In one hour, the FOMC comes up and the Federal Reserve is set to release the deliberations of June’s interest rate decision by central bank committee members.

Here are some central bank watchers’ comments on what to expect:

HSBC – At the 14 June FOMC meeting, the Committee voted unanimously to leave the federal funds target range unchanged at 5.00-5.25%. In the press conference, Fed Chair Jerome Powell emphasized that “nearly all” FOMC participants expect it will be appropriate to raise policy rates somewhat further this year. Indeed, the median policymaker projection showed a federal funds target range of 5.50-5.75% for the end of 2023. However, Powell said that it was judged “prudent” to hold interest rates steady at the June meeting “considering how far and how fast we’ve moved.”

The minutes of the June FOMC meeting should show a range of views with respect to whether additional rate hikes are likely to be warranted at upcoming meetings as the policymakers balance the risks of elevated inflation against potential downside risks related to banking sector stresses, tighter credit conditions, and commercial real estate.

TD Securities – Despite a still strong macro backdrop ahead of the June FOMC meeting Fed officials paused rate hikes for the first time in this cycle, though the strong data did lead to positive revisions in the SEP and new projections of additional rate increases. We expect this Wednesday’s FOMC minutes to expand on the reasoning and likely split discussions behind this policy shift, with the bulk of the Committee still leaning hawkish amid lingering uncertainties about the economic outlook.

Barclays Research – We will be looking for nuance in the decision to maintain the Fed Funds target range at 5.00-5.25% in June, but we expect evidence of broad support for a rate hike in July.

Daiwa Capital Markets – If we were to share one reservation about recent actions by Fed officials, it would be regarding the decision to hold rates steady in June. We are sympathetic the view that policy acts with lags, and that Fed officials want time to assess the cumulative effects of policy tightening thus far, but perhaps hiking in June and July ahead of a pause in the fall would have circumvented any confusion from a very brief interlude before the resumption of hikes. Given the hawkish shift in the dot plot and subsequent comments by Chair Powell, it appears that a hike in June would have both aligned with the views of many policymakers and found easy justification given readings on the labor market and inflation.

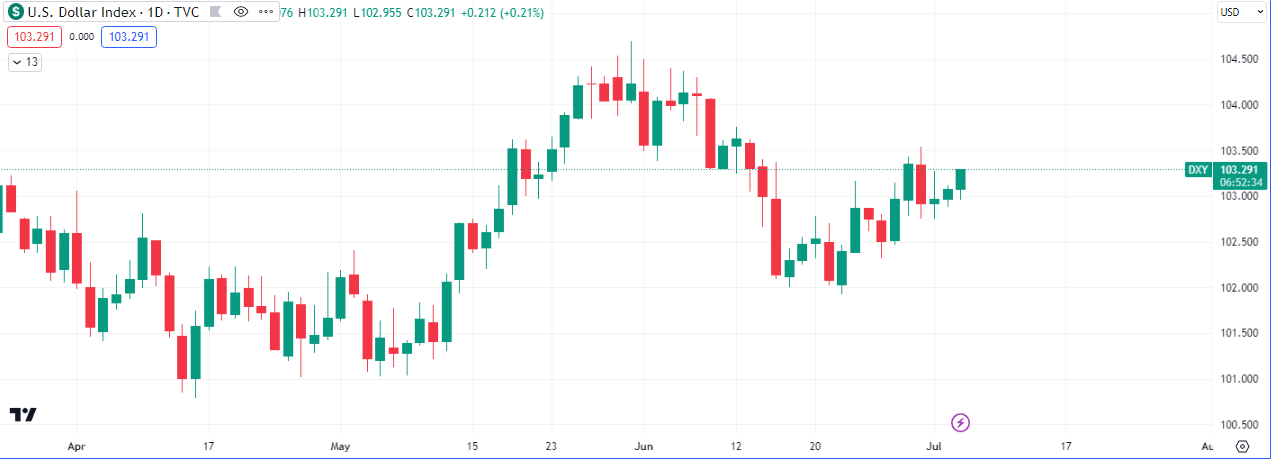

$DXY has been on an upswing this week, and looks likely to test the high of last week.

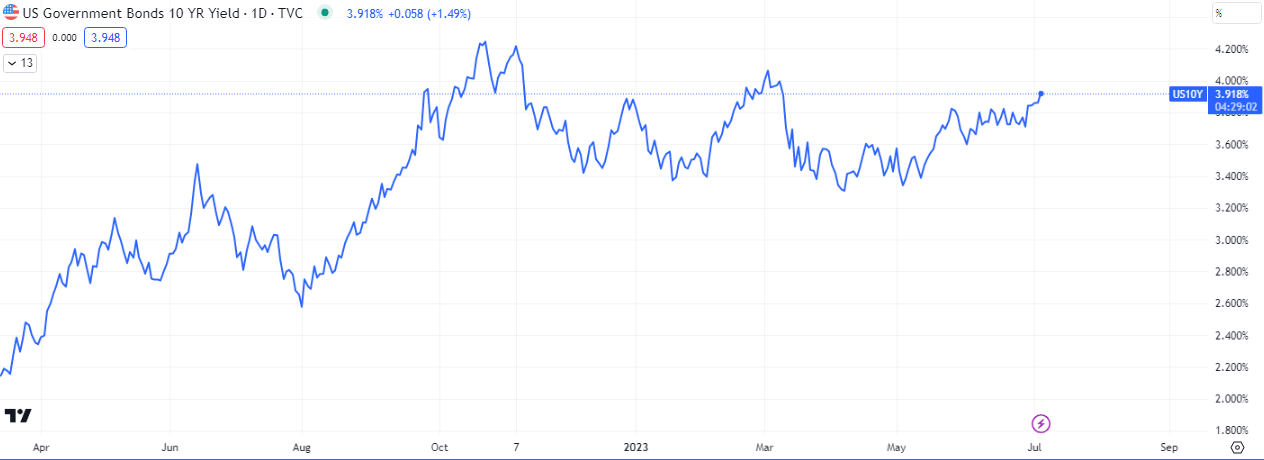

The 10Y treasury is also inclining as yields rise and this is contributing to the bid on the dollar.

Leave a Reply