The April Non farm payroll beat expectations after a massive revision, showing an unexpectedly strong labour market, with unemployment for African Americans hitting a record low.

Overall unemployment hit 3.4%, a number that is lower than any since 1969. For Black Americans, unemployment rates hit historic lows. Black men ages 20 and older had an unemployment rate of 4.5%, which is the lowest on record and the first time the unemployment rate for that group has been under 5% since the government began using the current unemployment tracking system in 1972.

253,000 jobs were added in total, despite Fed rate hikes. Black women in the same age range saw unemployment rise slightly to 4.4%. Black unemployment rates have typically been higher than rates for white workers by as much as 50%, due largely to systemic racism and discrimination in education and employment.

With this improvement in the labour market on the cards, investors will now look forward to the CPI numbers coming out next week Wednesday, to gauge the state of inflation in the economy.

In our previous report we had a bearish outlook on the volatility index ($VIX), therefore we expected a rally in the equity market, especially on $SPX. That narrative played out as volatility tanked on the day and we saw a risk on sentiment surge into the market with oil and equities making gains.

Key closes

-Daily-

$DXY -0.16%

$VIX -8.81%

$SPX +1.82%

$NDAQ +2.06

$DOW +1.68%

$WTI +4.05%

$BRENT +3.78%

-Weekly-

$DXY -0.38%

$VIX +4.61%

$SPX -0.91%

$NDAQ -0.03%

$DOW -1.28%

$WTI -7.09%

$BRENT -6.20%

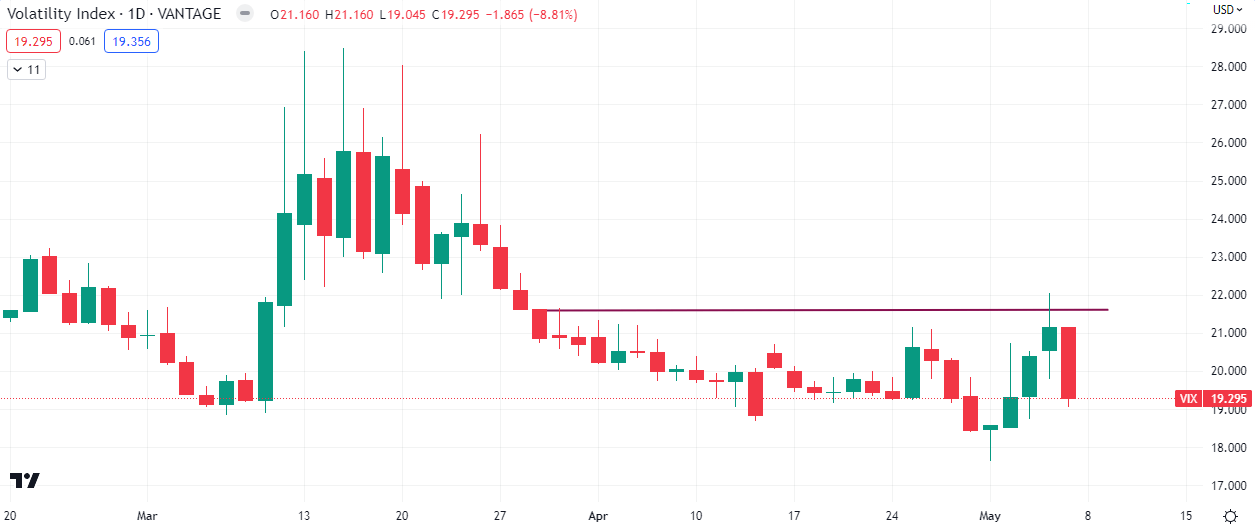

Volatility

The ‘fear’ index had a rejection at 22.00 which will likely lead to a retest of 17.000. This is bullish for equities.

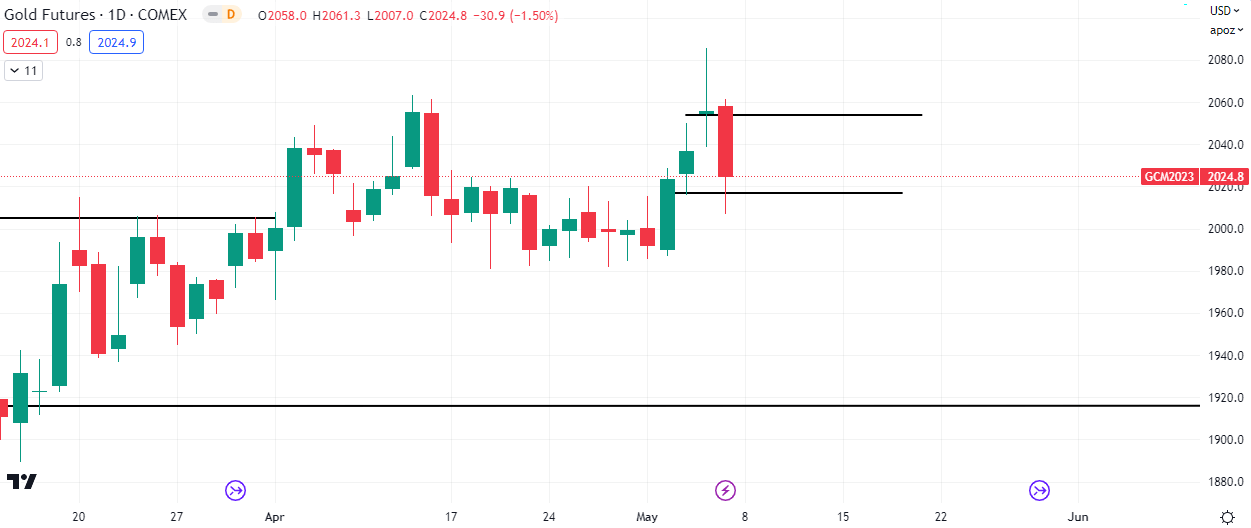

Gold

Gold retested it’s all time high this week and the current market structure suggests that price will retest $2060 next week.

Bonds

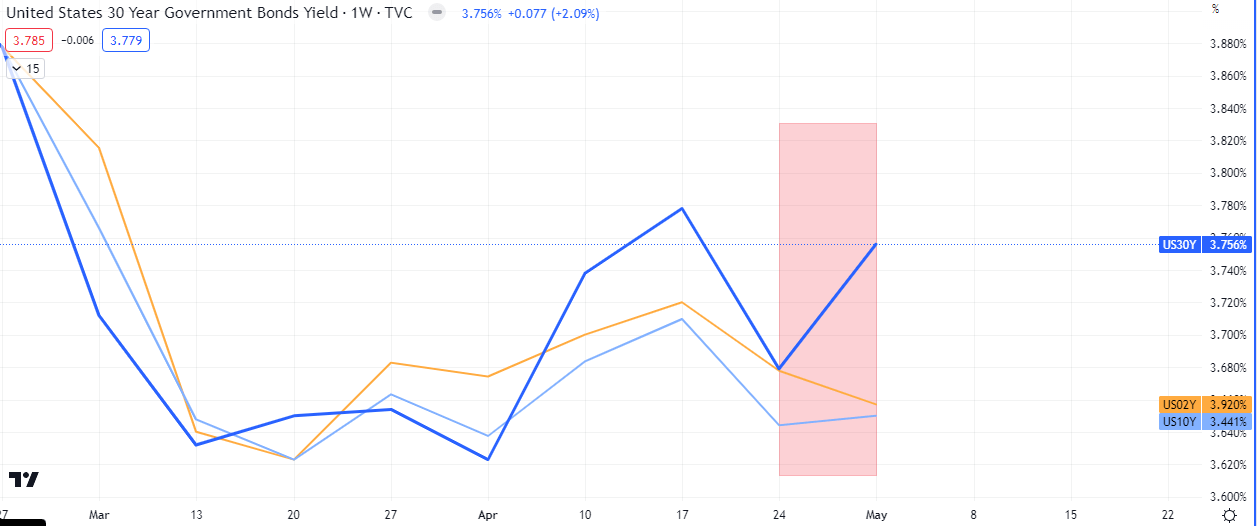

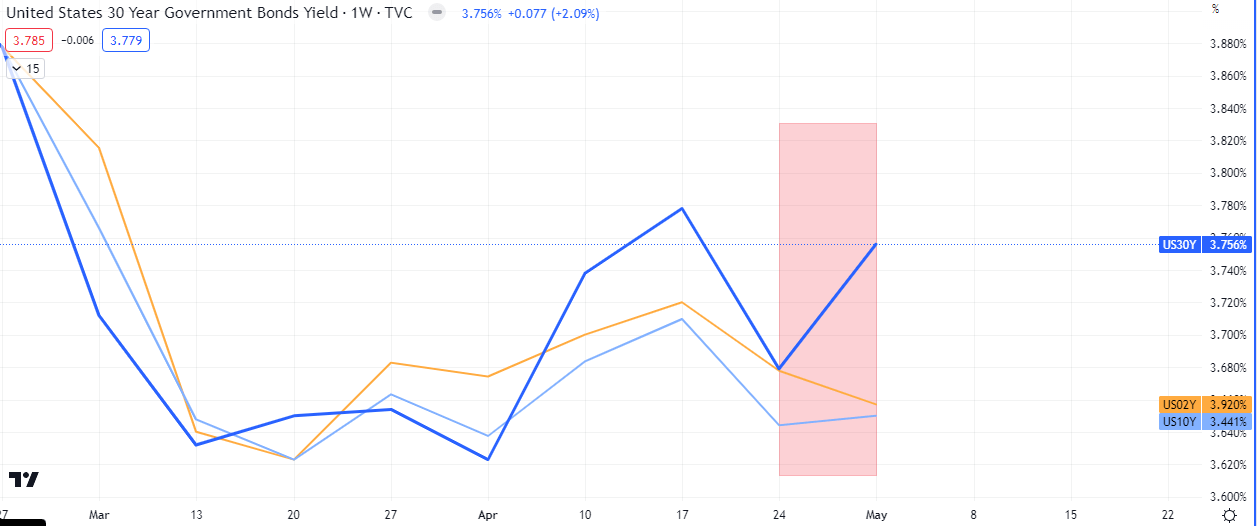

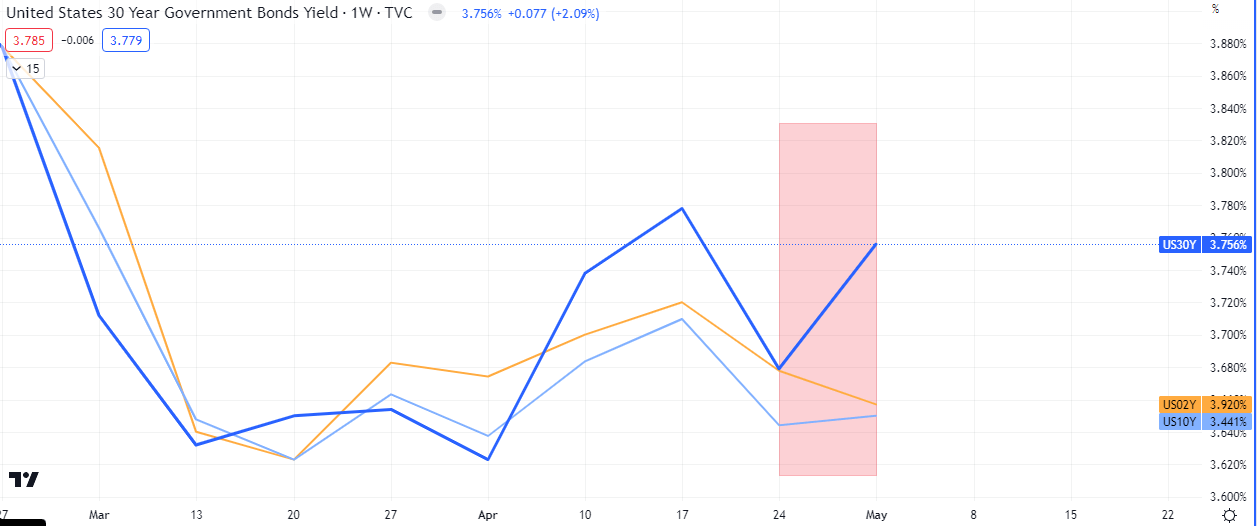

The US treasury market closed the week with a bull steepener as the 2 year bond lagged behind the longer duration debt. We may expect the spread to close next week as the 2 year yield would rise (dropping demand), which would be part of the risk on narrative in the broader market.

Leave a Reply