Closes are important in chart information, therefore I do not neglect them when I study situations in markets. In this article, I take a look at the weekly closes of interconnected asset classes in the energy market.

Last week some selling came into some of the internals of the oil market, and supply came into the market. All the metrics closed bearish with the exception of Energy Stocks and the Canadian Dollar/Japanese Yen pair.

The key weekly closes are as follows;

$WTI -1.37%

$BRENT -1.33%

$XLE +1.43%

$WTI -0.15%

Crude Oil Futures -8.13% (Contango)

Gasoline Futures -19.97% (Contango)

Refiner’s Margin -0.48% (Gap Fill)

CADJPY +0.89%

CA10Y-JP10Y -3.56%

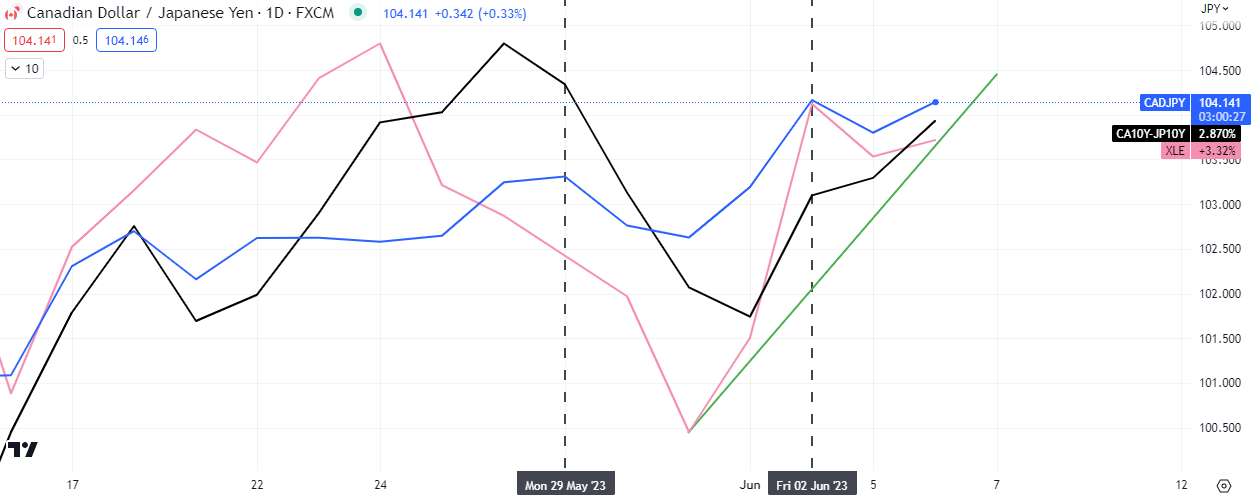

The entire uptick, underlined in green in the chart above, is susceptible to failure if the oil internal’s spread closes. It is interesting to observe that the currency pair, CADJPY, has broken it’s high and extended, while the yield differential of both currencies and the energy index ($XLE) are still range bound, despite the uptick.

Another thing to watch is the strained Bank of Japan dovish fx policies and the COT report for the Yen will show us when and if Yen bulls come into the market.

Conclusion

Failed bullish auctions in Energy stocks like $XOM, $CVX, $SLB and $OXY, may have room to drop to last week’s lows.

Leave a Reply