The second week of March was a rather volatile one in the markets. Fears of contagion in the banking sector spread and the expectations for rate hikes for the rest of the year swung from hawkish to dovish and may well swing back again to hawkish soon.

Crude oil futures dropped over 12% on the week in the largest weekly drop in one year, as Iraq and UAE expand downstream expansion in spite of the unstable macro environment.

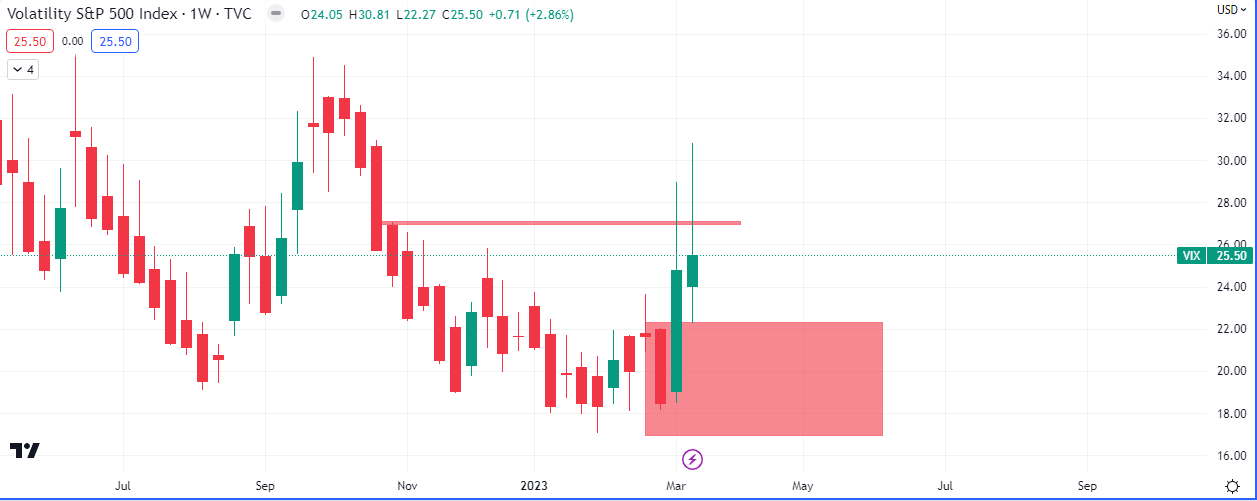

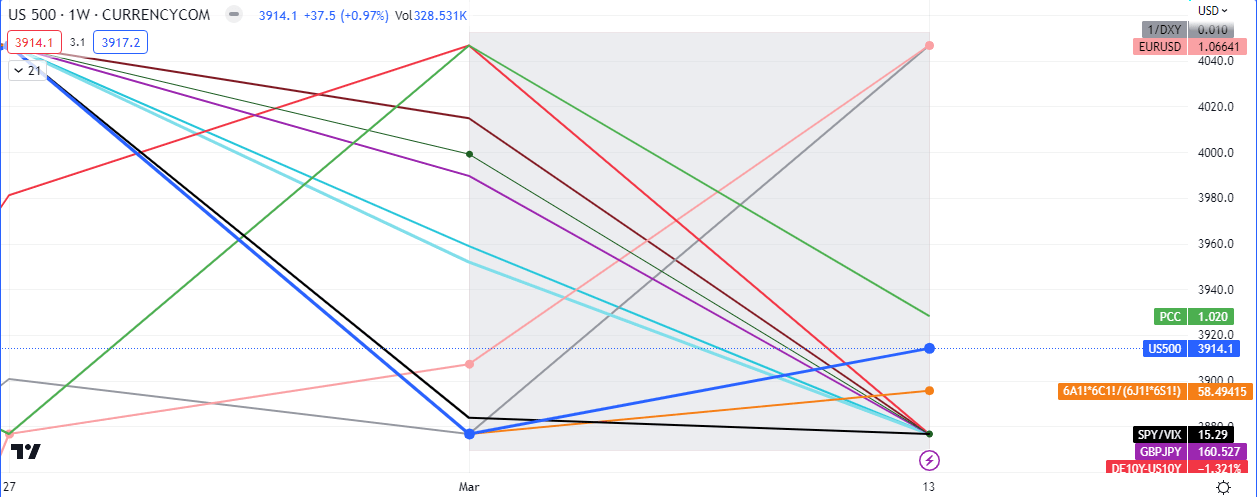

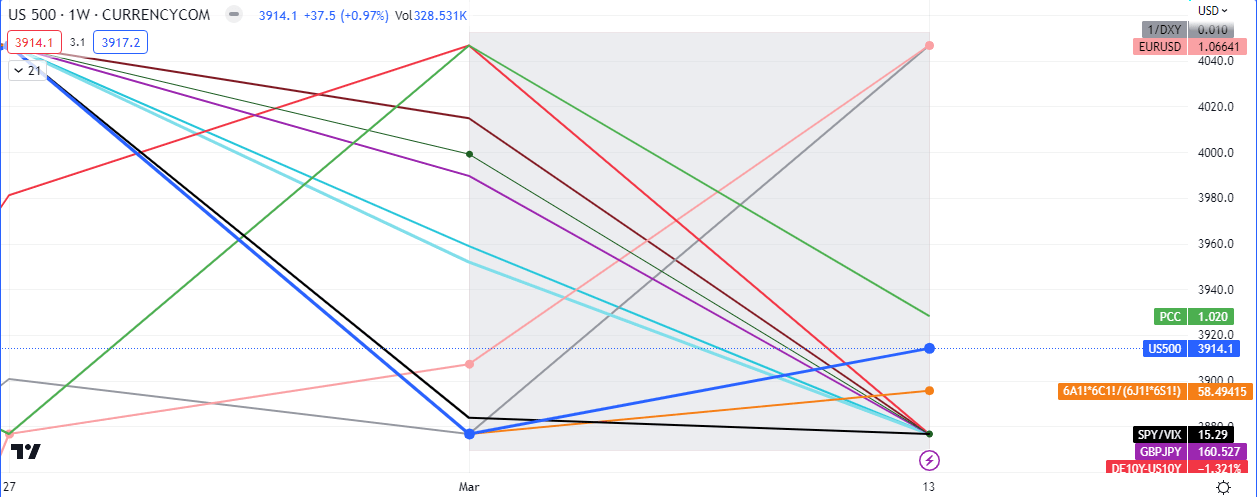

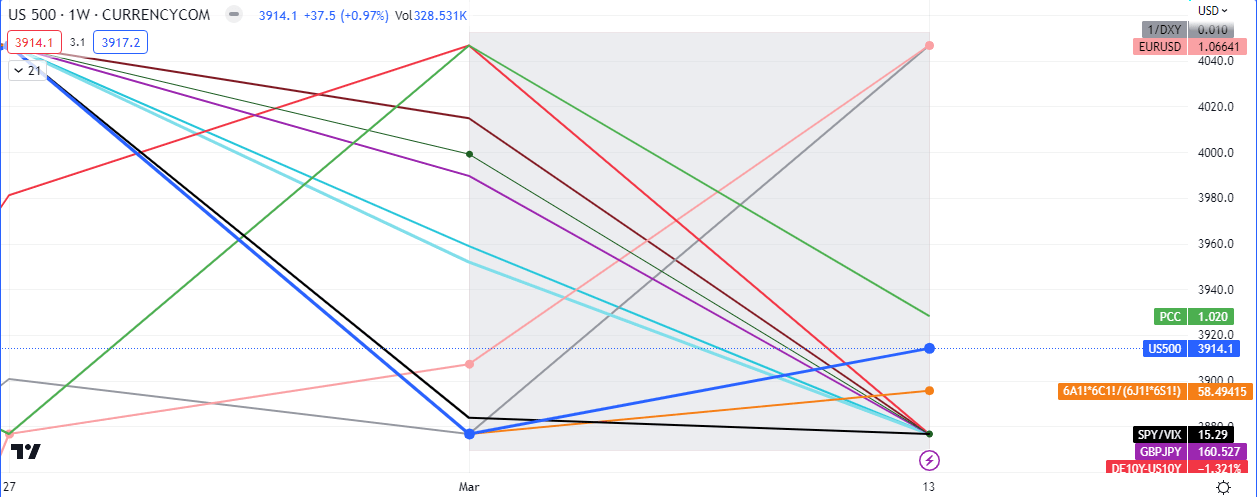

The situation with volatility looks likely to lead to a retest of the high of last this week’s price range. This scenario would likely be bearish for equities.

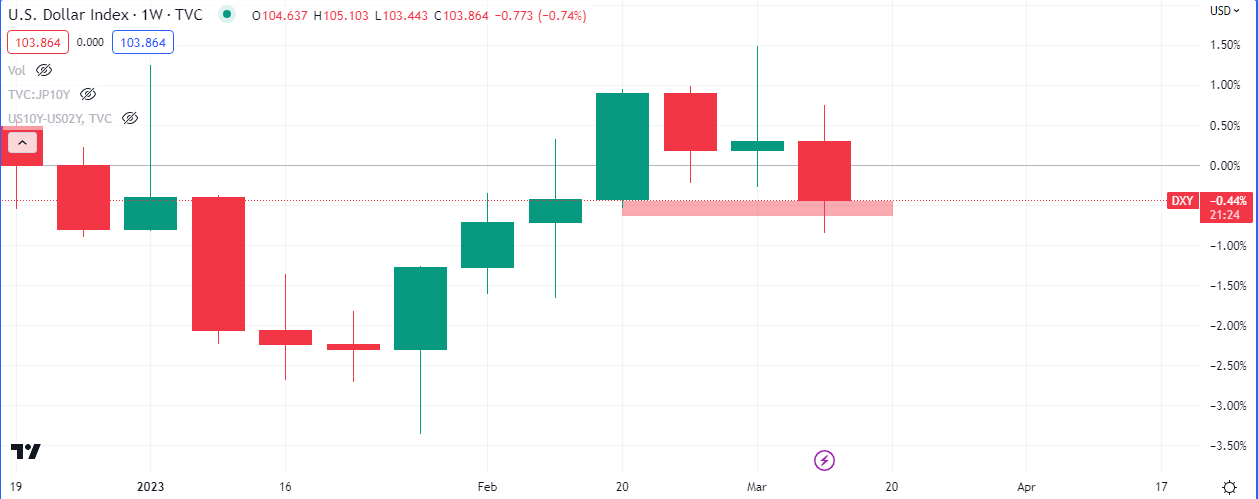

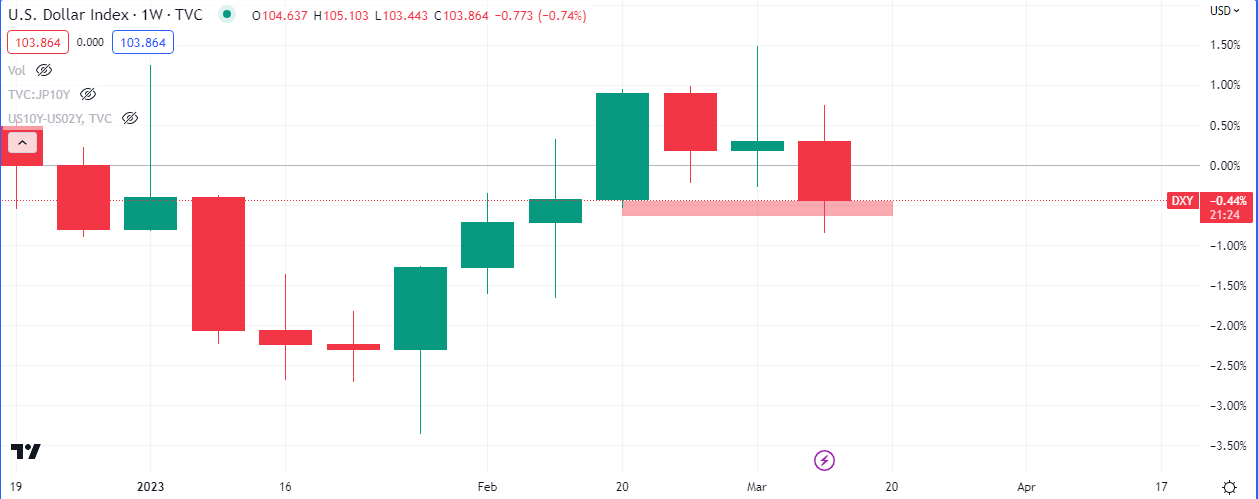

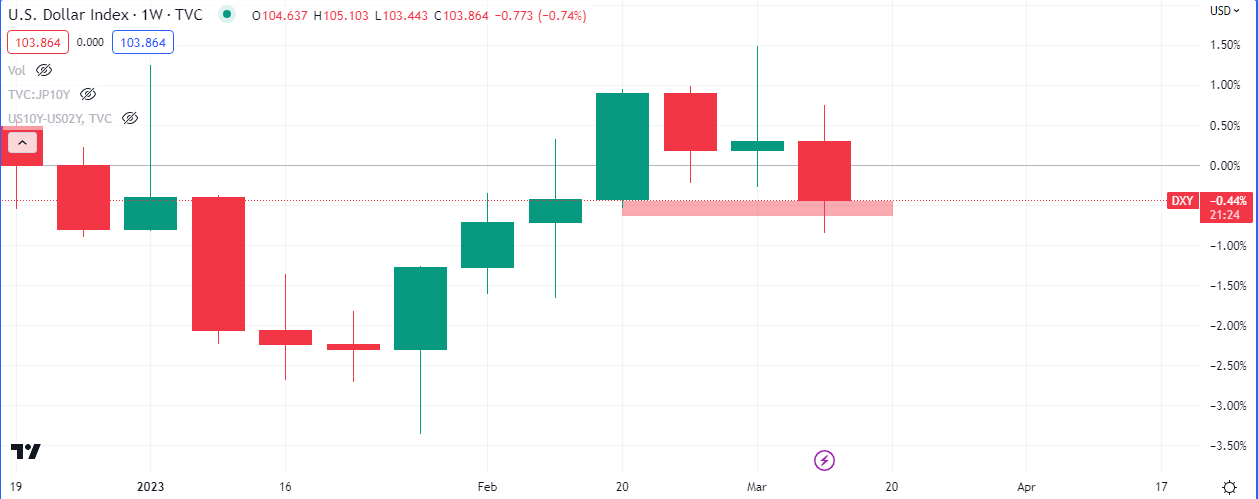

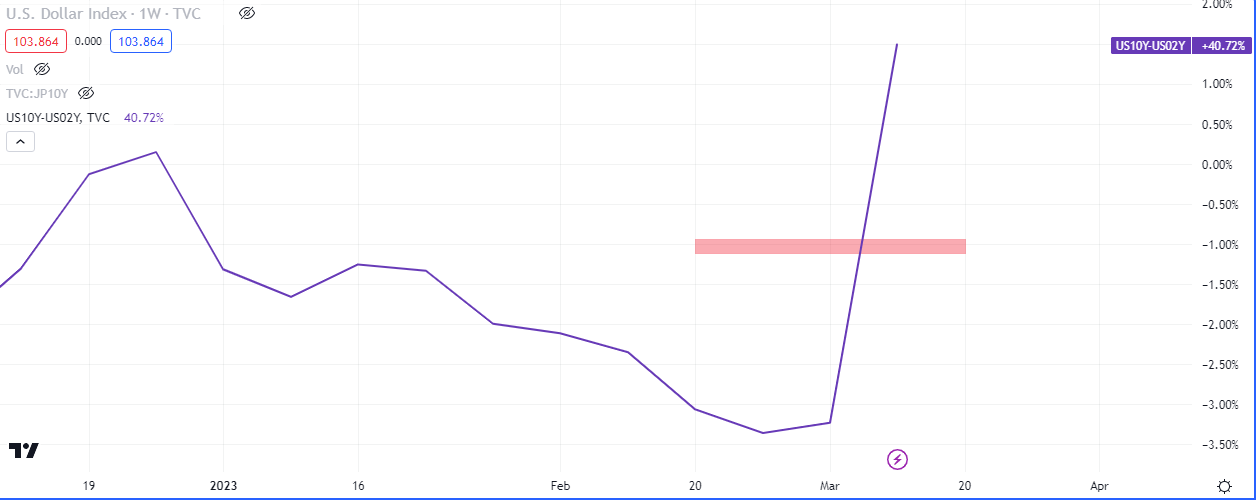

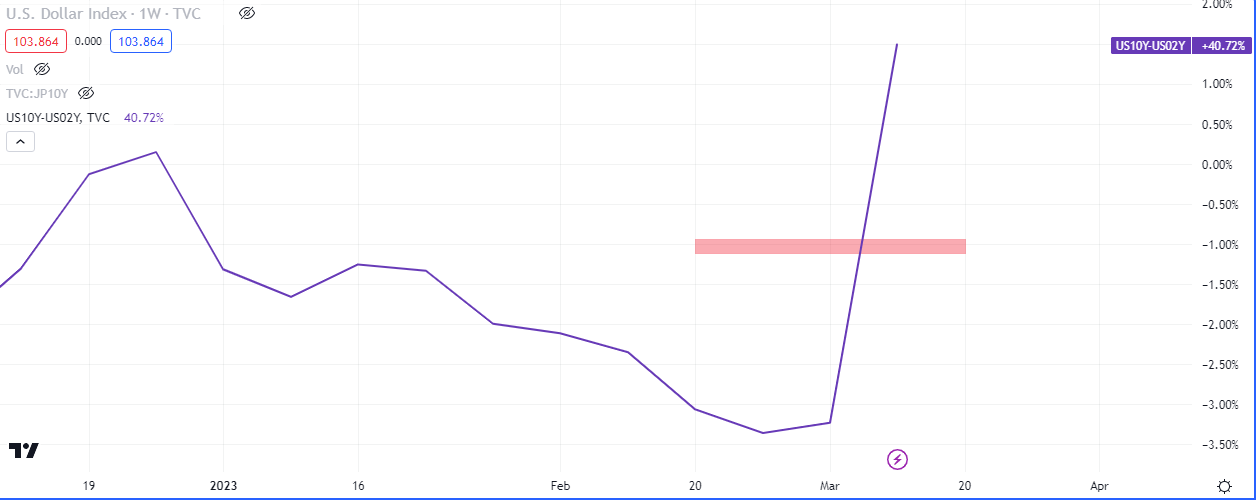

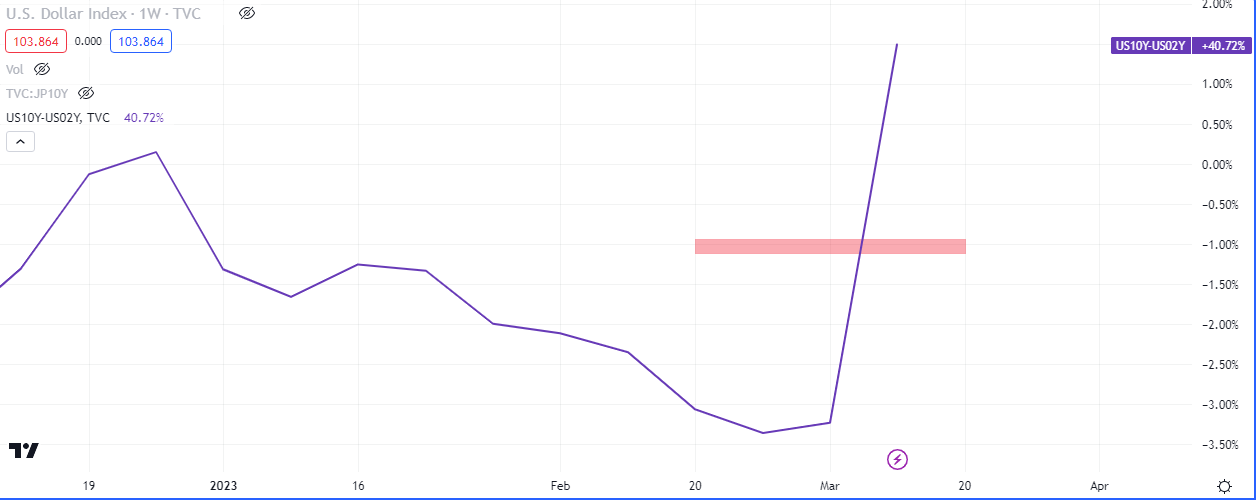

The dollar index could not close below the last key buy liquidity from 3 weeks ago, leaving room for the upside towards the the high of the current week’s range.

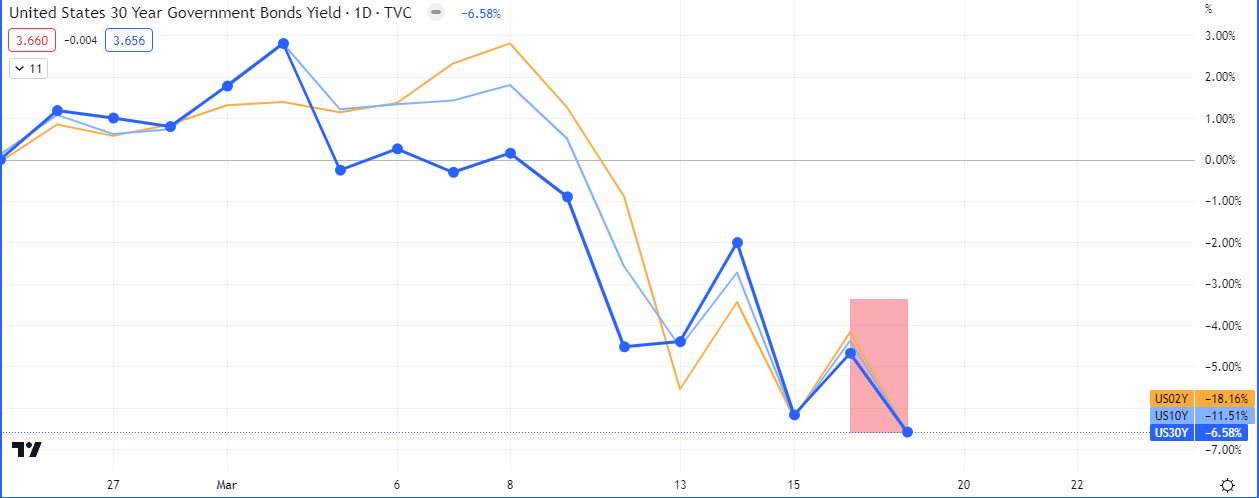

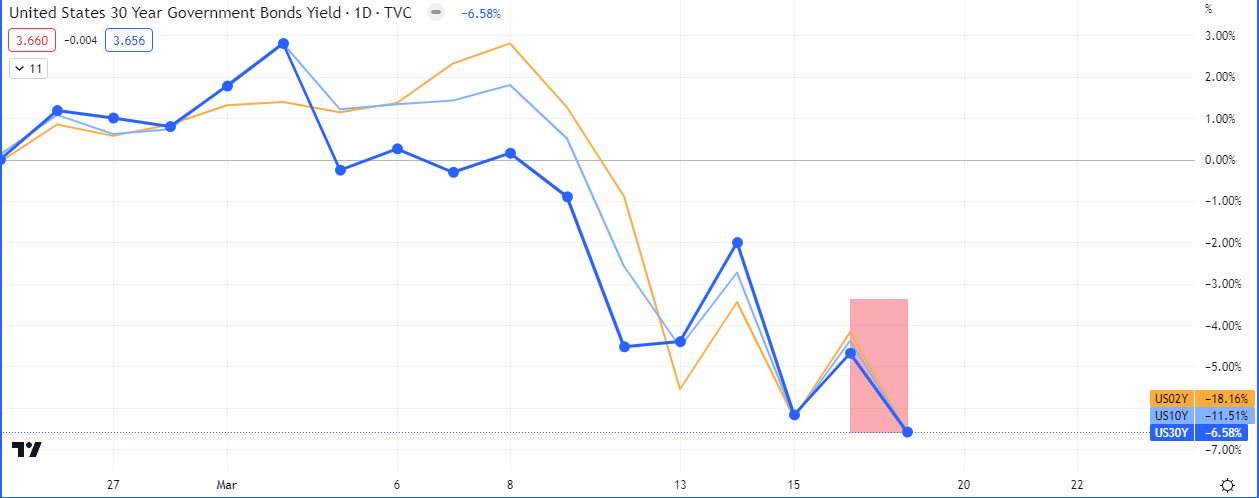

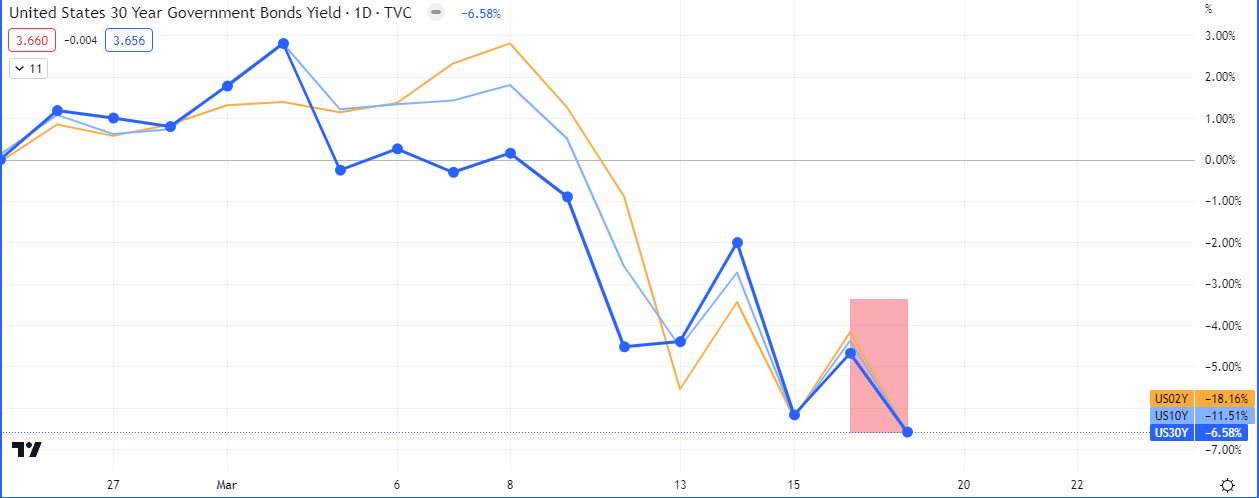

The US treasury curve is has been massively bid for the last couple of weeks and this should strengthen the dollar going into the new week.

The US treasury market (2Y, 10Y and 30Y) ended the week in a parallel shift.

The areas highlighted grey is the area to focus on. The risk on risk off basket shows a combination of closes;

USD –

Euro +

German 10Y Bonds –

Put-Calls Ratio –

USDJPY –

USDJPY 10Y Treasury Spread –

High Beta Currencies/Low Beta Currencies +

Yield Spread Ratio of HBC/LBC –

S&P500/VIX –

GBPJPY –

GBPJPY Yield Spread –

There may be room for some downside in equities if the strength noticed in the US treasury curve kicks in going into next week.

The Canadian Dollar and the Australian Dollar may also weaken in the direction of their dropping yields, versus the yields of the Japanese Yen and Swiss Franc IF a risk off sentiment kicks in next week.

Leave a Reply