According to data from the Central Bank of Nigeria, 46.3% of the adult population is unbanked. The CBN’s cashless society policy, in addition to reducing cash production costs and money laundering is also designed to integrate the tens of millions of Nigerians without access to banking services into the Nigerian banking sector via the tool that is the mobile phone.

No other financial service provider in West Africa is investing more into the technological infrastructure and architecture required to get the program up and running than GTBank.

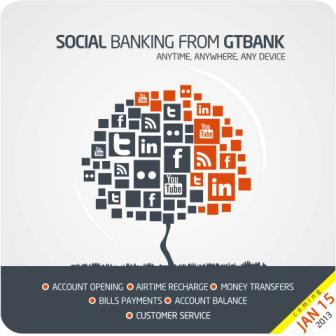

GTBank is expected to launch the Social Banking 2.0 application within a matter of days. This version is an improvement over the social banking application launched on Facebook earlier this year. According to insiders with knowledge on the technology upgrade, this version allows subscribers to GTBank’s Social Banking to open accounts from their mobile phones or on their computers, laptops and tablets. He said, “Basically there will be no need to enter into a physical bank branch to open an account. The procedure is designed to be as stress-free to the consumer as possible and is in line with best international practices on social banking.”

Our in-house IT expert, Seun Peters says, “Innovations like this have been known to affect the whole macroeconomic output of a country. In Kenya, for example, it has been proved that a half percentage increase in its national Gross Domestic Product growth is attributable to mobile money transactions.”

Go here to watch this cool animated short movie ‘Brazilian Kpomo‘ created by OurOwnArea for GTBank’s Mobile Money product.

Leave a Reply