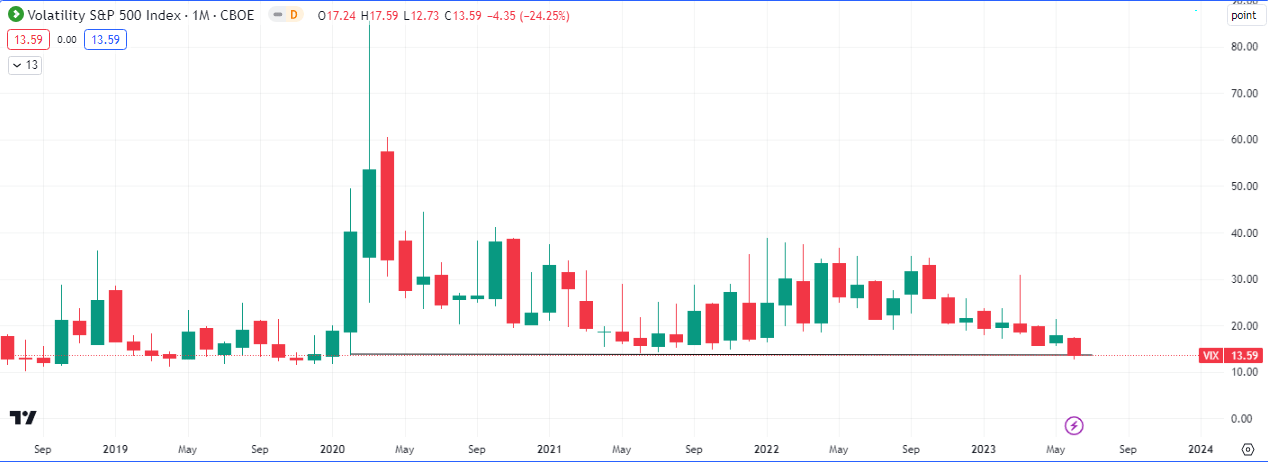

At the close of the market on Friday, the ‘fear’ index, also known as the VIX ($VIX), touched but could not close below the lows established during the COVID-19 pandemic. 2020 was a year marked with massive amounts of quantitative easing by the Federal Reserve due to the lockdowns.

The chart above shows June’s close touching the lows of 13.38 on the $VIX, but not closing below. This could be a sign of a reversal, although several other factors would have to align for a markup to occur.

One of those factors would be a bullish close this July, this would serve as a confirmation of some buying going on to possibly hedge some risk off in the equity markets.

We would also like to see a strong dollar ($DXY), weakening tech sector($XLK) and a strengthening utilities sector ($XLU), for this scenario to play out. The dollar currently looks strong with expected hikes by the Fed still on the horizon as well as an improving 10Y bond market.

It would also be pertinent to watch the high betas (CAD, AUD and GBP) as well as the low betas (JPY and CHF) to know when risk off or on really kicks in. The Japanese Yen is particularly important in this because it has been on a very long sell off spurred by the dovish BOJ. Any shifts in policy now would have massive ramifications.

The main factor to watch is the monthly close this July. Aggressive traders may look to start positioning themselves on the short side of the book if the daily timeframes begin to confirm this narrative, which remains incomplete till the end of the month.

The main releases to watch this week are the ISM Manufacturing Index, FOMC Meeting Minutes, ADP None Farm Employment Change, JOLTS Job Openings, Unemployment Claims, None Farm Payrolls.

The NFP is being forecasted to come out lower at 222,000 relative to a previous release of 339,000. A positive or a negative surprise on this number would affect the dollar and if it is inline with the $VIX, we can expect some large swings in equities.

Read up on our previous $VIX article here.

Leave a Reply