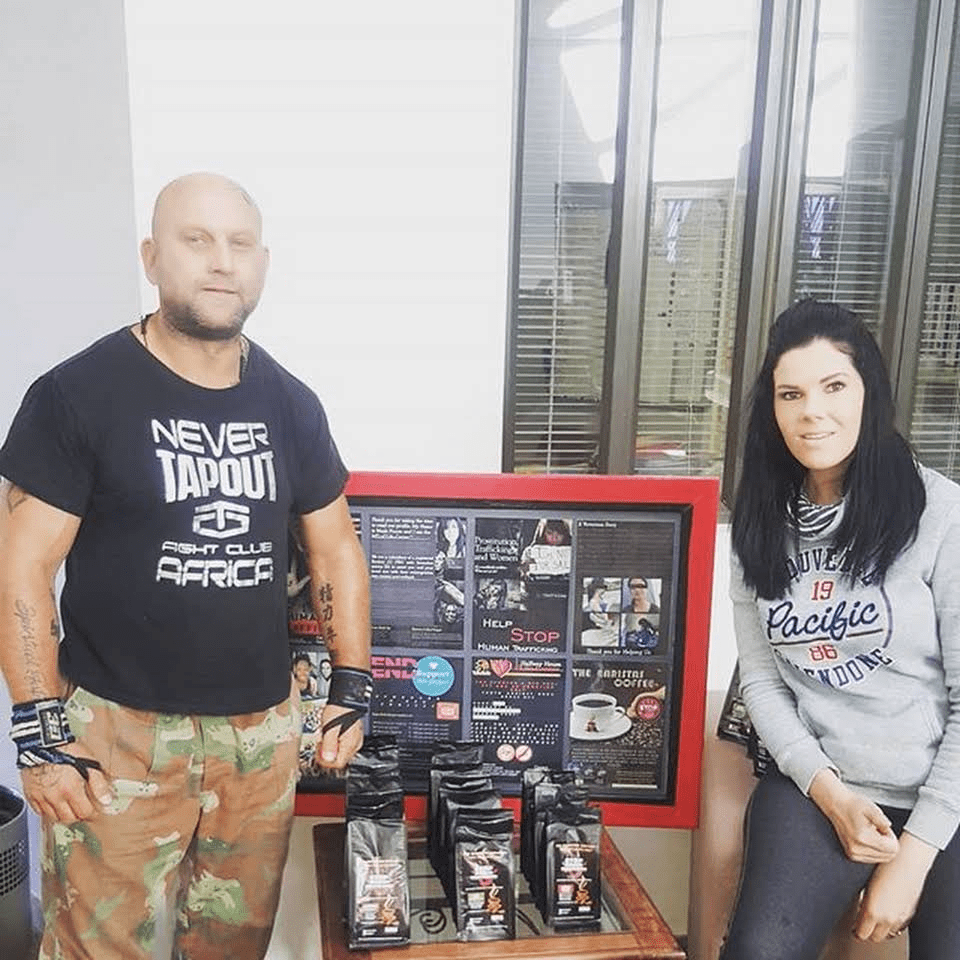

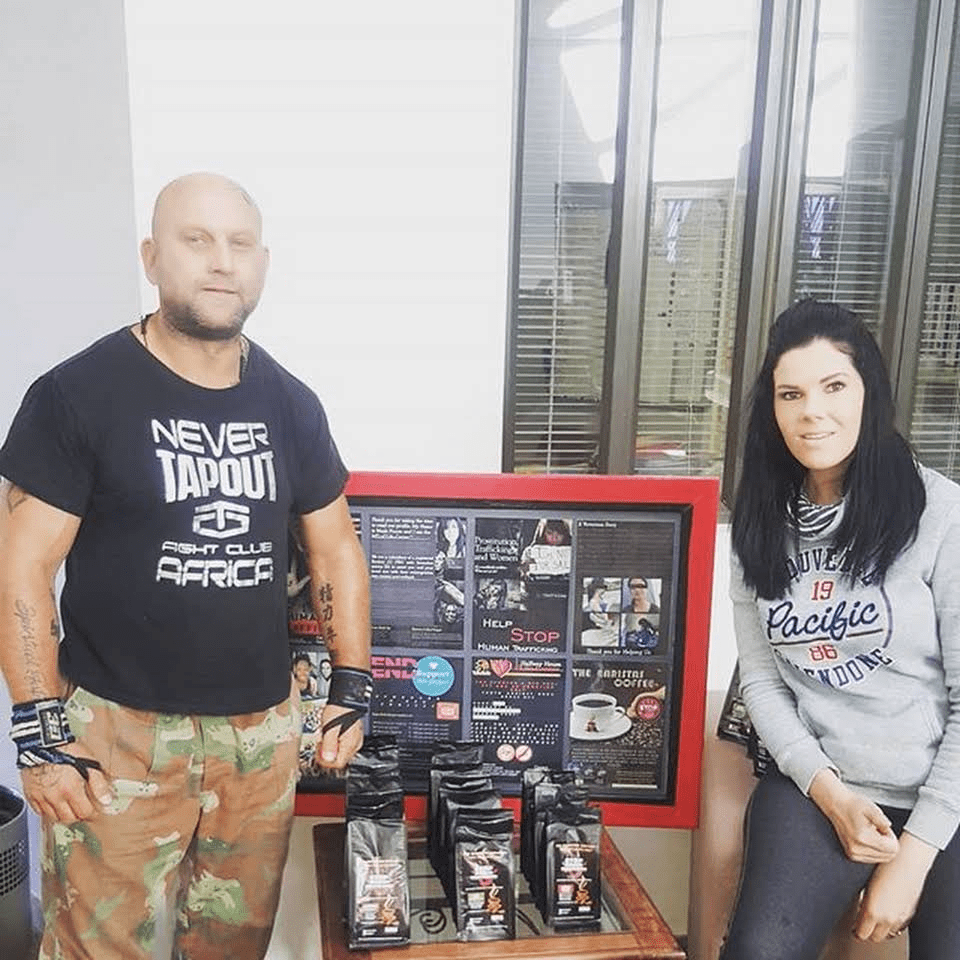

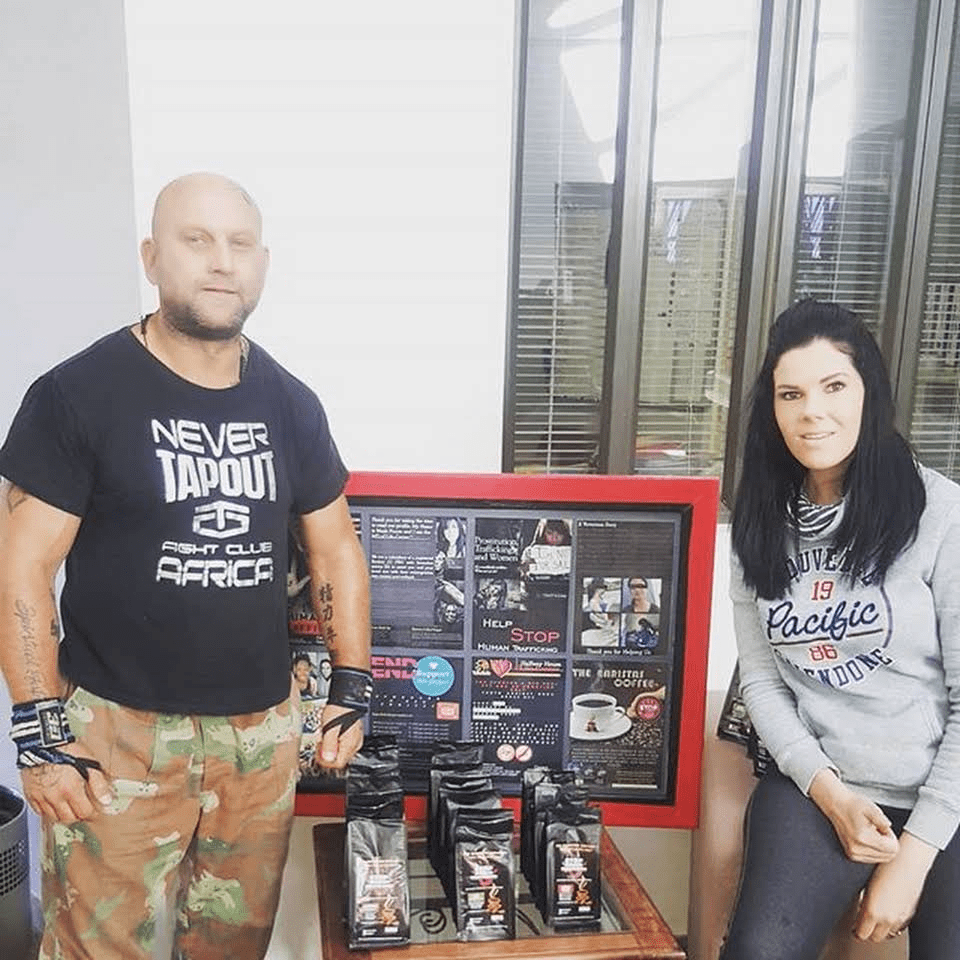

The financial instruments were in the name of Mmina Tshipi (Quantum Oil // OR John Issachar Carriers) represented by Jacobs and Barista’s Coffee Holdings (Pty) Limited represented by Wim Fourie and Madelin Fourie.

The investors began to raise eyebrows when they did not get their expected contractual returns running into millions of dollars, and after Jacobs and the Fouries could not provide their license to operate as Financial Service Providers (FSPs) in South Africa.

The Financial Advisory and Intermediary Services (FAIS) Act (37 of 2002) states that a person who provides either advice or intermediary services with respect to financial products must register as an FSP.

Section 8 of the Act states that no person may either act or offer to act as an FSP in South Africa unless they are licensed to do so.

Section 1 defines a “financial product” as including securities and foreign currency denominated investment instruments.

Convinced that Johannes Jacobs, Wim Fourie and Madelin Fourie had broken the law and failed to keep to the terms of their agreements, Kouassi and associate wrote them to demand their contractual returns running into millions of dollars.

This newspaper further reported that after months of back and forth, Jacobs and the Fouries, who run a Barista’s Coffee franchise in South Africa, agreed to settle with the investors for $300,000 but sent a confirmation of wire transfer purportedly through First National Bank (FNB). “A South African Reserve Bank official, Mr. Eben Minnie, confirmed the structure of the wire transmission was legitimate, but said the funds were never placed into an account, and the actual wire was never sent. Basically, the settlement was agreed upon, a wire transmission was emailed confirming the payment, but it was just another fraudulent act”, Kouassi and associate told this newspaper.

Jacobs and the Fouries also engaged an attorney, Sarel Roux of S Roux Incorporated to serve as paymasters for the settlement.

Copious email communications sighted by this newspaper showed that Roux promised on several occasions that Kouassi and his associate would receive the settlement proposed but the promise has not been kept nearly a year later, causing the complainants to question Roux’s involvement with Jacobs and the Fouries.

The trove of emails sighted by this newspaper showed that the investors have since made numerous efforts to get an amicable resolution of the matter without dragging the South African nation’s name into the mud.

The Herald confirmed that the Office of the President of South Africa; the South Africa Police Service (SAPS); South African Reserve (RES) Bank, the financial regulator in the country; the First National Bank (FNB), bankers to Jacobs and the Fouries; among others have been contacted by Kouassi and associate in their quest for justice.

“The South African Police Service has turned a blind eye to our complaints,” Kouassi’s associate told this newspaper.

An email dated January 26, 2022, sent by Director, Personal Support, Office of the Deputy President, Rahima Shaik to the complainants, read, “I am not a legal or criminal expert, however, in my view, Attorney Roux who by now is aware that Barista Holdings, Jacobs & Fourie’s are defrauding people, can be charged as an accomplice. Am I correct? I suspect that he actually knows more than he is letting on which makes him an accessory to the fact.”

Despite this admittance for this senior official, Kouassi and associate said they were baffled that no concrete step has been taken by the presidency to ensure justice in the matter.

Financial Surveillance Investigator, South African Reserve Bank, Eben Minnie also confirmed in an email to the complainants that an investigation was underway into whether First National Bank (FNB), Jacobs and the Fouries’ bankers, had any question to answer. The complainants had voiced concerns that FNB could not claim to be ignorant of Jacobs and the Fouries’ fraudulent act of offering unlicensed financial products having been petitioned over the matter.

Several months after giving the assurance, Minnie has not revealed the outcome of such an investigation, which made the complainants express the belief that the financial regulator was stonewalling to protect FNB.

In a February 14, 2023, email to Shaik in the deputy president’s office, Kouassi’s associate said, “Do you not, after months of going back and forth with Eben, find it strange that RES Bank has not done a thing to solve this issue with the police… The Police should have taken this case head on, and you would need to be blind not to see that this is going nowhere. I appreciate your assistance as always, but I believe I am being stonewalled by RES Bank…”

In another email addressed to the presidential official and dated February 22, 2023, Kouassi’s associate proposed a solution to the current impasse.

Copied in the email were representatives of the South African Police Service, Eben Minnie of the South African Reserve Bank, and Dave Heggie of Heggie & Associates, who is representing a trust allegedly duped by Jacobs around the same time that Kouassi and associate were defrauded.

The email read in part, “I have communicated with the Attorney representing a trust that was defrauded by Jacobs and his group of frauds the same time two years ago that we were defrauded. His civil filing is attached. I have presented a solution that I believe all involved would agree to. Instead of continuing on with this endless pursuit of these frauds I suggested that we offer one settlement for the actual amounts that they stole from us with fraudulent Instruments. My associate and I lost $50,000 US dollars each and the Trust attached lost $50,000 US dollars or $55,000 US dollars.

“If the Attorney drafts a letter for settlement VS criminal charges brought against them for the original amount stolen returned with 10% Interest per annum and Attorney fees for Dave, I think we can settle this out of criminal and civil Court.

“I think a Letter endorsed by the President’s office and RES Bank attached to this drafted settlement would potentially close this ugly scenario out and no more resources would be required.

“Attorney Roux, Wim Fourie, Madelin Fourie and Mr. Jacobs had 7 days to respond to this offer and have ignored us so at this point the offer is clearly expired.

“The action RES bank takes against account holders we have no control over and going after Barista for being an unlicensed broker would be up to RES Bank how that is handled. I think the objective after two years is for myself, Prosper and Daves Client to get our money back, but we believe a substantial settlement should be obtained. We believe the S. African Government has a fund placed aside to reimburse people that were defrauded, and we believe at this point the Government should step in and compensate us with an agreed settlement. Defrauding International clients is a cancer and that is why the African Government should resolve this quickly and not scare off International investment.

“I think approaching an election cycle that the Government would be a shining star to help settle this matter. At this point we all understand that these frauds are digging their heels in and that is why I think this strategy should be considered.

“All I am asking for is for the government to make good on a financial settlement. It is the least that could be done after every agency head in the S. African Government has literally ignored this fraud for 2 years. How can an Administration during an election cycle see this as anything but damaging. The Government should compensate us with a reasonable settlement and handle these frauds internally instead of in the international media because most likely this article will eventually get picked up Internationally.

“I think threats and Court filings are just time consuming. I am thinking that it is better to work on a solution VS the problem.”

The email also said that the government has a golden opportunity to disclose to the S. African voters that they do not tolerate fraud, that the case has been settled by the Government and swift action will be taken against the alleged fraudsters.

Wow such thieving bastards. Hard to fathom they’re being shielded by the South African presidency