Deflation in Japan began to take hold in the 1990s but it swung toward inflation in 2022. Japan now grapples with the highest inflation in decades—and the biggest wage gains since 1993—policymakers are struggling to keep up and are struggling to figure out what to do about it. A lot this has a knock on effect on the NIKKEI 225, which is now trading at a multi-decade high area.

The yen’s slide to 140 to the U.S. dollar is making the problem worse for the Bank of Japan. Much of the inflation Japan is experiencing is being imported thanks to elevated energy and food costs and a weak exchange rate.

BOJ Governor Kazuo Ueda took over the apex bank in April, and has been struggling to pull off a near impossible balancing act: supporting a fragile economy without fanning inflation.

Quantitative tightening could slam Japan’s economy, and with limited scope to tame inflation. Higher Japanese interest rates will do little to lower commodity prices caused by Russia’s Ukraine invasion.

On the other hand, leaving interest rates at zero—where they’ve been, effectively, since 1999—sends the wrong message to businesses and investors alike. The signal would be that it’s fine to ratchet inflation expectations even higher.

The answer is government action to increase competitiveness. The recent jump in wages is emblematic of the problem. Japan Inc.’s negotiations with labor unions this year yielded an average 3.8% pay bump, and that’s great. Yet, the increase could exacerbate national inflation pressures.

What’s needed is a commensurate increase in productivity and basic economic efficiency. Unfortunately, the bill is coming due for the last decade of prime ministers promising epochal reforms to cut bureaucracy, loosen labor markets and incentivize new innovation that don’t materialize.

When Haruhiko Kuroda stepped down from running the BOJ last month, the hope was that Kishida’s chosen replacement—Ueda—might try a different tactic. Rather he has reverted back to the old posture, a position that has the yen weakening anew.

That rational/narrative behind the bullishness of the $JPN225 has been that efforts over the last decade to strengthen Japanese corporate governance are finally gaining traction and that inflation has peaked. Global investors are however unbothered by this as they keep piling into Japanese stocks as the index is now approaching levels not seen since 1989-1990.

The underlying reason is probably a bit more complex and likely associated with the reshuffling of the global world order.

In the U.S., the cumulative effects from the most aggressive Federal Reserve tightening since the mid-1990s are dimming the outlook for growth and corporate profits. Extreme dysfunction in Washington, highlighted by the battle over the debt ceiling, have investors eyeing more stable, less volatile pastures.

China’s post-pandemic recovery has been lethargic and Germany is in recession., meanwhile, has been less energetic than hoped.

Therefore Japan is starting to look like the least of the evils. Some prominent investors have given the bullish narrative around Japan a major boost

In comes Warren with a bag of cash

In late 2020, the billionaire’s Berkshire Hathaway surprised many people with a bet on five of Japan’s old-school trading companies: Itochu, Marubeni, Mitsubishi, Mitsui & Co. and Sumitomo. And his bets on these cash-rich and undervalued Japan Inc. mainstays are doing very well.

Buffett, the “Oracle of Omaha”, has since suggested new Japan bets may be on the way.

Our View

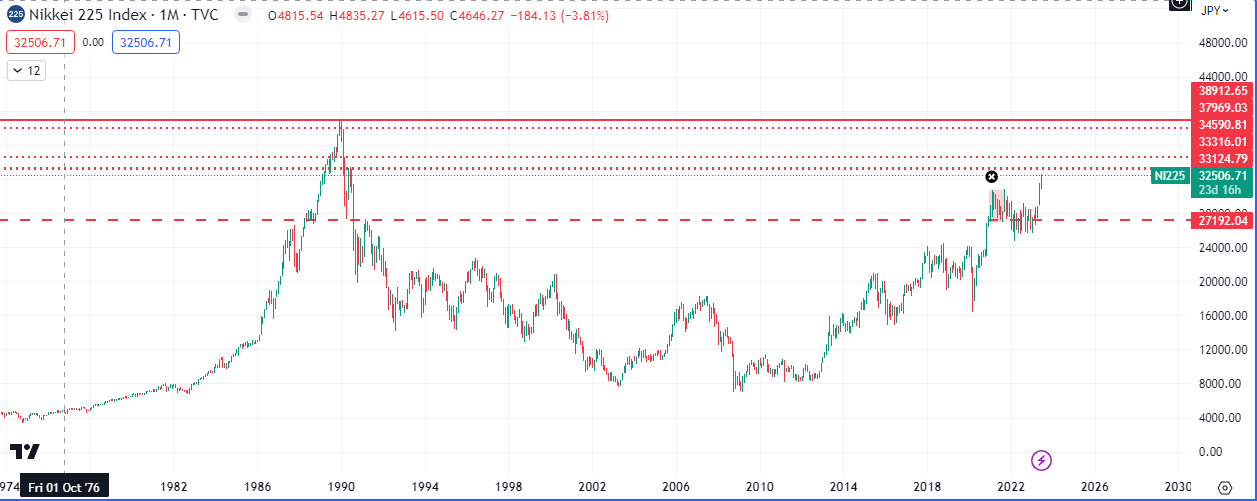

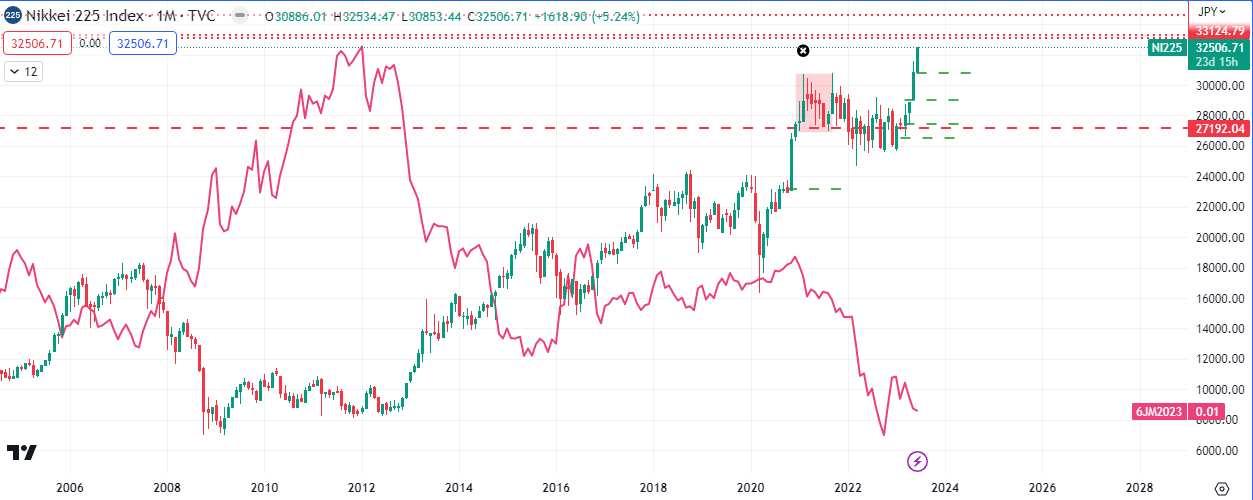

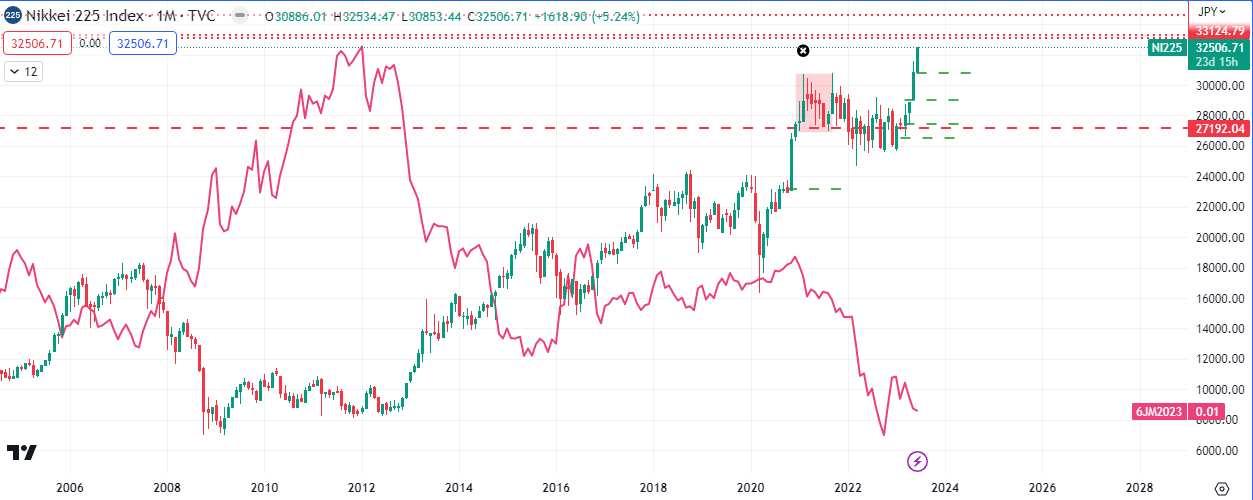

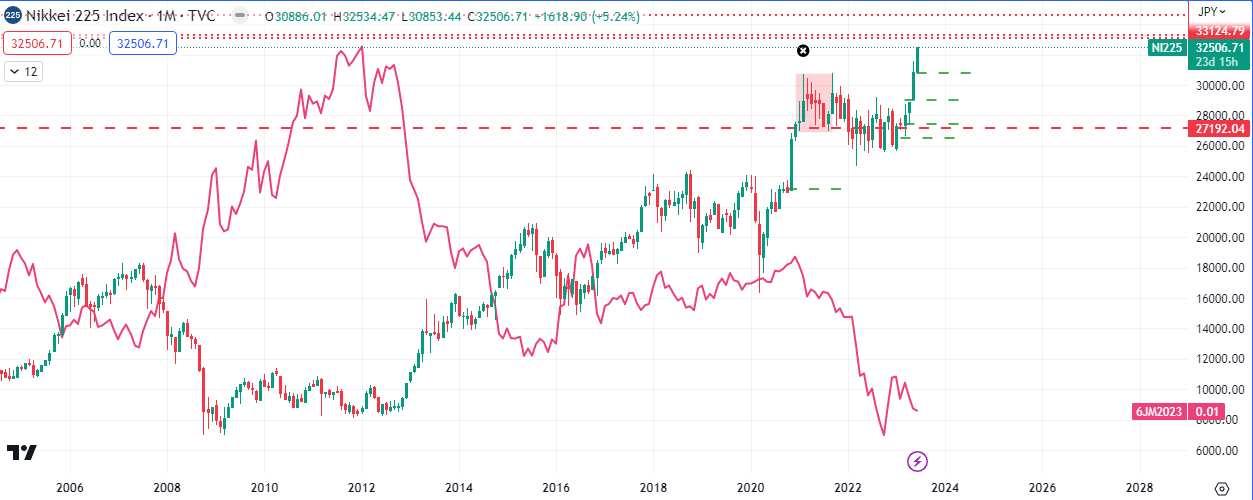

The chart above is the NIKKEI 225 monthly chart and it shows a resistance, marked red with a black x, has formed in a potential area of supply. Typically when this pattern forms, there is a high probability that price should return back to the base of the balance area. In this case the base would be around, ridiculous as it may seem, 8000. This would imply hyper deflation.

However the trend remains up and the first level of resistance before the all time high has been taken out at 32500, though the risk of a reversal remains elevated.

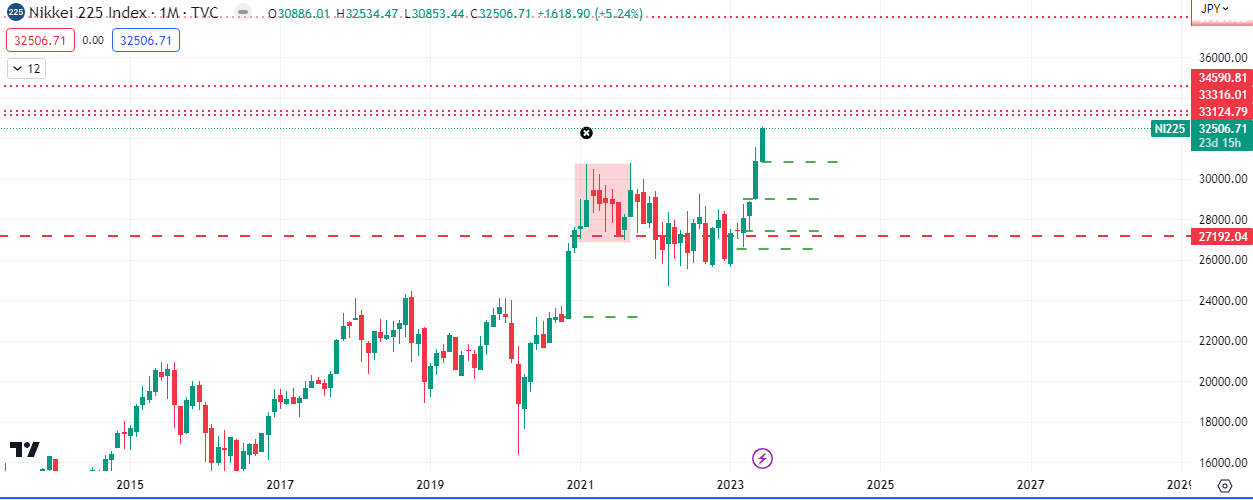

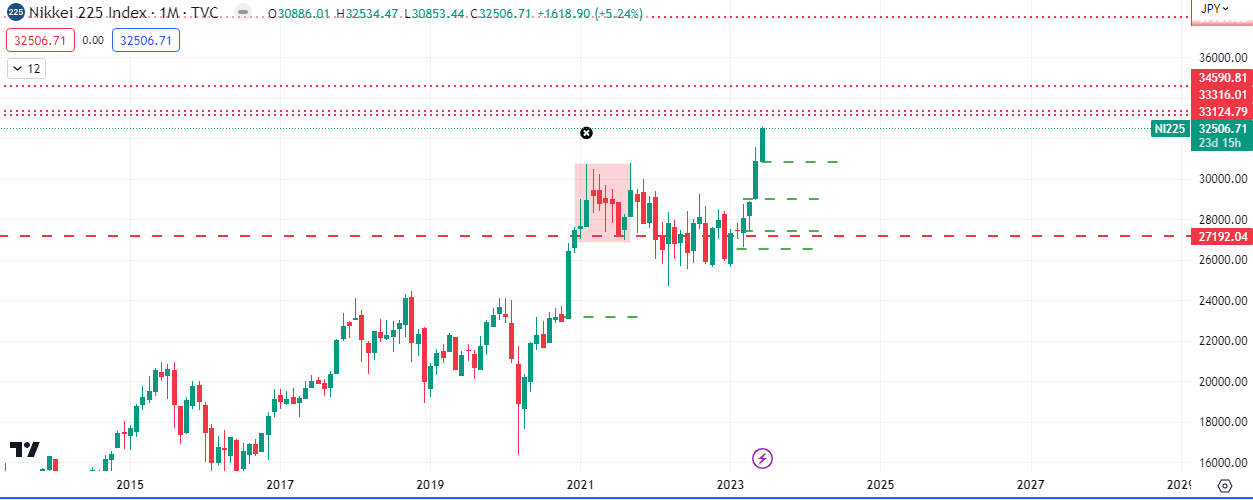

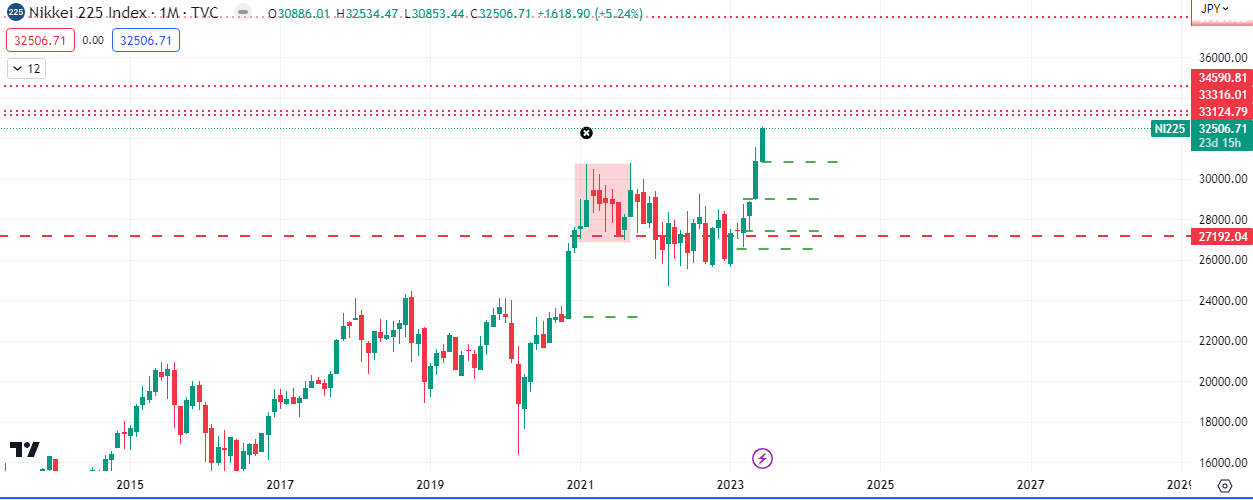

Some of the order blocks are highlighted in the chart above. Exhaustions in the 33124 area will likely turn price around at least for a retest of support starting at 30792.

The weak Yen spurred by ultra loose BOJ monetary policy is going to feel the pressure as the stock index keeps rising into institutional profit taking levels. A rally on the Yen will be one of the key catalysts to keep an eye out for if stocks are going to turn south.

Kashida has to convince global investors that Tokyo is acting to tighten, push companies to modernize, rekindle innovation and productivity, empower women and attract more international talent.

Post Japan’s decades-long obsession with generating inflation, as consumer prices race higher, Japanese households and global investors alike are wondering what comes next.

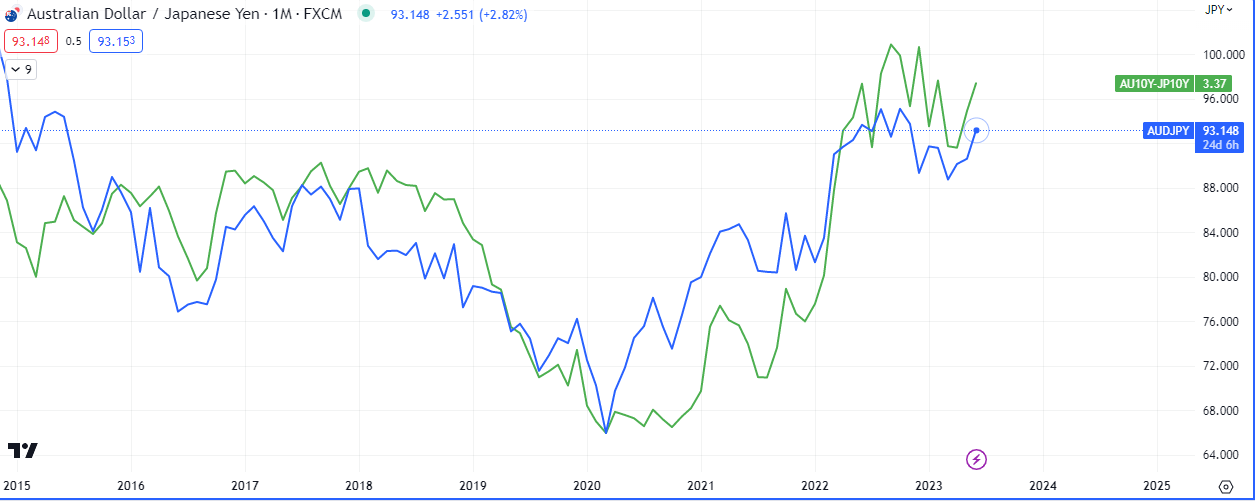

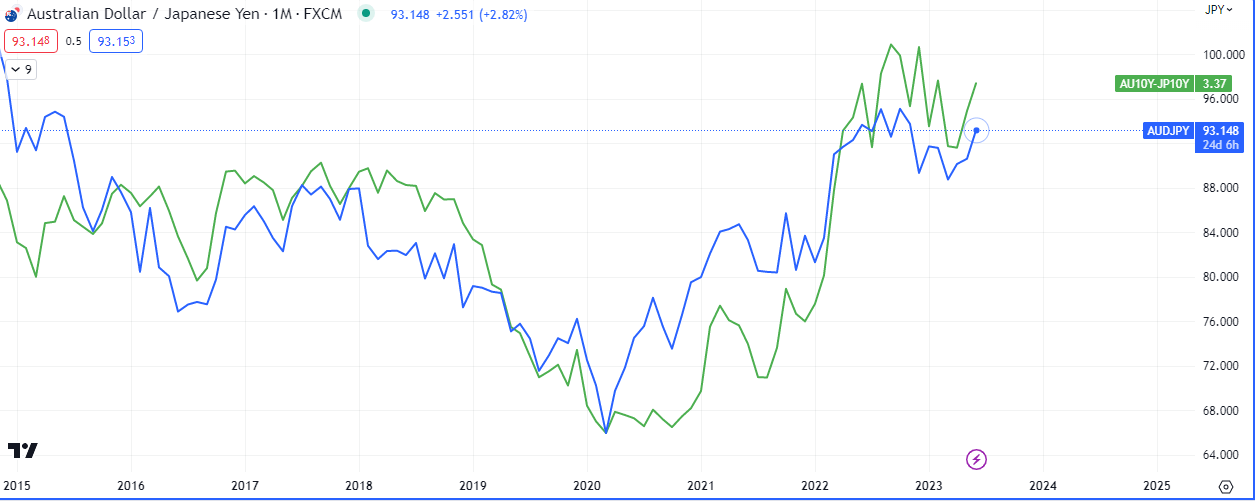

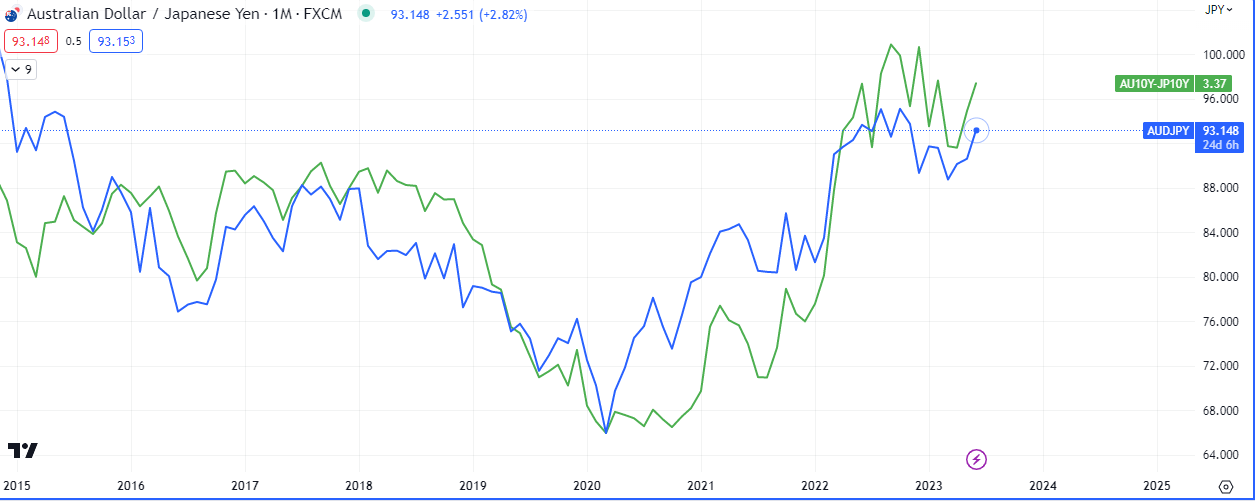

The carry trade

Watching the high betas vs the low betas idea is key to know when the flip may occur. The Australian dollar still in more demand than the Yen and this is fully in line with the risk off narrative we have seen pervade the market over the last few months. In fact we have been seeing outflows from the Yen into the Aussie since 2020.

We are also watching the commitment of traders report as we reach these extremes. At the moment, the institutions are still net short on the Japanese Yen.

Leave a Reply