In late January 2024, Yahoo Finance published an article about their views on the best 10 oil stocks to buy in the new year.

In this article we take a look at how the top 3 stocks have been performing relative to the energy stock index ($XLE), the volatility index and some other key market metrics.

The top 3 were Chevron Corporation ($CVX), Occidental Petroleum Corp ($OXY) and Exxon Mobil Corp ($XOM).

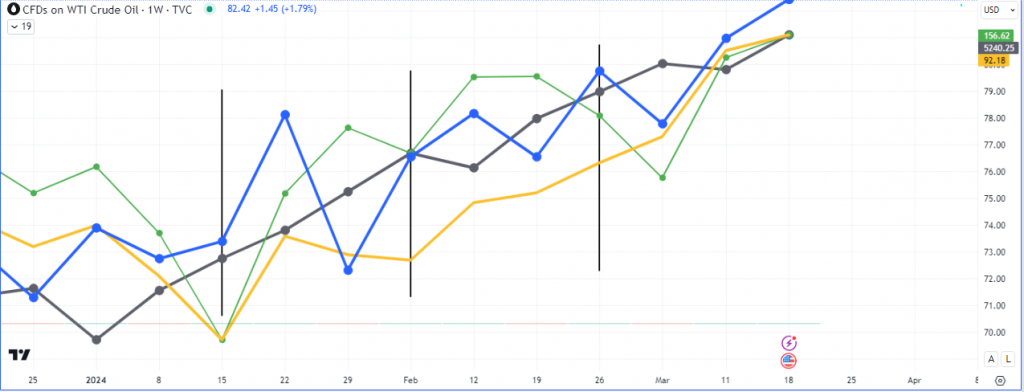

3. Chevron Corporation ($CVX)

The US energy giant has a dividend growth record of 36 consecutive years. Chevron Corporation (NYSE:CVX) is has a massive stock buy back program. The second largest integrated energy company in the U.S., operating in exploration, production and refining on a global scale.

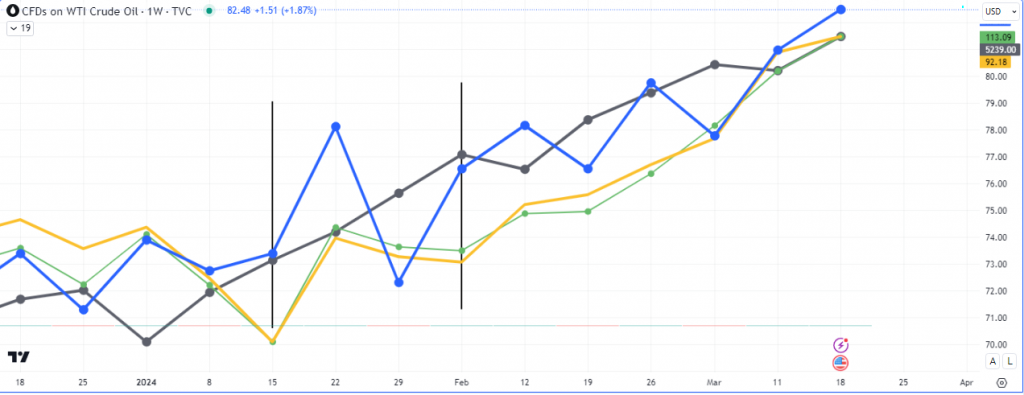

Energy stocks were higher Tuesday afternoon, with the NYSE Energy Sector Index and the Energy Select Sector SPDR Fund (XLE) each rising 1%. It has been a story of steady gains for energy stocks and oil since January.

There were however some pullbacks that created spreads against the general energy index ($XLE), oil and the S&P500. These were price and time points, highlighted with the vertical lines in the chart above, were possible buy opportunities for quick returns as high as 1.5-25% in a 48 hour period.

So far, this Yahoo Stock Pick is moving as expected.

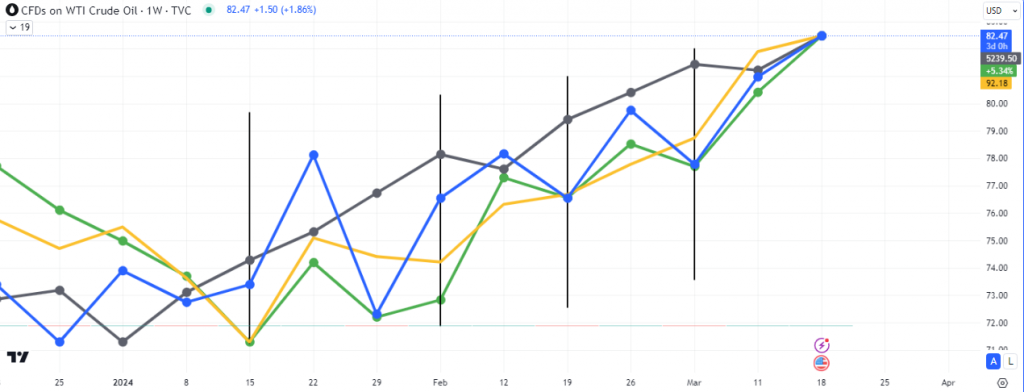

2. Occidental Petroleum Corporation ($OXY)

Founded in California, an American company engaged in hydrocarbon exploration in the United States, and the Middle East as well as petrochemical manufacturing in the United States, Canada and Chile. It is organized in Delaware and headquartered in Houston

Berkshire Hathaway has been consistently amassing of the stock. Latest SEC filings show that Warren Buffett’s Berkshire now owns a 34% stake in Occidental Petroleum Corp.

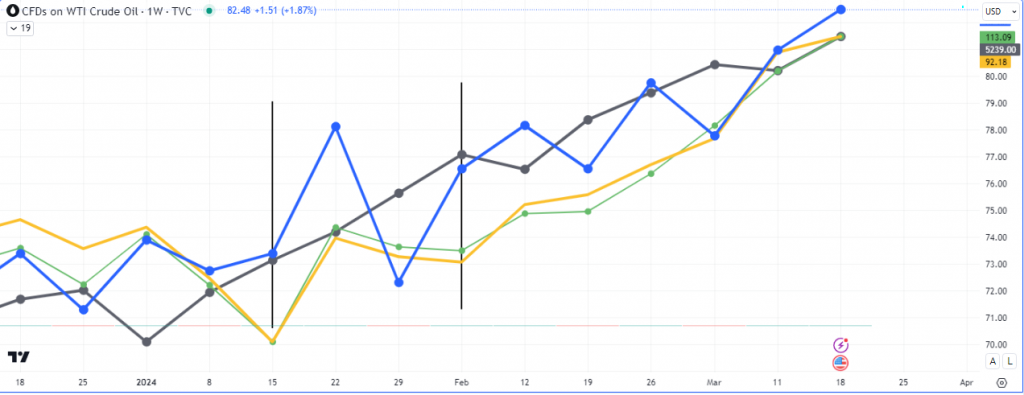

As seen in the chart above, $OXY has had 4 spread opportunities to be bought back up towards the energy basket, since Yahoo Finance put it on their watch list.

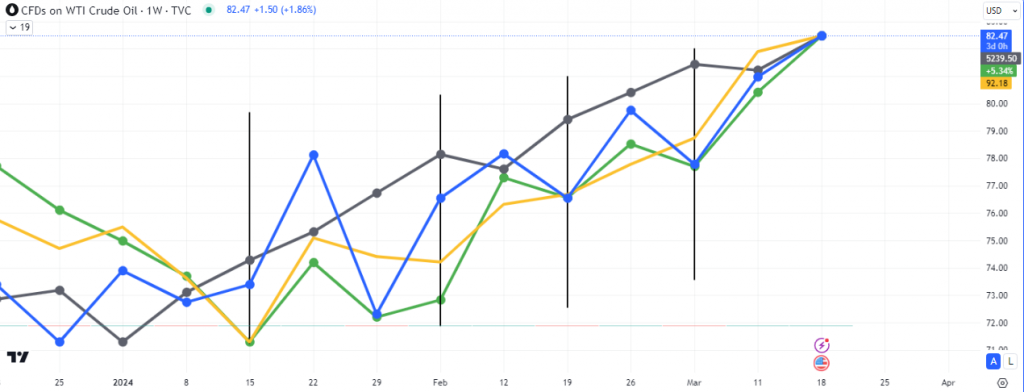

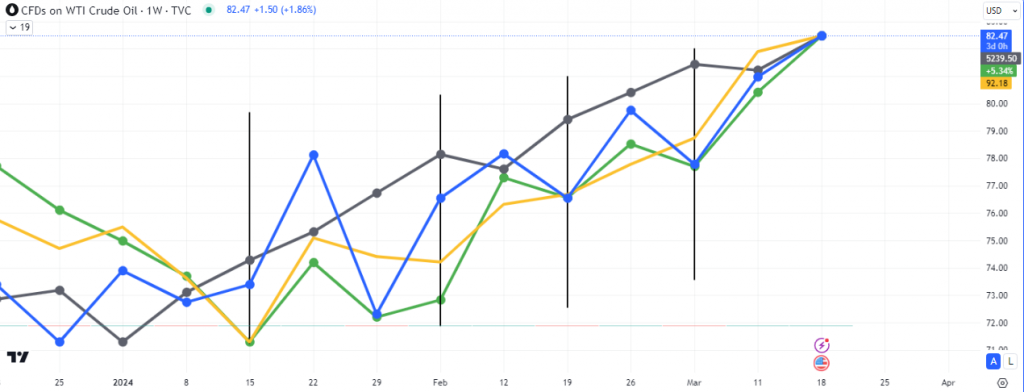

1. Exxon Mobil Corp

American multinational oil and gas corporation and the largest direct descendant of John D. Rockefeller’s Standard Oil. They engage in Upstream (oil exploration, extraction, shipping, and wholesale operations), Product Solutions (downstream, chemical) and Low Carbon Solutions.

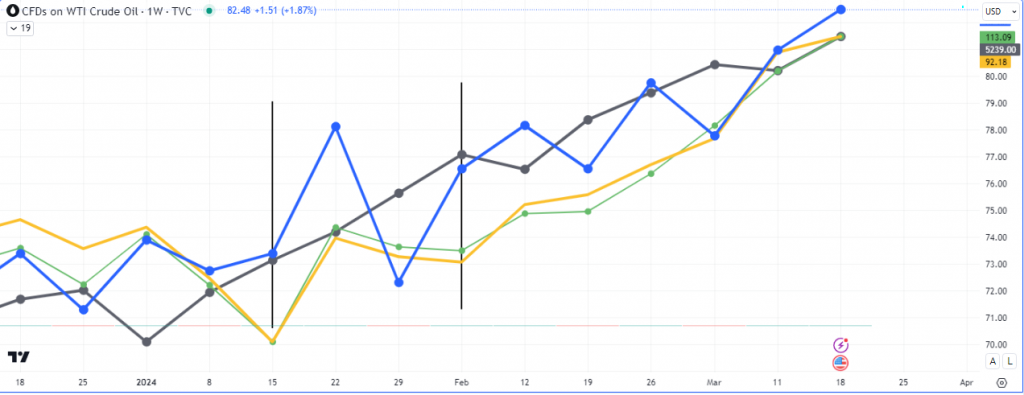

$XOM, which is up 0.78% this morning, had 2 spreads versus the energy basket, one in January and early February, and they closed rapidly in the bullish direction.

So far Yahoo Finance’s predictions have been going well in the first quarter of the year 2024.

The commodities market has made record profits over the last 5 years and the windfall does not look likely to abate any time soon. For example, Vitol Group, the world’s biggest independent oil trader, booked a record-high profit of $15.1 billion for 2022, thanks to the highly volatile energy markets after the Russian invasion of Ukraine.

Turn on notifications for more updates

Leave a Reply