Tesla’s Investor Day at the Gigafactory in Austin Texas could act as a catalyst this week, in support of the short term bullish evidence on the it’s chart. Tesla $TSLA shares are currently up +4.6% this week as the company prepares for its upcoming Investor Day on March 1. The stock initially jumped nearly 6% earlier in the week and is holding on to a gain of 4.6% at the end of the US session today.

Implications

Investors are looking forward to what the company says on Wednesday regarding new innovations and products such as robotic taxis and lower priced mass-market vehicles. However, events occurring in China and Europe may have a hand in the current surge in demand for its stock.

Tesla continues to ramp up its German manufacturing plant, and it is now producing 4,000 units per week ahead of schedule, according to Reuters. In China, EV maker Li Auto reported stronger sales and good outlook, which is good for the EV market in general. The lifting of Covid19 restrictions has also had a positive effect.

Tesla’s German factory being several weeks ahead of schedule with its production ramp-up means the EV company is likely to hit its 50% annual growth target for deliveries. The Gigafactory in China supplied some it’s European demand, but this should change once the factory in Germany is fully operational.

Tesla also plans to build a manufacturing plant in the northern Mexican industrial hub of Monterrey, according to a statement by President Andrés Manuel López Obrador on Tuesday. According to him , details of this investment will be made known on Investor Day on Wednesday in Texas.

“This will mean a considerable investment, and many jobs,” he said.

Mr. López Obrador said that Tesla agreed to a series of commitments to address water-shortage problems in Monterrey, including the use of recycled water in the manufacture of electric vehicles. “They are going to help,” he said.

Tesla currently manufactures vehicles in China, Germany and the U.S. The addition of the Mexican plant will take it one step closer to it’s target of 12 Gigafactories by 2030.

At the end of 2022, it had the capacity to make more than 1.9 million vehicles annually, and aspires to sell 20 million vehicles a year by 2030, which would make it the world’s largest car maker.

Mexico, the world’s seventh-largest auto maker and fifth-largest exporter of cars and light trucks, has recently stepped up its efforts to advance production of electric vehicles. Vehicles and auto parts account for around 3.5% of Mexico’s gross domestic product and a third of its manufactured goods exports.

Price Action

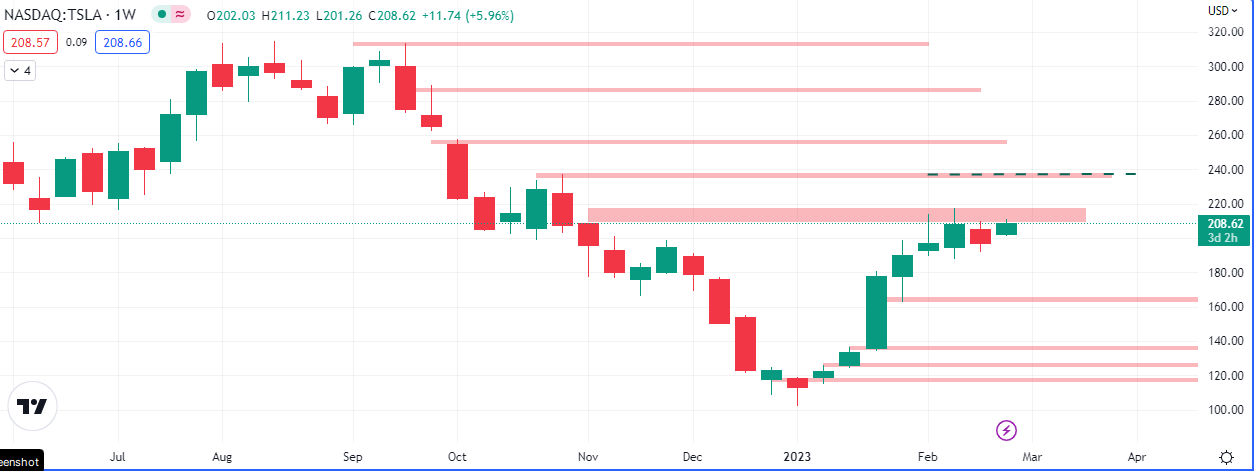

-Weekly-

Price was range bound between $190 and $218 through the month of February. Our current price target for $TSLA is currently $240 due to how price closed 2 weeks ago.

Leave a Reply