A quicker-than-usual sell-off in technology stocks and a surge in Treasury yields has pushed Cathie Wood’s flagship ARK Innovation ETF slightly under water, leaving the famous fund down more than 20% for the month of August, so far.

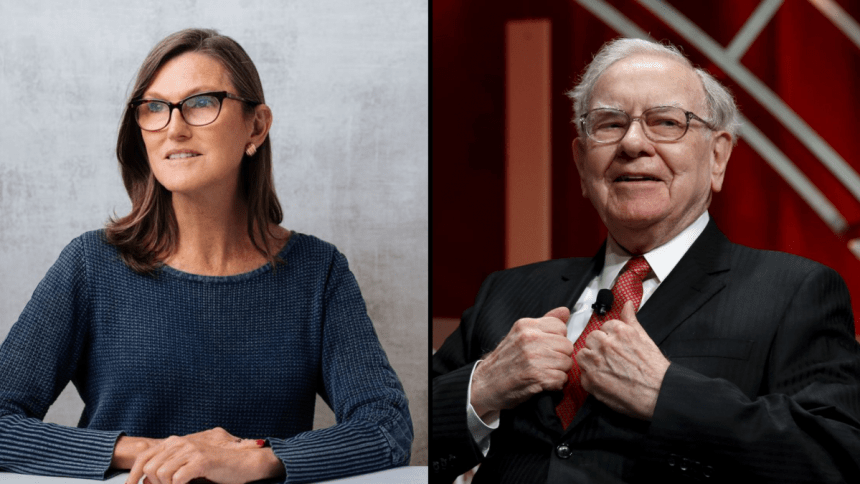

Wood, whose $7.2 billion fund bets large on companies such as Coinbase Global ($COIN), Roku ($ROKU) and Tesla ($TSLA), is still one of the best-performing fund managers for the year to date, despite the deep losses this month. ARK is currently up 29%, however the recent bearish positioning of arguably more seasoned investors like Michael Burry and Warren Buffet have taken a more bearish position in the stock market of late.

Michael Burry, who needs no introduction, predicted and profited immensely from the 2008 stock market crash, the housing market bubble and even the dotcom bubble. His successful track record, though not perfect, as a contrarian investor and trader made it worth raising an eye brow at least, when he sunk in $1.3 billion into put options in the S&P 500 and the Nasdaq 100 – both of which are representative of the US economy at large.

Security Exchange Commission filings released on last week Monday show that his fund, Scion Asset Management, was shown to have bought large stakes in put options against both stock-market indexes. Put options give the right to sell an asset at a particular price.

He bought $866m (N866,000,000,000) in put options against a fund that tracks the S&P 500, and $739m (N739,000,000,000) put options against a fund that tracks the Nasdaq 100. Burry also dumped all his holdings in US regional bank stocks earlier in the month.

In a different but related development, the Warren Buffet, the so-called “Oracle of Omaha”, also “took the other side of the book” by selling $8 billion worth of stocks over the course of the second quarter of the year 2023.

Newsweek reported that Buffet’s investment firm, Berkshire Hathaway, sold $13 billion in stock in the second quarter while buying less than $5 billion, resulting in a net sale of $8 billion in stock, according to the organization’s second quarter earnings report. This was subsequent to a $13 billion sale the company did in the first quarter of 2023.

With over $140 billion in reserves, in form of short term US treasuries, the investment tycoon may be staying cash in preparation for a crash or the failure of the Fed to guide the US economy to a soft landing. In other words he may be prepping to buy cheap after a the much talked about recession arrives.

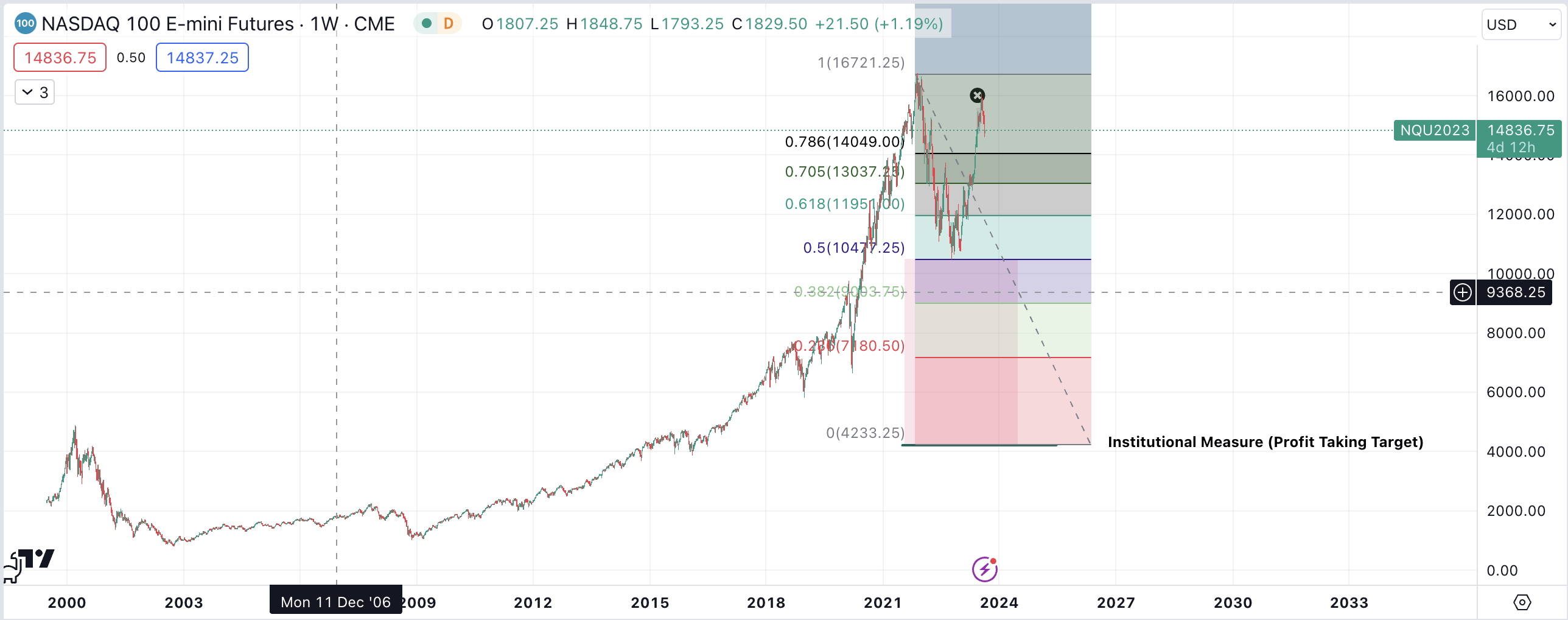

The Nasdaq100 ($NQ1 or $NDAQ) is the tracker for the top technology stocks in the US and the current situation on the technical side of analysis suggests there may be serious trouble brewing. The failed auction (marked x) in the chart above, occurred in a strong area of supply and if the markdown occurs we may be in a for a deep drop to 4000, which is the measured move, where institutions would buy back to begin to take profits from short positions!

The 10,000 could hold as well if buyers come back in at that level but a failure to do so there would most likely lead to 4000. It is worth noting that this bearish narrative/scenario may not play out if strong buying comes in at low’s established in the bullish imbalance/rally/trend that occurred in 2023.

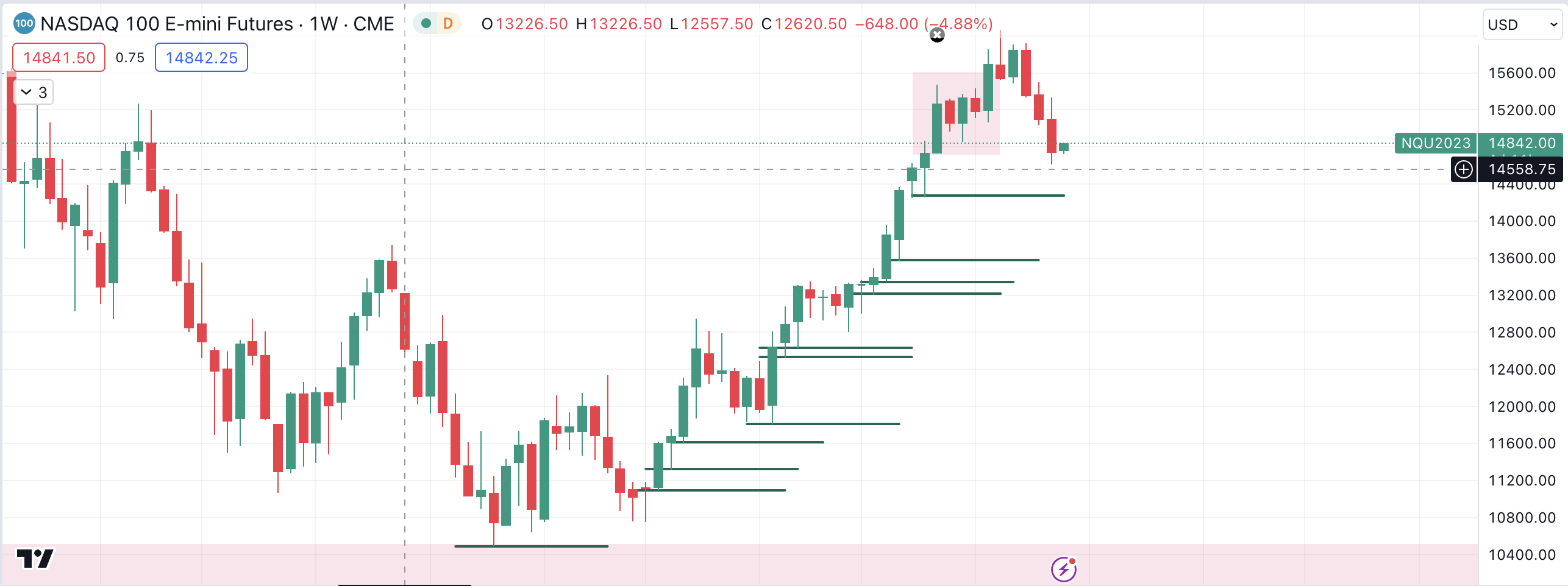

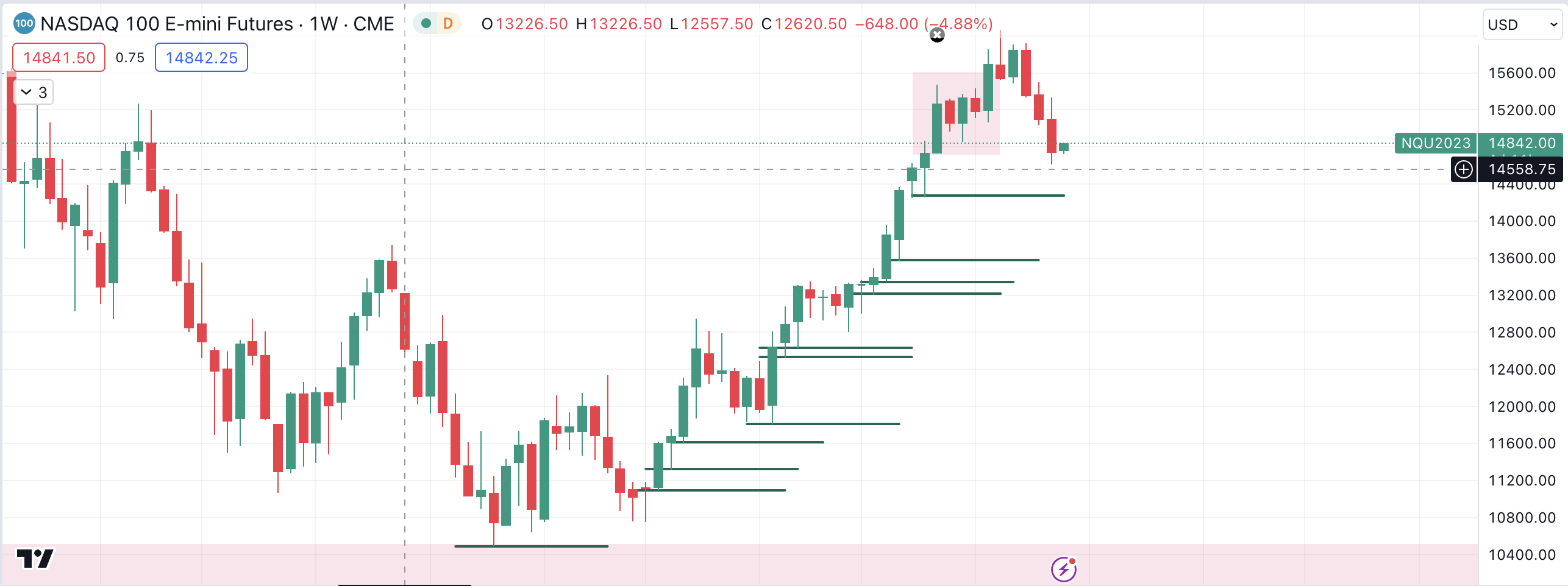

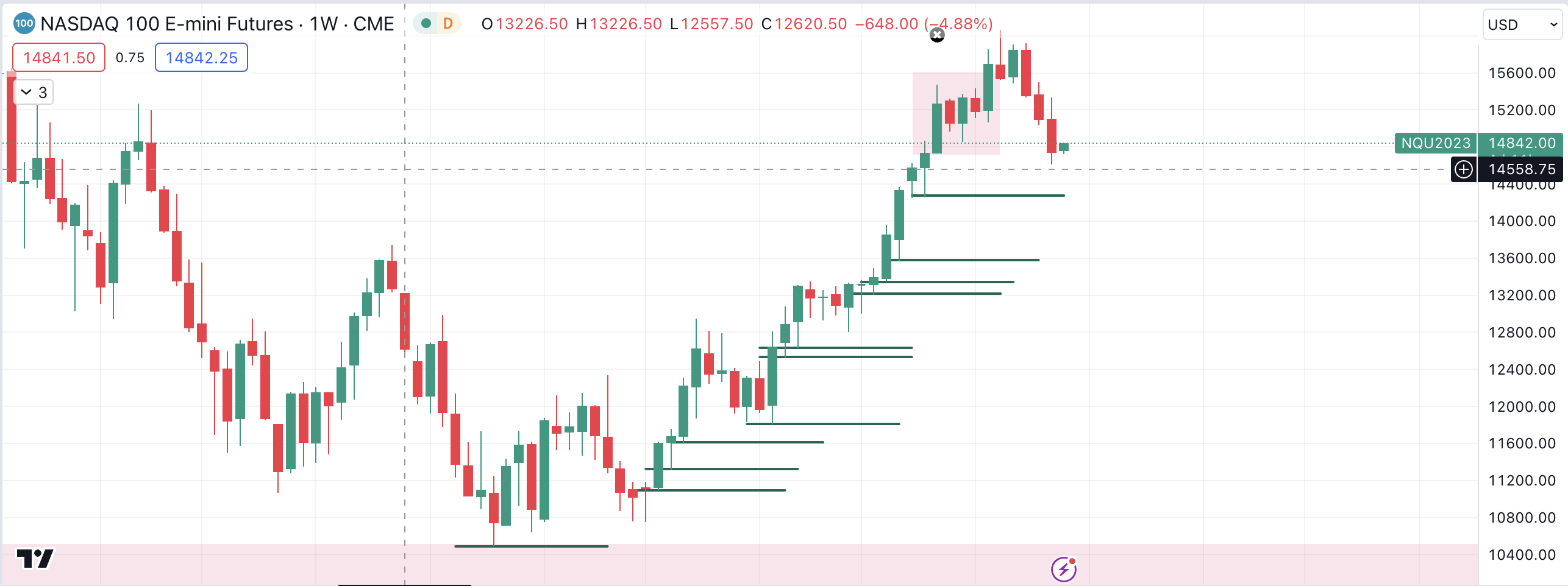

In the $NDAQ weekly chart above, each candle represents one week and each black line represents levels where massive buying came into the market. Failure and bullish reversals at the lines would likely be signs of continuation back towards the all time high.

For now, while the market remains bullish overall, although there is a very high probability of a large drop to seek liquidity as some large institutions take profit. The Federal reserve’s decisions post CPI numbers coming up on the 14th of September will also be a determinant of market direction.

Leave a Reply